LIC Surrender or Continue? Making the Right Choice for Your Financial Goals

- Understand the difference between surrender and paid-up LIC policy options.

- Learn when each decision makes financial sense.

- Discover how to reinvest your LIC surrender value wisely.

Not sure if you should surrender your LIC policy or go paid-up? Let’s break down the difference and help you make an informed, goal-aligned decision.

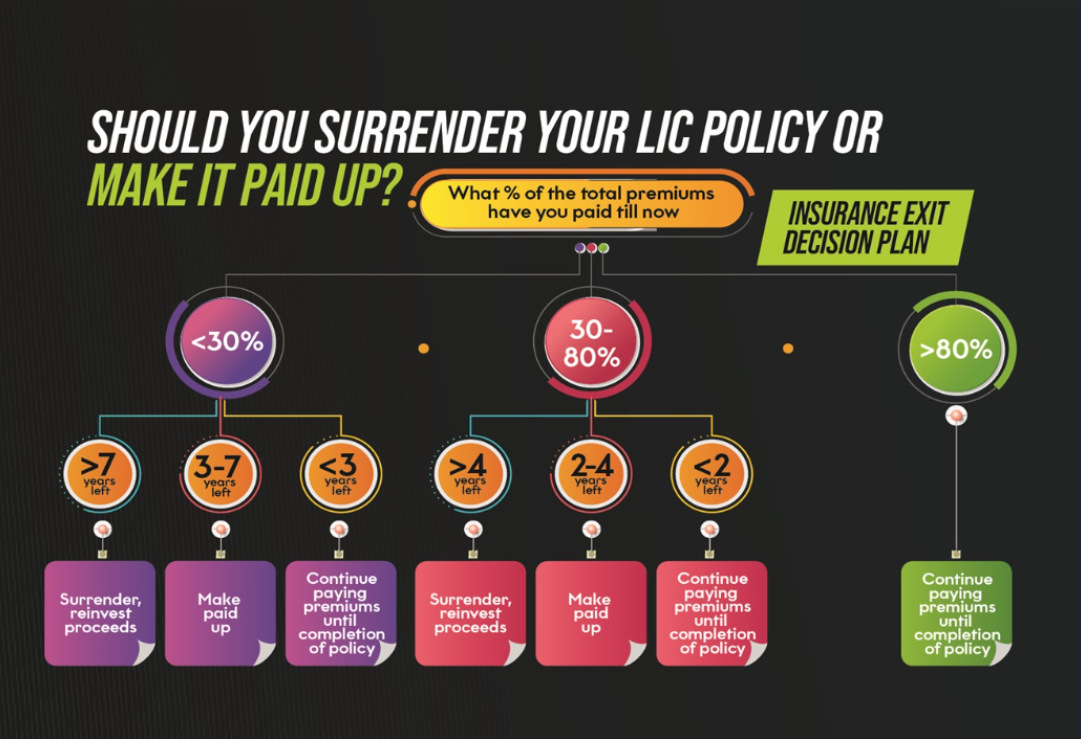

Many investors wonder whether to surrender or continue their LIC policy, especially when old insurance decisions no longer align with their financial goals. Over the years, policies taken mainly for tax-saving often stop fitting into one’s broader wealth-creation plan.

Before you decide, it’s crucial to understand the difference between surrender and paid-up LIC policy, and how each option affects your long-term financial goals.

Understanding LIC Policy Surrender vs Paid-Up

When you surrender your LIC policy, you terminate it before maturity and receive the LIC surrender value, a lump sum that’s usually a percentage of your total premiums paid, minus charges. When you make it paid-up, you stop paying future premiums but retain a reduced life cover and maturity benefit. This way, your policy stays active without additional payments.

Knowing which option suits you depends on:

-

How long you’ve held the policy

-

Your need for liquidity

-

Your overall financial plan and goals

When Paying Up Your LIC Policy Makes Sense

Opting for a paid-up LIC policy can be a smart decision in the following cases:

-

You’ve Paid 3+ Years of Premiums

Most traditional LIC plans allow conversion to paid-up status after three years of payment, ensuring you don’t lose accrued benefits. -

You Want to Avoid Booking a Big Loss

If the LIC surrender value is much lower than the total premiums paid, going paid-up may help salvage some benefit while retaining partial insurance coverage. -

You Don’t Need Liquidity Right Now

A paid-up policy continues to provide a smaller death benefit and earns bonuses until maturity, ideal if you can afford to wait.

When Surrendering Your LIC Policy Could Be the Better Move

In some cases, surrendering the policy outright makes more financial sense.

-

You Have 15–20+ Years Left on the Policy

Continuing a low-yield plan for decades can hold back your returns. Surrendering early and reinvesting in goal-based options may help build higher long-term wealth. -

You’re Young and Healthy

Replacing the lost insurance cover with a cost-effective term plan is easy and affordable in your 20s or 30s. -

You Have High-Return Alternatives

Instead of locking funds in low-yield policies, reinvesting the surrender value of your LIC policy into mutual fund SIPs or goal-linked investments can potentially create greater long-term value.

Expert Perspective: Why Professional Guidance Matters

The decision to surrender or continue an LIC policy should never be impulsive. It needs to align with your broader financial goals, whether that’s securing your retirement, funding your child’s education, or building long-term wealth.

A qualified investment expert can help you:

-

Assess your policy’s current stage and accumulated benefits

-

Evaluate the financial implications of surrendering or making it paid-up

-

Identify suitable reinvestment opportunities based on your goals and risk tolerance

Getting unbiased advice ensures you make a well-informed decision, one that protects your existing investment while setting you up for long-term financial success.

FAQs

Your Investing Experts

Continue Reading

Types of Gold Investments: A Complete Guide for Indian Investors

Gold continues to be one of India’s most trusted assets, but the way we invest in it has evolved. With multiple formats now available each serving a different purpose it’s important to know where gold truly fits into your financial plan. This guide simplifies your options so you can choose the format that aligns with your goals, behaviour, and long-term strategy.

Instant vs Delayed Gratification: A Behavioural Lens on Long-Term Wealth Creation

Wealth creation is not driven only by market movements or income levels, it is equally shaped by everyday behavioural choices. The balance between instant and delayed gratification often determines whether an investor accumulates meaningful wealth or repeatedly falls short of long-term goals.

What Are Bonds in India?

From government to corporate and tax-free bonds, understand what bonds really mean and how they function within India’s financial ecosystem.

.png)

.png)