Tax Saving

ELSS Funds – A great way to achieve your Financial Goals

Most of us look at tax saving as a last-minute chore to be undertaken a few days before the end of every fiscal year! Needless to say, the last-minute rush leads to a number of regrettable investment decisions too. Usually, tax saving aspirants have flocked to Life Insurance as their preferred tax saving avenue, but ELSS funds are a far superior option. If you’re wondering what ELSS Funds are and how you can use ELSS funds to save taxes, you’ve come to the right place.

What are ELSS Funds?

Your investments made into ELSS Funds are deemed as tax deductible under Section 80C of the income tax act. Section 80C has a limit of Rs. 1.5 lakhs in a given financial year, and also encompasses other popular avenues such as your home loan principal, tuition fees for your kids, your PPF investments and your life insurance premiums. If you’re falling short of Rs. 1.5 lakhs after considering all the above stated, you should ideally plug that gap using an ELSS fund.

How do ELSS funds score over other, traditional instruments?

ELSS Funds score over their traditional counterparts (such as Life Insurance of Term Deposits) on two counts. First, they have the shortest lock-in period of three years compared to term deposits (5 years), PPF (15 years) and Traditional Life Insurance (ranging from 10 to 20 years). Second, they harness the unparalleled wealth creation potential of the equity markets, thereby providing investors with the opportunity to create long term wealth from their tax-saving investments rather than getting locked into fixed income investments in the name of safety. Especially for younger investors who can afford to extend their time horizons if their lock-ins expire amidst the throes of a bear market, ELSS Funds make a lot of sense.

