Mutual Funds Kyu Sahi Hai?

Mutual Funds can help you create 300% more wealth for your long term goals

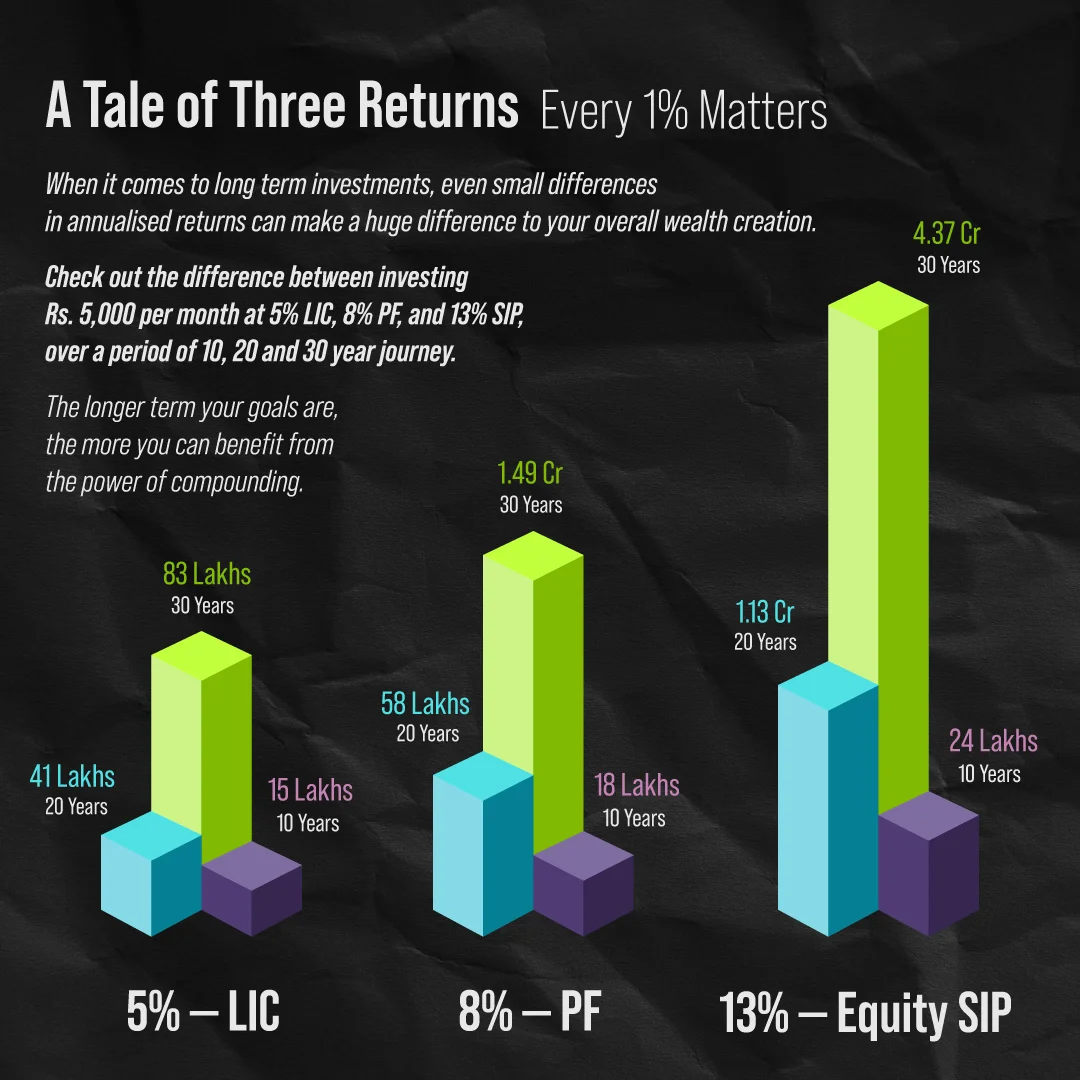

If you can invest with the correct expectations, understand risks, and manage your investing behaviors, equity mutual funds have the potential to create a 3X higher corpus compared to traditional investments such as FD's, PF and Life Insurance over a 30 year period.

The Compound Effect

The Real difference between 8% and 13% is much more than you think!

Start investing in Mutual Funds!

How selection of the best product enables a massive difference in corpus due to compounding

With close to 3,000 different Mutual Fund Investment schemes present across more than 25 categories, picking the best type of mutual fund scheme to suit your unique goals can be quite challenging. It’s not enough to simply pick a high return investment based on the past 2 or 3 year returns. Selecting the right mutual funds for your goals can make a huge difference to your long term wealth creation, and the support of an investment expert can prove to be invaluable in helping you choose the right fund and remain invested in them for your important goals.

