Greed and Fear in Investing: Why Traders Lose Money

- Greed and fear are the biggest causes of poor investing outcomes.

- Short-term trading often relies on emotion, not fundamentals.

- The behaviour gap shows how emotions reduce real investor returns.

- Long-term investing success comes from discipline and patience.

Greed tempts investors to chase quick gains, while fear pushes them to sell too soon. Long-term wealth is created by resisting both and staying disciplined through market ups and downs.

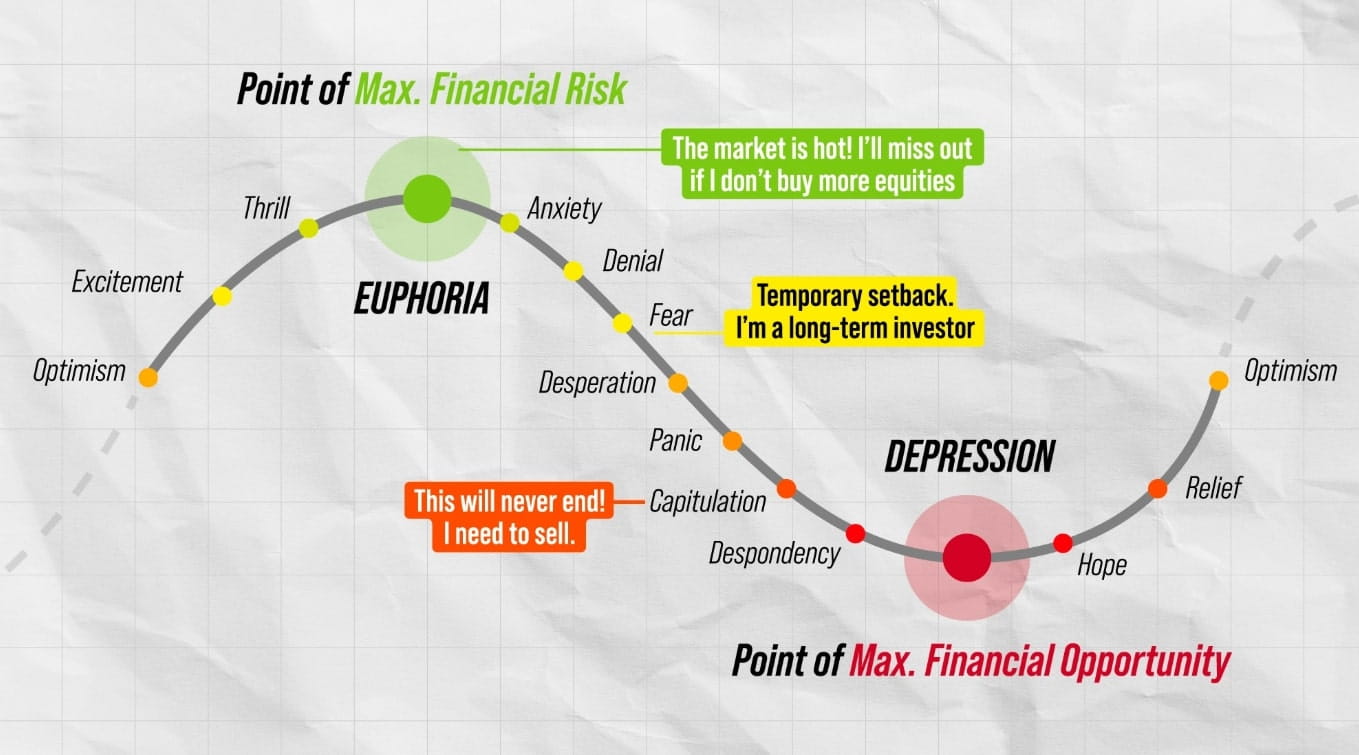

Investing should create peace of mind, not anxiety. Yet many investors find themselves on an emotional roller coaster, driven by the twin forces of greed and fear. The desire to double money quickly or chase hot stock tips often ends in disappointment. On the other hand, fear during downturns prompts hasty exits, leading to missed opportunities. Understanding these emotional traps is the first step towards building true investing resilience.

Why Trading in Stocks or Crypto Usually Fails

It’s Mostly Noise in the Short Term

Short-term price movements are rarely based on fundamentals. A large buy or sell order can change prices drastically, making it impossible to predict outcomes reliably. Traders often end up relying on luck rather than strategy.

Emotions Run High

From scanning for “hot stocks to buy today” to reacting to every news update, day traders often let adrenaline take over. Emotional decisions cloud judgment, and while early “beginner’s luck” may create confidence, the long-term result is usually loss.

The Rewards Are Small

Even when trades succeed, the profits are often small. To achieve meaningful returns, traders repeat the cycle again and again — each time increasing costs, taxes, and risks.

Trading Becomes Irrational

Many traders struggle to stick to stop-losses. Hoping for a recovery, they hold on longer than they should, turning small losses into large ones. Instead of doubling their money, they often end up cutting it in half.

The Behaviour Gap in Long-Term Investing

Even disciplined investors can fall prey to greed and fear. The behaviour gap refers to the difference between the returns markets deliver and what investors actually earn, caused by emotional decision-making.

Common Behavioural Biases

-

Action Bias: The urge to change portfolios too often, especially when markets are flat.

-

Loss Aversion: The tendency to exit investments whenever values fall, even though downturns are often temporary.

-

News-Driven Reactions: Headlines and predictions can cause investors to stop and restart SIPs frequently, leading to lower long-term returns.

Over time, these behaviours reduce the benefits of compounding and prevent investors from realizing the full potential of their investments.

Building Resilience Against Greed and Fear

True resilience comes from discipline. By staying invested, ignoring short-term noise, and tying investments to long-term goals, investors can overcome emotional traps. Returns are ultimately the reward for patience, and compounding works best when investments are left undisturbed through market cycles.

FAQs

Your Investing Experts

Continue Reading

Is COVID-19 Triggering These Behavioural Biases in You?

The COVID-19 market crash was more than a financial shock, it was a psychological one. For many investors, it exposed deep-seated behavioural biases that quietly shape our decisions, often at our own cost. Whether it's abandoning your SIPs during a dip or chasing trends at the wrong time, understanding these patterns is the first step toward better investment outcomes. Let’s unpack the most common behavioural traps triggered by market turbulence, and how to avoid them.

5 Behavioural Biases That Influence Our Investment Decisions

Human behaviour takes shape over a period of time based on various factors. Some of these include what we see, read, watch, and learn from people in our lives, television, social media, etc.

Chasing Returns vs. Wealth Creation

Creating Wealth from your investments is all about return maximization, right? Wrong! It may surprise you to know that your pernicious little habit of always trying to maximize portfolio returns may in fact be what is impeding your ability to generate long-term wealth. Here’s are four reasons why.

.jpg)