Best Way To Invest

When it comes to investing, more than 84% of mutual fund investors search for the best mutual funds to invest in for the year.

Investing in them only due to past performance is the reason why most investing journeys end up in losses.

The single biggest mistake people make while investing is that they think past performance is the key to future performance. Nothing can be further from the truth.

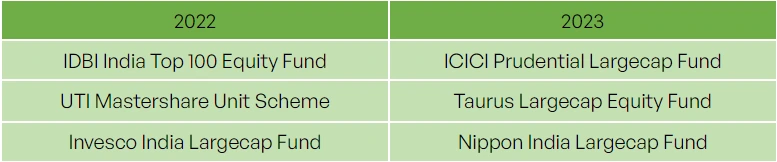

No two mutual funds are the same and the probability of a fund being a top performer for a particular year can result in it being at the bottom of the list on the very consecutive year. The table on the right gives us a sneak peek of the different best mutual funds to invest in 2022 vs 2023 and that exactly speaks about the market not being dependent on certain parameters every year.

Past performance data provides insights into the historical risk and return characteristics of a mutual fund and it allows investors to assess how a fund has performed in different market conditions. A fund with a history of consistent, positive returns may be less risky than one with a history of volatility or losses.

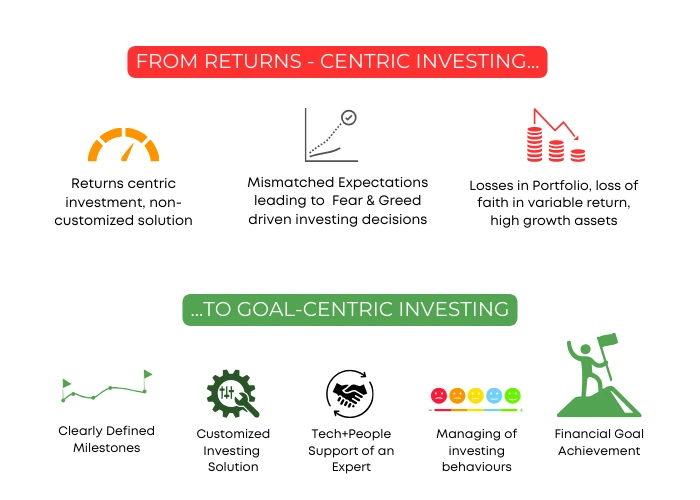

However, contrary to what most people think, fund selection is not the most important thing to do when making a smart investment plan!

