Best Investment Strategy for 2025

Unlock Superior Returns with FinEdge

At FinEdge, we believe that the best investment strategy for 2025 revolves around personalization, discipline, and purpose-driven investing. In a world filled with distractions and market volatility, our proprietary platform, Dreams into Action (DiA), combines cutting-edge technology with human expertise to help investors achieve their financial goals while maximizing returns.

Why Choose FinEdge?

Our unique strategy is built on a foundation of goal-based investing, bionic technology, and client-centricity:

• Goal-Based Investing: We help you prioritize your financial goals—whether it’s building a retirement corpus, funding your child’s education, or buying a dream home. Our structured framework ensures that every investment is aligned with your aspirations.

Learn more about goal-based investing

• Bionic Technology: Our DiA platform leverages data-driven insights and predictive analytics to create personalized investment strategies while ensuring disciplined execution.

Discover How Our Technology Works

• Client-Centric Approach: With a strong emphasis on behavioural management, our advisors work collaboratively with you to navigate market cycles and maintain investment resilience.

Read About Our Client-Centric Philosophy

Your Investing Experts

Backed by Research and Real-Life Results

Studies consistently show that goal-based investing outperforms traditional methods by fostering discipline and reducing emotional decision-making. According to a 2024 study by Morningstar, investors who follow structured, goal-driven strategies see up to 20% higher returns over a decade compared to those without a clear plan.

Real-Life Example:

Case Study:

• Investor Profile: Aman, a 35-year-old professional, wanted to save for his child’s higher education.

• Challenge: Unsystematic investments in mutual funds and stocks.

• Solution: FinEdge helped Aman implement a disciplined Systematic Investment Plan (SIP) tailored to his timeline and risk profile.

• Result: Aman’s portfolio grew by 15% CAGR over five years, ensuring his goal was on track with reduced stress and effort.

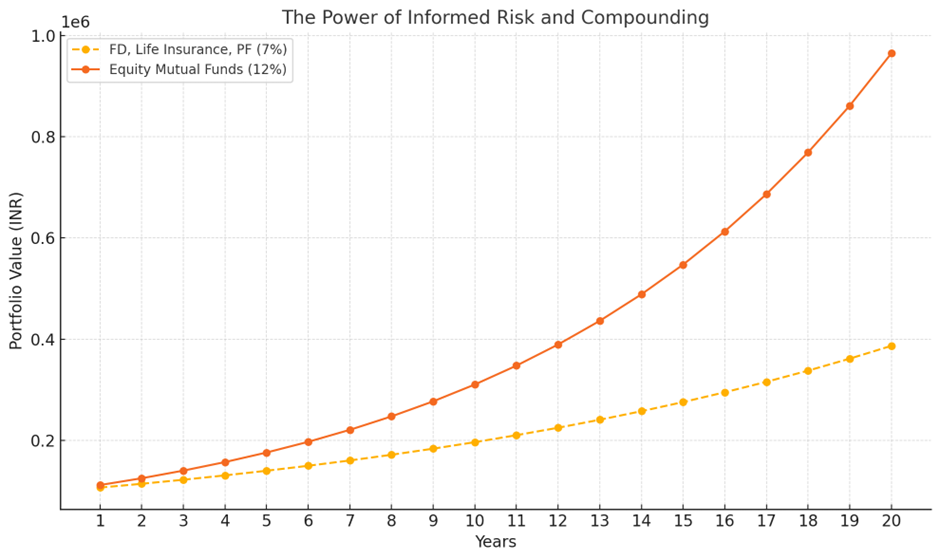

The Power of Informed Risk and Compounding

Investing with an informed understanding of risk and leveraging the power of compounding can significantly impact your wealth-creation journey.

Real-Life Example:

Scenario:

• Investor A: Invests INR 1,00,000 annually in Fixed Deposits (FD) or Provident Funds (PF) earning 7% annually.

• Investor B: Invests INR 1,00,000 annually in Equity Mutual Funds earning 12% annually.

Over 20 years:

• Investor A ends up with a corpus of approximately INR 44,00,000.

• Investor B, with informed risk and higher returns, grows their corpus to over INR 72,00,000.

This demonstrates how taking calculated risks and allowing compounding to work over the long term can lead to transformative financial outcomes.

Read More About the Power of Compounding

How Investors Benefit

1. Better Returns Through Discipline: Our platform automates processes to remove impulsive behaviors and optimize portfolio performance. Understand the power of disciplined investing

2. Hyper-Customization: Every investor is unique. That’s why our strategies are tailored to your goals, risk tolerance, and time horizon. Explore tailored strategies

3. Resilience During Volatility: Our advisors ensure you stay the course, protecting your investments from emotional decisions during market swings. Learn to navigate market volatility

Take Charge of Your Financial Future

Overall, the best investment strategy for 2025 involves a disciplined and purpose-driven approach. At FinEdge, we make it simple, transparent, and rewarding.

Join thousands of investors who have transformed their financial journeys with our DiA platform and expertise.

Ready to begin?

Contact us today and let’s turn your dreams into action!

Attain Financial Freedom

Related Articles

The Pros and Cons of Robo Advisors

The rise of digital services and a young aspirational population in India has led to the growth of robo-advisory platforms. Before investing, it is important to understand their pros and cons.

What it Takes to Build a Resilient Portfolio

The Indian stock market has been rising for nearly three years, with the 30% correction in March 2020 now a distant memory. Discover how a resilient portfolio can help you navigate market volatility.