SIP Advantages

Reduce risks by up to 38% and achieve 3x higher growth with SIP's

Over a 7 year duration, SIP's lower risk by 38% and have the capability to multiply your corpus by 3X compared to traditional investments over a 30 year saving period. In the past, SIPs in equity MFs delivered positive returns 100% of the time over a 7+ year timeframe, and a 10%+ CAGR 100% of the time when the investment time frame exceeded 10 years

Start your SIP today!

5 Benefits of SIP Investing

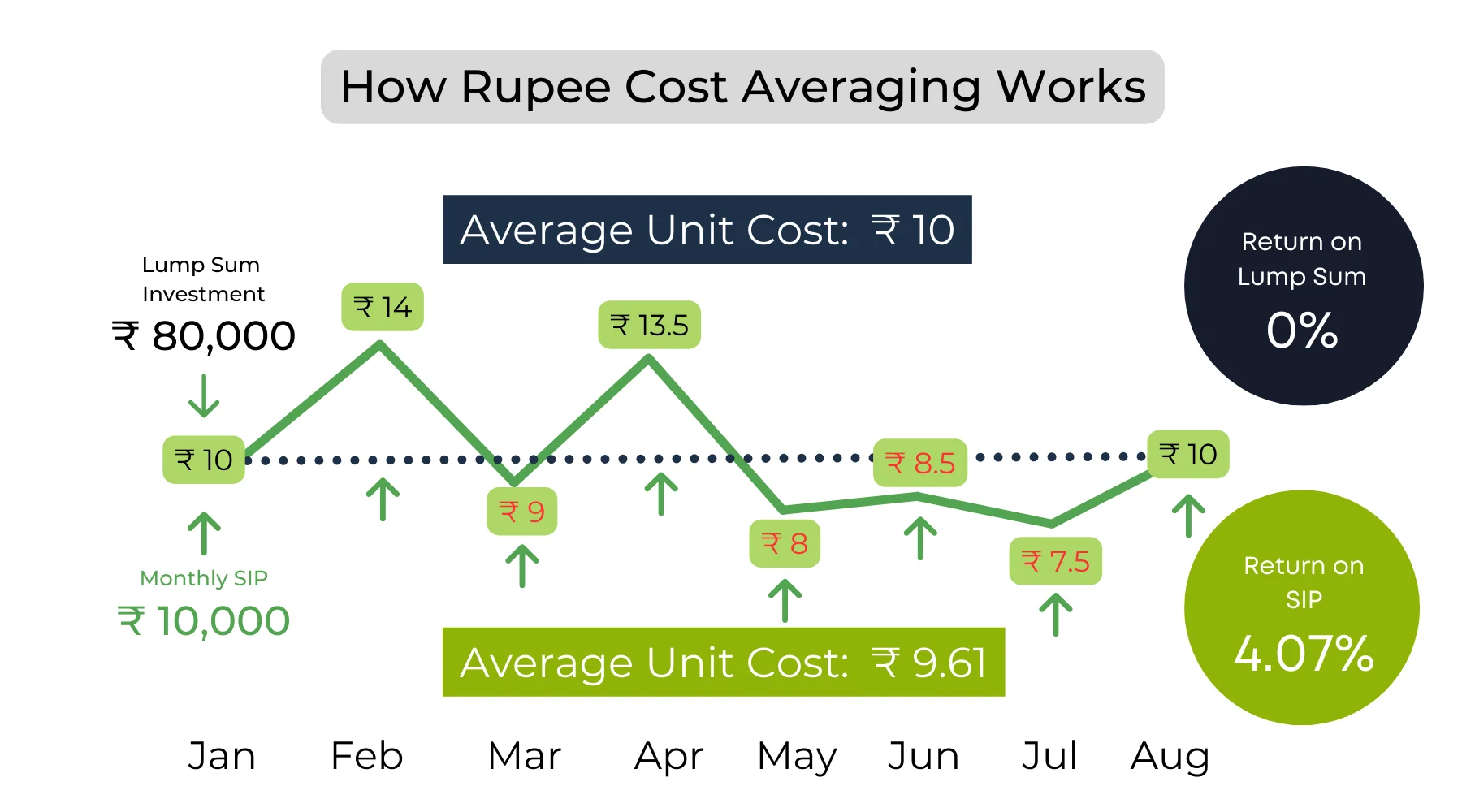

Rupee Cost Averaging = Reduced Risk

By investing a fixed amount every month, you buy lesser units when markets go up and more when they come down… Over time, this reduces risk by averaging out the purchase price of your investment.