How to invest into ELSS Funds

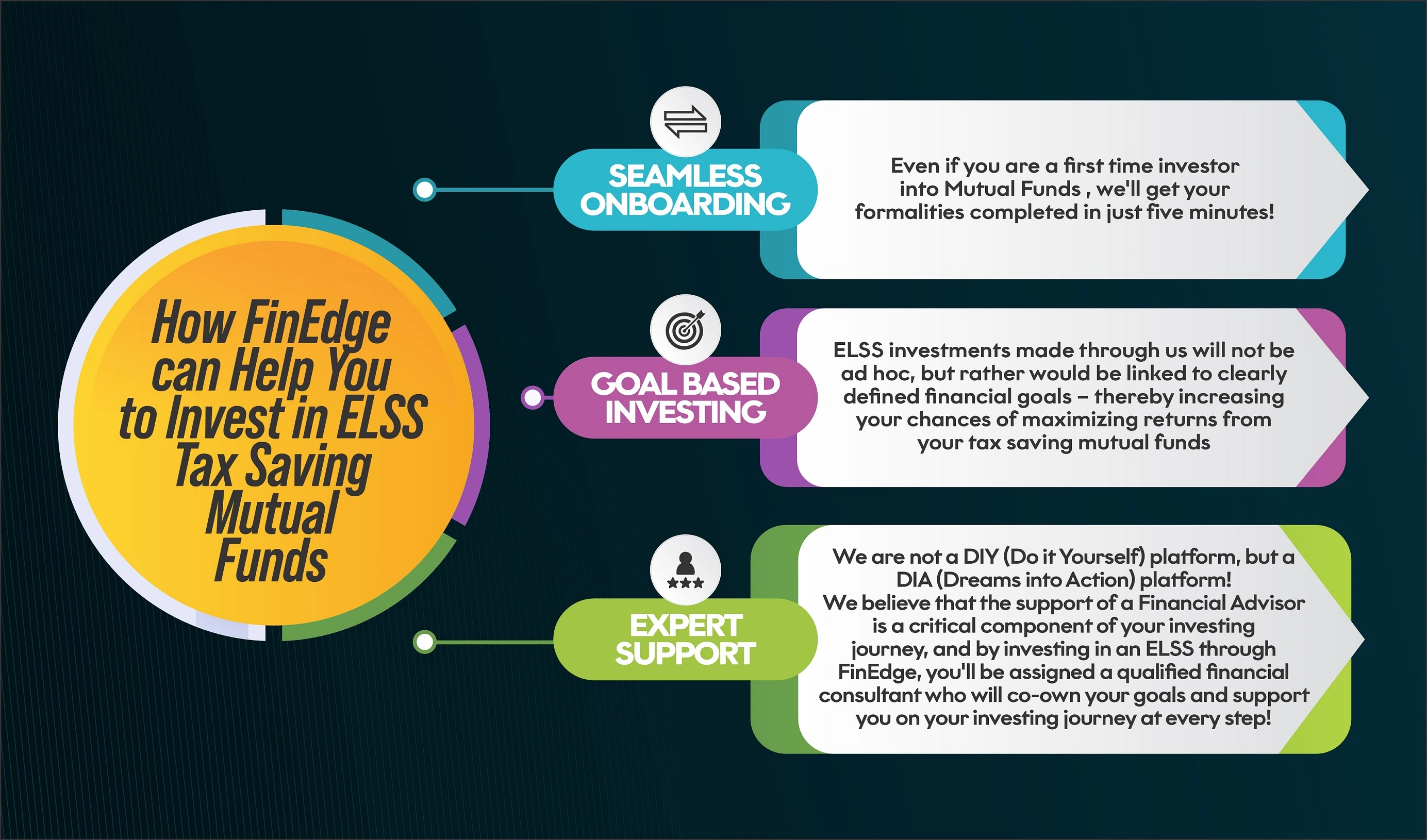

If you’re a first-time investor into Mutual Funds, you’ll need to undergo a simple KYC registration process (Know Your Customer), which is a simple online process that takes less than 15 minutes. Moreover, the investment itself can be done online, without any paperwork. For best results, you should ideally compute your 80C gap and stagger your annual required outlay over a period of several months, rather than as a lump sum at the end of the Financial Year. Doing this will not just make it easier on your pocket, but also protect you from the risk of betting your investments on one specific point in the market cycle. A qualified Advisor could help you gets started with your ELSS Fund investment. Feel free to get in touch with us today.

Your Investing Experts

Avoid these 3 ELSS Mistakes

Have you decided to meet your financial goals and save taxes through ELSS funds? Here are three ELSS fund mistakes to avoid.

Fixating on the 3-year lock in

By fixating on the three-year lock-in, many investors carry the mistaken belief that three years is a sufficient time horizon to invest into ELSS funds. A time horizon of five to seven years is a lot more appropriate.

In situations where lump sum investments are made when market valuations are already stretched, it is quite likely that ELSS returns could be flat to negative over a three-year period, with a couple of rough rides thrown in during the course too.

In such situations, investors need to be willing to extend their time horizons by a further three to four years (beyond the mandated three-year lock-in) to really reap rewards. Stock markets are cyclical in nature, and phases of capitulation will invariably be followed by phases of rapid growth – only the timing is uncertain, their occurrence is almost a given. Redeeming ELSS money with flat to negative returns ‘just because three years are up’ would be an incorrect course of action. While you can derive a degree of comfort that the mandated lock-in will finish within 36 months, you need to mentally commit yourself to longer investment horizon if you’re opting for an ELSS; as is the case with any equity-oriented investment.

Not understanding their risks properly

One of the ultimate truths of the investing world is that there are well and truly no free lunches. Increased return potential will invariably be accompanied with increased risk of capital erosion. Being equity linked, ELSS funds are high risk in nature. Did you know that ELSS Mutual Fund NAV’s fell by 28% on average during the pandemic, in just one month? However, if you had the resilience to continue investing with discipline, you would have surely reaped the rewards when markets rebounded soon after.

The mandatory lock in period of three years also allows ELSS Fund Managers more flexibility with respect to picking stocks. Armed with this flexibility - and with the promise of a more predictable degree of redemption pressure, ELSS Fund Managers tend to concentrate their portfolios into ‘value’ picks that may not move in sync with the broader market, but which have the potential to become multi-baggers in the longer term. This usually results in long term outperformance, but at the cost of a few short-term shocks.

As an investor, you would do well to understand the risks associated with ELSS funds before taking a final decision. If you’re very risk averse, you may want to consider splitting your tax saving amount between ELSS funds and other lower risk instruments such as PPF or Tax Saving FD’s - lower returns notwithstanding. Respecting your unique investment preferences and risk tolerance levels and critical for long-term investing success.

Going in “all at once”

The third – and arguably most common ELSS related mistake - is the habit of waiting until the penultimate moment and making a lump sum investment into an ELSS in the last week or fortnight of the fiscal year.

While this approach could work wonders if lady luck is on your side and you end up catching a market bottom; it could work to your severe detriment if you invest at or near a market peak. In other words, the ‘throw in the kitchen sink at the last moment’ approach to ELSS investing significantly increases your investment risk.

A much smarter, and more convenient approach would be to start an SIP (Systematic Investment Plan) in an ELSS at the start of the fiscal, after computing your projected deficit for the year. For instance - start a monthly SIP of Rs. 6,000 if you’ve already got Rs. 80,000 out of the Rs. 150,000 covered through other instruments. In doing so, you’ll be benefiting from a wonderful mechanism called “Rupee Cost Averaging” which greatly mitigates the risks associated with the ups and downs of the stock markets. In the long run, your returns will be a whole lot smoother, and you’ll face a lot less heartache if and when markets head south.

How to Save Tax Using ELSS Funds

Tax Saving Investments - Compared

If you’re yet to make your tax saving investments under Section 80(C), here are some options you could be considering. Before you invest, consider the pros and cons of each of them.

ULIPs

ULIP’s have seen significant reforms post 2009, before which they were traditionally mis sold very heavily. Woeful tales of ULIP mis-selling, including them being sold as ‘five-year FD’s to hapless senior citizens and even poor farmers made it to the media. Even now, after the reforms, ULIP’s are not an optimal choice as they tend to underperform mutual funds of the same risk category. Besides, they typically do not contribute much to your life coverage too.