What Is the Best Way to Invest in a Mutual Fund

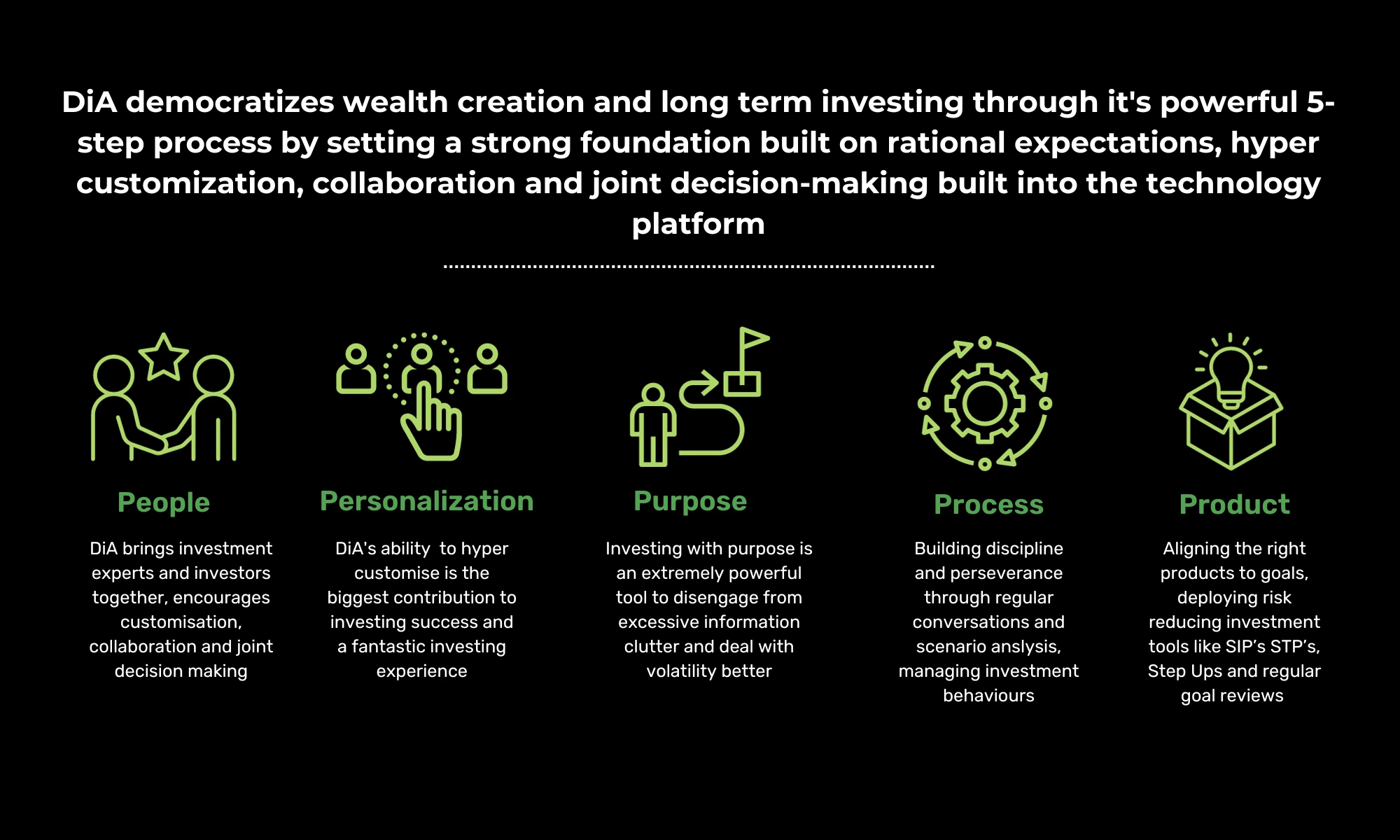

So, what are the key things to keep in mind to find your best way to invest? The answer lies in the 5 P’s for investing success

Personalisation: Your requirements, risk profile, goals and investing personality are unique! A smart investment plan must be hyper customised for your requirements. A fund that might work extremely well for your friend as per their risk appetite might be the total opposite for you. Do not follow ‘herd mentality’ at any cost.

Process: MS Dhoni’s credits his secret to success to ‘trusting the process’. This is also true to any successful investor. Controlling your emotions, setting the right expectations, being disciplined are key ingredients to a great process. Find an investing platform which helps you with a strong investment process.

People: A trusted advisor who understands your needs and guides you through market volatility are worth their weight in gold. A key question……are you investing because its cheap or are you investing to meet your critical investment goals. If creating wealth was so easy, everyone would be a billionare! A good financial advisor is the difference between being successful at investing or not.

Purpose: It is critical to plan and invest with specific goals in mind. You need to have your sights firmly on the maths of investing, take into account your income and expenses, future inflation, impact of compounding etc and most importantly the focus to ensure that you do not dip into your goal linked investments for lifestyle purchases!

Products: Taking managed risks is extremely important for long term investments. Equity mutual funds along with staggard investments (STP’s or SIP’s) form a great combination to reduce risk as well as allow time for accumulating capital. Over 3000 mutual fund schemes ensure that funds can be selected as per your individual requirement. Once again, short term past performance should be the last reason for investing in mutual funds

FinEdge’s Dream into Action (DiA) investing platform is unique in terms of providing a holistic digital wealth management platform. Not only does it leverage on cutting edge technology but also allows expert investment managers to assist in hyper customising the investing journey of the investor. An investor + Technology + Investment expert collaboration which is unmatched in the investing world!

DiA helps you cut through the noise and invest with purpose. Start your journey with us today!

While we start to invest, it's imperative to understand our own requirements, needs and wants for us to be able to take the next step. Some ways to identify our prerequisites are as below:

Set definite financial objectives: Decide what you hope to accomplish with your financial investments. Are you putting money down for retirement, a down payment on a home, your child's education, or are you just trying to increase your wealth? Give a time frame for each objective. Different investment techniques may be needed for short-term aims versus long-term ambitions.

Determining risk tolerance: Know how much danger you can take. How at ease are you with the prospect of losing some or all of the money you invested? This is where a risk assessment questionnaire can be useful. When determining your level of risk tolerance, take into account your age, financial security, and investment experience.