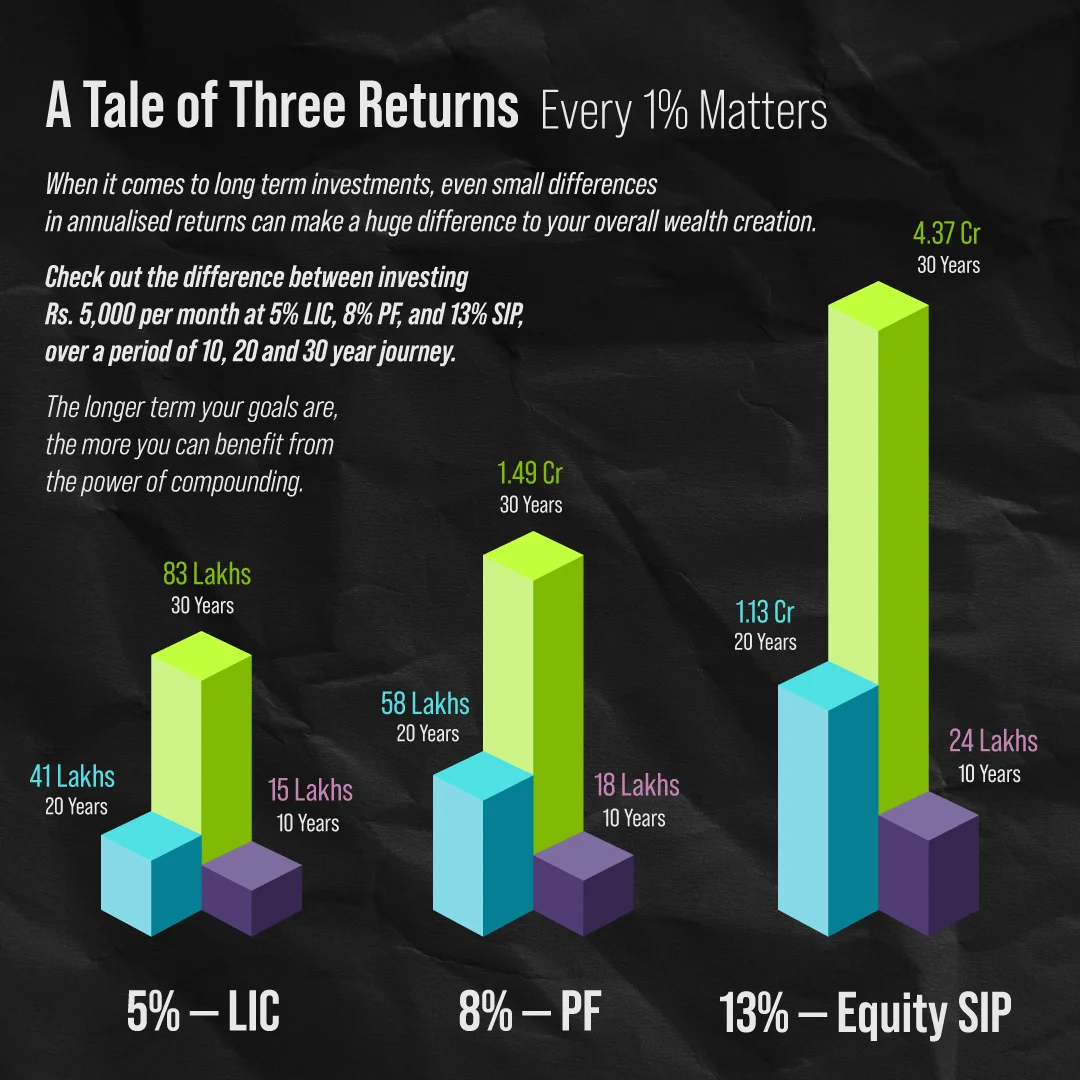

Power of Compounding = Wealth Creation

With SIPs, you earn “returns on returns” every year... This is called the power of compounding, and is the reason why even a few percentage points of extra return over 10,20 or 30 years can make a difference of lakhs…or even crores!

Discipline = Lesser Mistakes

SIP’s reduce mistakes like timing the market, waiting for corrections or trying to predict the best performing funds. You simply continue investing with discipline and let market cycles work their magic.

