Generating Investment Income

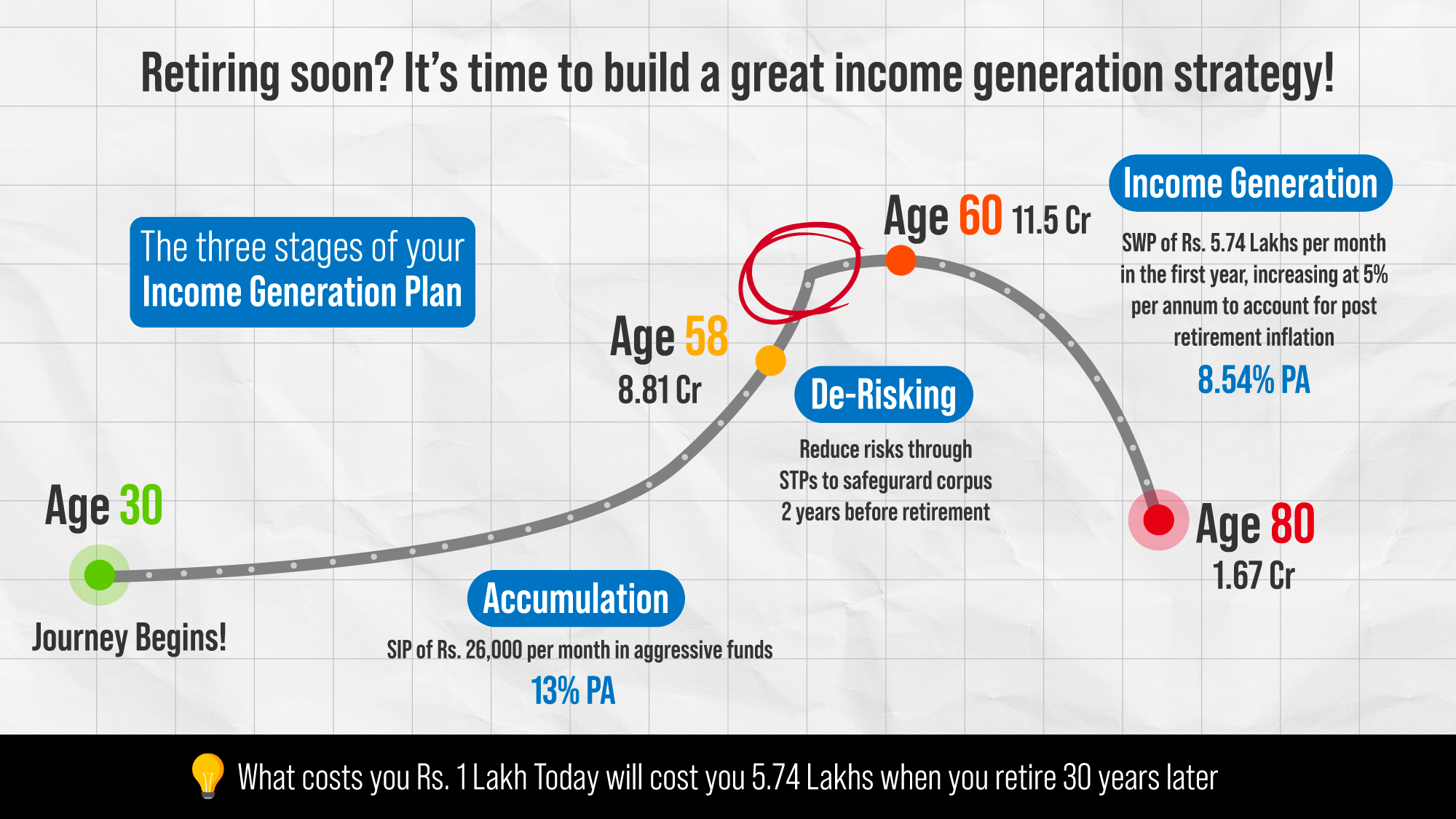

Post Retirement Income Generation requires long-term planning...

Post Retirement Income Generation requires long-term planning...Start Today!

Need for income generation? beware of annuity plans from life insurers!

Aggressively advertised as the ‘ultimate gateway to a secure retirement’, Annuities are, in a sense , Traditional Policies turned inside out. You commit a lump sum of money after your retirement, and the policy safeguards you against the risk of living too long by assuring you an income stream till you’re alive.

How Annuities are mis-sold.