Diversification: Choose the level of diversification you desire for your investing portfolio. By spreading out the risk, diversification can lessen the effects of market volatility. Choose the asset types you want to invest in. Invest in securities like stocks, bonds, properties, or other financial instruments.

Required Liquidity: Analyse your immediate liquidity requirements. Do you anticipate having immediate access to your funds to cover expenses or emergencies? Your choice of investments will be influenced by this.

Savings and the budget: Determine the amount you can easily invest on a regular basis. How much you can initially devote to your investing portfolio will depend on your financial situation and ability to save.

Tax implications: Be mindful of how your investments may affect your taxes. The tax benefits of specific investment vehicles may vary by area. To make wise selections, seek the advice of a tax professional.

Horizontal Investment Time: Your investment approach must take into account your time horizon. With a longer time horizon, you might be able to take on greater risk because market downturns can be recovered from more slowly.

Education and Research: Spend some time learning about various asset classes, investing methods, and investment possibilities. A vital tool for making wise judgments is knowledge.

As mentioned in one of the points above, determining risk tolerance is one of the most important factors while investing.

We need to understand that risk is directly proportional to returns. It plays a significant role while choosing our investments because every individual/organisation has a different risk appetite.

Risk appetite refers to the level of risk or uncertainty that an individual, organisation, or investor is willing to accept when making decisions or engaging in activities. It is a subjective measure of how much risk one is comfortable with and can vary widely from person to person or from one organisation to another. Understanding your risk appetite is important in the context of financial planning and investment strategies.

In the long term, there is a general relationship between risk and return in investing, often referred to as the risk-return trade off. This principle suggests that, over an extended period, investments with higher levels of risk tend to offer the potential for higher returns, while investments with lower risk typically provide more modest returns.

Here's a more detailed explanation of this relationship:

Higher Risk, Higher Potential Return

Investments that are considered riskier, such as stocks and certain types of bonds, have the potential to generate higher returns over the long term. However, these investments are also subject to greater price volatility and the potential for significant losses.

Lower Risk, Lower Potential Return

Lower-risk investments, such as government bonds, high-quality corporate bonds, and certificates of deposit (CDs), tend to provide more stable and predictable returns over the long term. However, their returns are generally lower compared to riskier assets.

Diversification and Risk Management

Diversifying a portfolio by holding a mix of different asset classes, such as stocks, bonds, real estate, and alternative investments, can help manage risk in the long term. Diversification spreads risk across various assets and can help smooth out the ups and downs of individual investments.

Time Horizon Matters

The long term is a critical factor in this relationship. While riskier investments can experience significant short-term fluctuations, they have historically shown the potential to recover and grow over extended periods. Investors with a longer time horizon, such as those saving for retirement, may be better positioned to withstand market volatility and benefit from the compounding of returns.

Risk Tolerance and Individual Circumstances

An investor's risk tolerance and financial goals play a significant role in determining the right balance between risk and return. What is appropriate for one person's long-term investment strategy may not be suitable for another, depending on their individual circumstances and comfort with risk.

Risk Management and Diversification

Risk management and diversification strategies can help balance the risk-return tradeoff. By constructing a diversified portfolio that aligns with your risk tolerance and long-term goals, you can aim to achieve a balance between risk and return that suits your needs.

Historical Data and Future Expectations

It's important to note that while historical data can provide insights into the risk-return relationship, past performance is not indicative of future results.Economic and market conditions can change, impacting the risk and return characteristics of various investments.

Concluding that, the risk-return tradeoff suggests that investors who are willing to accept higher levels of risk may have the potential to earn higher returns over the long term. However, achieving the right balance between risk and return depends on individual goals, risk tolerance, and the construction of a well-diversified portfolio that aligns with one's specific financial circumstances. It's advisable to consult with investment experts to develop an investment strategy that best suits your long-term objectives.