Goal Achievement = Peace of Mind

Just like little drops of water become an ocean, even small SIP investments made over many years can grow into a large sum of money that can help you meet your important goals like your child’s education or your own retirement. They key to success is to manage your investing behaviours along the way!

Flexibility = Customization

SIP’s are one of the most flexible investing solutions available. You can tailor make the monthly amount, risk level and even the automated annual step up to your unique goals You can even pause and restart your SIP’s if needed. This flexibility helps you customize your SIP’s to your unique goals.

The SIP Advantage

Your decision to make an SIP investment may be one of the smartest investing moves you’ll make! Here are some of the main benefits of starting an SIP.

Convenience

Did you know that an SIP investment can be started with as little as Rs. 500 per month? It’s extremely convenient to start a SIP, as the entire process is paperless and can be completed in under 10 minutes with FinEdge’s world class onboarding platform.

Risk Reduction

By allowing your SIP investment to continue irrespective of market cycles, you’ll benefit from the “rupee cost averaging effect” which will ensure that you buy more units when markets fall and less units when they go up – leading to better risk adjusted returns from your SIP Mutual Fund in the long run. This is one of the key benefits of SIP.

Power of Compounding

By starting an SIP investment in an equity-oriented fund, you’ll benefit from the power of compounding, as you’ll earn returns on returns year on year. In the long run, this can result in exponential returns on your capital, showcasing one of the true benefits of SIP.

Achieve your goals with SIP's

How to Start a SIP?

Starting a SIP through FinEdge is simple and paperless! Here's how its done.

Financial Planning & Goal Setting

Starting a SIP investment without setting proper goals is one of the main reasons why investors fail! The first question to ask isn’t which SIP mutual fund to invest into, but “why” you are investing. An Investment Expert can help you define your goals through a detailed and eye opening financial planning process.

KYC & Online Account Opening

Having set your goals, you are now ready to move to the next step in your SIP investment journey by opening a SIP investment account! FinEdge offers seamless, fully digital KYC (Know Your Customer) and account opening solutions. All you need are soft copies of basic documents such as your PAN Card, Aadhar Card and a copy of your cheque with your name on it.

SIP Mutual Fund Selection

Fantastic! Now, with your financial goals clearly defined with the help of an investment advisor, your KYC formalities done, and your account opened; you can select the best SIP Mutual Fund for your goals. For long term goals like your retirement, you can go for an aggressive SIP investment that has the potential for delivering high returns in the long run. For shorter term goals, you can choose debt funds, liquid funds or arbitrage funds.

How do SIPs Work?

When it comes to creating long term wealth from equity, our biggest enemies are our own greed and fear. Most of us either fear volatility and sit on the side lines indefinitely, or end up investing after markets have gone up. But how does an SIP help with this?

Here’s how - an SIP investment puts your savings on auto-pilot and takes away the need to time the market (an impossible feat). It’s a well-known fact that predicting short term market movements is impossible, and trying to do so can make us miss out on market rallies or incur losses, eventually losing faith in equity as an asset class. Basically, SIP investments ensure that we do not waste time trying to time the market!

An SIP also helps us inculcate savings discipline and maintain a healthy savings to surplus ratio. With an SIP, you can invest a predetermined sum of money every month or quarter. In this manner, a SIP investment puts you firmly in the driver’s seat on your journey to wealth creation from equities!

What are some types of SIP investments?

Now that we’ve covered quite a bit of ground when it comes to what a SIP is, how a SIP investment works, and what the benefits of a SIP investment are – let’s dig deeper into the two predominant types of SIP that you need to choose from.

Static SIP Investment

The default kind of SIP investment is a “static” one, in which a fixed amount is invested every month into a SIP Mutual Fund of your choice. You can specify an end date for the SIP investment or opt for a “perpetual” SIP – which basically means that it will continue to run until terminated. Since a SIP is highly flexible and can be stopped at any time, it’s advisable to start a perpetual SIP, which you can then stop once you achieve your goal! While a static SIP is simple and easy to understand, the wiser choice when it comes to achieving your long-term goals.