First and foremost, no insurance agent really positions this product as a part of a well-drafted post retirement cash flow plan. For instance: A retirement cash flow plan needs to account for inflation, but most annuities provide for a fixed some of money throughout the pay-out phase. Even the so called ‘increasing’ annuities scale up at 3% per annum (non-compounded) are not useful because they start off with very a much smaller % return.

Secondly, most annuities will not have a surrender option built into them; once you’re in, you’re in for good! For the ones that do, the surrender value usually cuts a sorry figure, and the ability to surrender itself has a plethora of conditions attached. Make sure you understand both of the above points very clearly before you rush headlong into purchasing an annuity.

Thirdly, very few agents will explain to you that the annuities received are taxable as regular income, and so the post-tax CAGR from the plan (even assuming a fairly high life expectancy) will probably never exceed 5-6% per annum or thereabouts.

Lastly, watch out for ambiguous or meaningless text message campaigns such as “Invest Rs. 2269 per month and get PENSION of Rs. 25k + 4.3 Lakhs at maturity with **** Life”. Invest Rs. 2269 per month - for how long? Is the pension monthly or annual? Is this amount guaranteed or ‘indicative’? These opaque messages are meaningless and misleading. Give them a pass.

Do not make the mistake of buying an annuity plan from a life insurer! It will be a regrettable and irreversible mistake. Work with an investing expert and build a predictable income stream through SWP’s instead!

Get in touch with us today to work with an expert on your customized income generation strategy!

Is “Rent” a good income generation solution?

For many of us, the phrase ‘investment income’ is synonymous with ‘rental income’. But this really isn’t a great idea at all. Gross Rental yields are extremely low in most metropolitan cities; In Delhi, they typically range from 2.75% to 3.50%. In Mumbai, they are even lower, at closer to 2.40%. They used to be close to 7% in Bangalore until a few years back; they are down to roughly 4% now.

What this means is that you can expect a rental income of just Rs. 20,000 to Rs. 30,000 per month on a property that you bought for Rs. 1 Crore; factor in taxation (rental income is taxed as normal income), maintenance costs and the time that your property spends vacant between tenants, and you’ll likely end up at a real rental yield of closer to 2% per annum – which is very, very low!

A deeper, concern is that such low rental yields are often signal over valuation in the real estate pocket….. so you may just be dealt a double whammy in terms of low rent, plus zero to low appreciation for an extended period of time.

Real Estate is also indivisible and relatively illiquid, so the only way to realize interim liquidity from it (for instance, in case of emergencies) is to take a LAP (Loan Against Property). Needless to say, this will involve an interest burden. We don’t feel that rent is the most optimal solution for income generation. You are better off with Mutual Fund SWP’s instead.

FAQs – Income Generation

Are Reverse Mortgages a good option for income generation after retirement?

A Reverse Mortgage is a variation of a Loan Against Property, wherein a homeowner aged 60 or more can avail a loan against a self-owned property. The difference between an RM and a LAP is that instead of the borrower paying back EMI’s (as in the case of a LAP), the lender pays the loan amount to the borrower in tranches (capped at Rs. 50,000 per month). At the end of the tenor, the loan is settled by the legal heirs by liquidating the property or by paying off the loan amount. There are no repayments to be made by the borrower during his or her lifetime.

A Reverse Mortgage is not inflation linked, and therefore isn’t a complete solution. Needless to say - what’s worth 50,000 per month today will be worth a lot less in ten years’ time. There are much better solutions available for generating income.

Should I invest into POMIS (Post Office Monthly Income Scheme) for my retirement income?

A POMIS (Post Office Monthly Income Scheme) allows for a maximum investment of Rs. 15 lakhs in a joint account. At the current rate of 6.7%, this works out to just Rs. 8,350 per month; and this income is taxable on top of that! The tax inefficiency and low ceiling value makes POMIS an incomplete and ineffective solution. Go for a customized Mutual Fund SWP strategy instead.

Is SWP tax free?

The tax efficiency of your SWP would depend upon a number of factors, including the time that you have held your investment as well as the type of SWP fund (equity of debt). An investing expert can help you set up an SWP plan in the most tax efficient manner possible.

Can I stop my SWP midway?

Yes, you can stop your SWP midway. In case you feel that you do not need your income for a few months, you could stop the SWP and allow returns to accrue within your portfolio. Restarting it is very easy – it can be done digitally without any paperwork.