Your Investing Experts

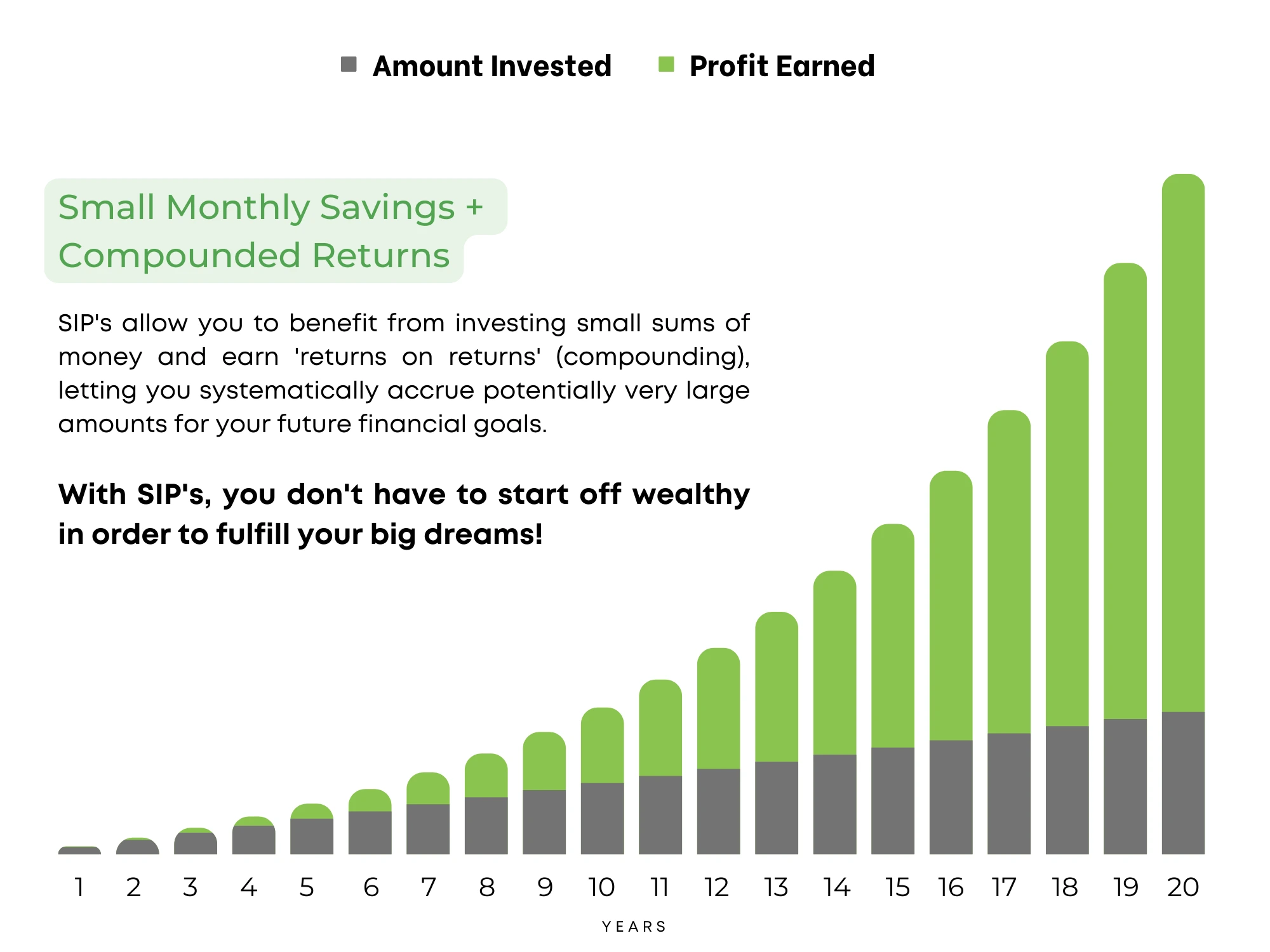

The risk to return tradeoff can be helped by the 8th wonder of the world - COMPOUNDING!

The power of compounding, also known as compound interest, is a fundamental concept in finance and investing. it refers to the process where the interest or returns you earn on an investment are reinvested, and over time, those reinvested earnings generate additional earnings.

Some significant benefits of compound interest include:

Exponential Growth: The most significant benefit of compounding is the exponential growth of your investments. As your earnings are reinvested, they start generating their own earnings. Over time, this compounding effect can lead to substantial growth in your investment portfolio.

Accelerated Wealth Accumulation: Compounding allows your money to work for you. The longer your money is invested, the more it can grow. Over a long time horizon, even small contributions can grow into substantial sums.

Time Is Your Ally: The earlier you start investing and the longer you stay invested, the more powerful the compounding effect becomes. This is why it's often recommended to start investing as early as possible to maximise the benefits of compounding.

Risk Mitigation: Compounding can help mitigate the impact of market volatility and economic downturns. Even if your investments experience periodic declines, the long-term trend is generally upward due to compounding.

Wealth Preservation: Compounding helps preserve the purchasing power of your money over time. Inflation erodes the value of money, but investments that compound can potentially outpace inflation and maintain or increase your real wealth.