Step-up SIP Investment

Think of a step-up SIP investment as a turbocharged SIP! In a step-up SIP mutual fund, you basically issue a standing instruction to top up your SIP every year by a fixed amount. For example, you may only be comfortable investing Rs. 10,000 per month today, but are quite confident that you’ll be able to increase this SIP investment by Rs. 2,000 per month on an annual basis. Instead of waiting for a year to lapse and increasing this SIP investment manually, you can issue an upfront instruction to adjust the SIP mutual fund by Rs. 2,000 annually. This is a fantastic choice for long term goals, and it therefore recommended by top investment advisors and financial consultants. It may surprise you to know that even a small annual step up can make a 3x-4x different in your final SIP mutual fund corpus! …you can calculate your step-up sip investment by using FinEdge SIP Calculator

FAQ’s - SIP Investing

Is SIP a Good Investment?

SIP in itself is not an investment, but a way to invest into a mutual fund. To create long term wealth from your equity mutual fund SIP’s, it is important to continue them for the long term without trying to time the market. Also, one should understand how SIP’s work before investing, because SIP returns can fluctuate in the short term.

Can I withdraw SIP anytime?

This will depend on the fund that you are running your SIP into. If your SIP fund is not locked in, you can withdraw your units anytime. However, if your SIP fund has a lock in period (for example, an ELSS), your units may be locked in for a specific time period from the SIP purchase date.

Is SIP tax free?

Whether your SIP returns are tax free or not will depend upon the underlying fund that that SIP is running in and the holding period of your units. For example, if you are running a SIP in an equity-oriented fund and redeem all your units after 2 years, the units purchased in the past 12 months will attract short term capital gains tax and the units purchased prior to that will attract long term capital gains tax.

What are SIP tax benefits?

By starting a SIP in an ELSS (Equity Linked Savings Scheme), which is a specific type of diversified equity fund with a 3-year lock-in period, one can get tax benefits under Section 80C. Running a SIP in an ELSS throughout the year instead of investing a lump sum at the end of the year is a wise move because it reduces risks and is also easier on the pocket.

Is SIP in Life Insurance good?

Unfortunately, many life insurance companies wrongly represent their products and try to lure SIP investors into them. You should only start a SIP in a mutual fund, not in a ULIP or any other life insurance policy. These policies have high costs attached to them, and also tend to underperform compared to mutual funds.

Should I close my LIC and start a SIP instead?

Whether or not you should close your LIC and start a SIP instead depends primarily on what stage of the policy you are in. If you are in the first 3-4 years of your LIC policy, it makes sense to surrender it and start a SIP instead, because returns from these policies usually do not even beat inflation! Besides, the life cover associated with them also tends to be insignificant. A Mutual Fund SIP + Term Plan combination would be a lot better. However, if you are already 70-80% into your policy tenor, you should complete the term instead of bearing such high surrender charges. Once your policy ends, you can start a SIP.

How to stop insurance and start SIP

The easiest way to stop your Insurance Policy is to stop paying premiums. The policy will then become paid up and the sum assured will be revied accordingly. If it’s a ULIP, the funds will stay in a discontinuation fund and earn some nominal returns until its lock in period finishes. You can then start a SIP after planning your goals and channelize the saved funds into that SIP instead.

How to do SIP in stocks?

Some broking platforms allow you to set up a “stock SIP”, which is similar in structure to a mutual fund SIP and allows you to buy a predetermined quantity of shares at defined intervals. However, a stock SIP does not have the same benefits as a mutual fund SIP because the diversification benefits are missing. For instance, a monthly mutual fund SIP of Rs. 5,000 may give you a diversification benefit across 40-50 stocks. However, the same amount could fetch you just 2 shares of Reliance Industries in a stock SIP! Mutual Fund SIP’s are a much better alternative to stock SIP’s.

What happens if I miss an SIP instalment?

If your SIP investment ends up bouncing due to insufficient balance or some other bank related issue, the SIP will be re-attempted from the next month onwards. If the SIP investment was started offline, it may terminate in the event of three consecutive bounces. Also, your goals could be impacted – so it’s advisable to top up your SIP Mutual Fund with a lump sum in case of a bounced instalment!

What is the minimum amount I need to start a SIP investment?

The minimum SIP investment amount varies from fund to fund, but most SIP mutual funds can be started with as little as Rs. 500 per month. However, it is recommended to map your goals and invest accordingly instead of starting off with the minimum amount permitted in a particular SIP mutual fund.

Can I automatically renew my SIP?

Yes. At the time of registration of your SIP investment, you can opt to automatically renew your SIP mutual fund on the completion of its tenure. If you choose this option, the SIP investment will restart for the previously selected duration (for example, 3 years). However, SIP investments are very flexible – so they can be stopped midway even after an auto-renewal.