Considerations: Since ULIP’s represent an incomplete solution to both your investing and insurance needs, they are best avoided. Combine a simple term plan with Mutual Funds instead.

Sukanya Samriddhi Yojana

Sukanya Samriddi Yojana or SSY was set up with the singular intent of helping people secure the futures of their girl children. Your SSY account will attract interest on the 10th of every month, and the moneys will be compounded on an annual basis. You’ll need to continue making the deposits for a period of 15 years, and the balance will continue to attract interest until the 21st year of your starting the account; at which point it will mature, tax-free. Alternatively, you may withdraw the entire balance, if you so desire, for her education purposes when your daughter turns 18, or when she gets married. The returns from this scheme are generally higher that the yield on government bonds.

Considerations: Though the SSY is a good alternative to fixed income instruments, it will only barely help you outpace inflation – so make sure you balance out your goal-based savings for your daughter’s future with equity-oriented investments too.

Senior Citizen’s Savings Scheme

If you’re above 60, and risk averse, you could consider investing into the SCSS. The SCSS or Senior Citizens Savings Scheme is a 5-year, fixed return investment with a sovereign backing. The retiree has the option of extending the tenure by a further three years at the end of the 5th year, at the rate prevailing at that time. Unfortunately, the SCCC has a hard cap of Rs. 15 lakhs, implying a maximum possible income generation of Rs. 10,500 per month at the current rate of 8.3% per annum. Interest income generated from the SCSS is fully taxable in the hands of the retiree.

Considerations: SCSS rates fluctuate, and are reset by the government at the start of every quarter. This may work to your detriment in falling interest rate scenarios.

ELSS

ELSS or “Equity Linked Savings Schemes” have risen in popularity in recent times, mostly on the back of a strong equity market performance in 2017, and AMFI’s consistent efforts to promote Mutual Funds amongst the less-informed masses. With a category average 5-year return exceeding 18% per annum as on date, ELSS funds have caught the fancy of retail investors. In a nutshell, ELSS funds are a type of equity oriented mutual fund, with a mandated 3-year lock in. Most ELSS funds maintain diversified portfolios, with an even spread between various market capitalisations. The locked in AUM allows fund managers to take value-based calls in richly valued markets such as these.

Considerations: ELSS funds are high risk in nature, and investors should make an effort to understand the potential downsides before investing. Additionally, with the new norms related to dividend distribution taxes that have been proposed in the recent budget, opting for the growth option makes a lot more sense.

Tax Saving Investments – FAQs

Who Can Invest in ELSS Funds?

Resident Indians, NRI’s and PIO’s can invest into ELSS Mutual Funds. To invest into tax saving mutual funds, you must be KYC compliant. With our digital onboarding process, you can complete your KYC formalities in a matter of minutes.

What is the lock-in period in ELSS Mutual Funds?

The stipulated lock in period for ELSS Mutual Funds is three years. Please do bear in mind that each SIP tranche would be counted as a fresh purchase and remain locked in for three years from it’s purchase date.

How much to invest in ELSS Funds?

There’s no limit to the amount you can invest into ELSS Funds – however, the maximum allowed tax deduction is Rs. 1.5 Lakhs (the Section 80C limit). Ideally, you should invest up to Rs. 1 5 Lakhs in ELSS funds and allocate the rest to other diversified equity funds as per your goals.

NPS or ELSS - which is better?

Although NPS is a superior tax saving option compared to a lot of traditional options such as life insurance and PPF, their returns pale in comparison when it comes to ELSS Mutual Funds. Also – NPS enforces restrictions when it comes to maximum equity allocation, making it a suboptimal long-term investment avenue. Hence, tax saving mutual funds score over NPS in the long run. However, you can use ELSS to complete your 80C quota, and then invest a further Rs. 50,000 a year into NPS to avail of an addition deduction under section 80CCD(1B).

PPF or ELSS - which is better?

Although PPF investments are less volatile, their long-term returns can never beat those from ELSS Mutual Funds – and in the long run, the difference between 7% and 12% is more than you can imagine. Hence, ELSS Funds score over PPF as a tax saving avenue.

How ELSS saves tax?

The amount that you invest into an ELSS in a given financial year is deducted from your income for that financial year, and your tax is computed accordingly. In this manner, ELSS Mutual Funds help you save taxes.

Are Equity Linked Savings Schemes Safe?

From a regulatory standpoint, all mutual funds (including ELSS Funds) are extremely safe. Mutual Funds are structured as a trust, with the unit holders as the ultimate beneficiaries of the trust. Having said that, it’s important to know that ELSS Funds invest into stocks, and the stock market can be volatile. What this means is that your fund value could fluctuate in the short term, and your returns will not be linear, unlike those from FD’s and PPF. However, by investing via SIP’s and by holding on for the long term, risks associated with equity investing tend to get smoothed out.

Attain Financial Freedom