Passive Income: As your investments grow, they can generate passive income in the form of dividends, interest, or capital gains. This income can be used to supplement your earnings or fund your retirement.

Retirement Planning: Compounding is a crucial element in retirement planning. Consistently saving and investing over your working years can build a significant retirement nest egg, which can provide financial security in your post-working years.

Long-Term Goals: Whether you're saving for a home, education, or any long-term financial goal, compounding can help you reach those goals more effectively.

Tax Efficiency: Some investment accounts, like IRAs and 401(k)s in the United States, offer tax advantages that enhance the benefits of compounding. Earnings can grow tax-deferred or, in some cases, tax-free, allowing your investments to compound more efficiently.

Financial Independence: Over time, the compounding effect can help you achieve financial independence. You can potentially rely on your investments to provide for your needs, reduce financial stress, and attain greater freedom in your life.

Investing always carries some level of risk, and there can be periods of market volatility and downturns. Additionally, the rate of return on your investments will influence the speed and magnitude of compounding. Therefore, it's essential to make informed investment decisions, maintain a diversified portfolio, and consider your risk tolerance and financial goals when implementing a compounding strategy.

As markets are never linear, disciplined investing is the best possible approach in the long term. We need to understand the importance of investing systematically and should always have an approach ready. Investing in specific financial goals is a critical aspect of effective financial planning and wealth management, it helps us with:

systematically and should always have an approach ready. Investing in specific financial goals is a critical aspect of effective financial planning and wealth management, it helps us with:

Clarity and Focus: Investing in specific goals provides clarity and focus on what you are working towards. When you have well-defined goals, you are more likely to stay committed and disciplined in your financial decisions.

Motivation: Specific goals serve as motivators. Knowing that your investments are helping you work towards a specific objective, such as buying a house, funding your child's education, or retiring comfortably, can inspire you to save and invest more consistently.

Financial Planning: Goals help you develop a financial plan. When you have clear objectives, you can create a roadmap that outlines how much you need to save, how to allocate your investments, and when you need to achieve the goal.

Measurable Progress: Specific goals allow you to measure your progress. You can track how close you are to achieving your objectives, which helps you make adjustments as needed and stay on course.

Time Horizon Considerations: Different goals have different time horizons. Short-term goals, like a vacation, may require different investment strategies compared to long-term goals, like retirement. Tailoring your investment approach to the time horizon of each goal is important.

Risk Management: Goals help you assess and manage risk. Understanding the importance of a specific goal can influence your risk tolerance and the types of investments you choose. For example, you may take a more conservative approach for a near-term goal to protect the capital.

Asset Allocation: Goals influence your asset allocation. Your mix of stocks, bonds, real estate, and other investments should align with the goals you're pursuing. More aggressive investments may be suitable for long-term goals, while conservative investments may be preferred for short-term needs.

Avoiding Haphazard Decisions: Investing without specific goals can lead to haphazard decision-making and impulsive behaviour. Having clear objectives helps you avoid making irrational choices based on market volatility or short-term trends.

Minimising Financial Stress: When you invest in specific goals, you reduce financial stress and uncertainty. You can have confidence that you're making progress toward your objectives and are prepared for upcoming expenses or life events.

Legacy Planning: Some specific goals may include leaving a financial legacy for loved ones or charities. Investing with this goal in mind allows you to allocate assets and engage in estate planning activities to fulfil your wishes.

In summary, investing in specific goals is crucial for effective financial planning. It provides direction, motivation, and a structured approach to managing your finances. Whether your goals are short-term or long-term, having a well-thought-out investment strategy for each objective can significantly increase your chances of achieving financial success and realising your aspirations.

FAQs on best ways to invest!

How much should I invest

The amount you should invest depends on your financial situation, goals, and budget. A general guideline is to save and invest a portion of your income, typically 10-20%. However, the right amount varies from person to person.

How do I determine my risk tolerance?

Your risk tolerance depends on your financial goals and how comfortable you are with market fluctuations. Assess your ability and willingness to take on risk through a risk tolerance questionnaire or consultation with an investment expert.

What is the role of financial goals in investment planning?

Financial goals provide direction to a smart investment plan. They help you determine how much to save, where to invest, and the time horizon for your investments.

How do I stay informed about my investments?

Regularly review your investment portfolio, monitor market news, and stay informed about the performance of your investments. Many financial institutions provide online tools and statements to help you track your investments.