Plan Your Mutual Funds Investment around your Goals

Most investors spend a lot of time trying to select the best mutual funds to invest into, without addressing the key question of “why” they are investing! However, fund selection is of secondary importance. The best way to invest in mutual funds isn’t by looking at past returns or star ratings or blindly selecting a high return investment, but on the basis of your financial goals. For example, if your goal is to retire wealthy 25 years later, a small cap mutual fund investment may be best suited for that need. On the contrary, if you’re looking to invest in mutual funds to build a solid emergency fund, the best mutual funds to invest into would be much lower risk in nature, such as an arbitrage fund or a liquid fund. So, it makes sense to use your goals to determine the best mutual fund investment for you, rather than trying to chase returns or buying into the latest NFO (New Fund Offer).

Don’t assign a risk profile to yourself – assign different risk profiles to different goals instead

One of the most common mistakes that investors make is to invest into products based on their individual attitude to risk. For example, a high-risk taker will invest all their money into a potentially high return investment such as futures and options and a low risk taker will end up investing all their money into PPF or Life Insurance, even if the funds are meant for a very long term goal like retirement. Both are wrong approaches! The ideal way to invest is to assign different risk profiles to different goals, irrespective of your attitude to risk. Investments for short term goals should be made into funds that have a high capital safety, even if they fetch lesser returns. Investments for long term goals should be made into funds that have the ability to grow at supernormal rates and compound over the long term, after clearly setting expectations and understanding risks of course.

Focus on the process of Mutual Fund Investment

Investing is easy, but remaining invested and creating long-term wealth is hard! To actually benefit from compounding and earn the published returns of a mutual fund, you need to have investing resilience and discipline. This comes from having a proper, structured process in place. For example, making a mutual fund investment according to a clearly defined financial plan and not in an ad hoc manner, maintaining discipline and not timing the market, not redeeming or stopping your SIP’s unless its an urgent need, and stepping up your investments periodically. Having an investment expert to guide you along the way can be extremely helpful.

Why Mutual Funds are the No. 1 choice of smart investors!

Every day, more and more smart investors are moving away from traditional investments and investing into high return investments such as mutual funds. With more than 40 lakh crores of mutual fund investments already made, it’s an undisputed fact that “Mutual Funds Sahi Hai!! Whether it’s your Retirement, your Child’s Education or simply a family vacation, there’s a mutual fund investment available for every goal and time horizon. Whether you want to save systematically for 30 years, park your money for just a couple of weeks before you deploy it somewhere else, benefit from the growth potential of a particular sector or theme, or invest your newly received bonus into an emergency fund - you can be sure that there’s a mutual fund investment available for your needs!

Why invest in Mutual Funds

Diversity

Whatever your financial goal, there is a mutual fund investment to fit your needs! From low-risk liquid funds that offer returns that are slightly better than savings accounts to high risk/ high return equity mutual fund investments that can help you generate tremendous long-term wealth from compounding, mutual fund investments are a “complete” investing solution. Mutual Funds Sahi Hai!

Transparency

A Mutual Fund Investment is the most transparent investing tool available today. Portfolios and NAV’s are disclosed publicly, and so are associated costs. Unlike many traditional instruments such as life insurance, there are no ‘hidden’ costs in mutual fund investments. What you see is what you get, and this is yet another reason why Mutual Funds are the best investment.

Professional Management

Whether you are investing Rs. 500 per month or Rs. 500,000 per month, you’ll enjoy the advantage of having an expert fund manager and an expert team of analysts looking after your funds. By leaving the money management to the experts, you can stop worrying about whether your investments are being managed properly!

Safety & Regulatory Comfort

You can sleep peacefully at night knowing that your mutual fund investment is strictly regulated. In fact, a mutual fund investment is structured as a trust, which is managed by a board of trustees. The only beneficiaries of the trust are unit holders – that is you, and others who have invested into it. SEBI, the regulator, has gone to great lengths to ensure that mutual funds are a highly trustworthy investment avenue.

Low Cost

When it comes to investment costs, Mutual Funds Sahi Hai! In fact, the regulator has placed strict caps on Total Expense Ratios (TER’s) that mutual funds can charge their investors. Since there are no up-front costs associated with mutual fund investments, it is almost like a ‘pay for usage’ sort of model!

Liquidity

Barring ELSS Funds and a few select close ended schemes, mutual funds are extremely liquid and can be redeemed any time! This ensures that you always have emergency access to your capital, unlike other traditional instruments which either have hard lock ins or prohibitive exit costs. However, make sure that you don’t let this liquidity work against you by redeeming your long term investments for your ‘wants’! Having clearly defined goals can help you maintain investing discipline.

Tax Efficiency

Along with being the best investment tool for goal achievement, Equity Mutual Funds are also highly tax efficient. Long term capital gains on equity mutual funds are only 10%, which is one of the lowest rates on any instrument available today. In fact, long term capital gains become applicable only above Rs. 1 Lakh per financial year.

What are Mutual Funds and what are the types of mutual fund schemes?

Mutual Fund are true all-rounders when it comes to helping you meet your financial objectives! Basically, a mutual fund investment is nothing more than a pooled investment vehicle. When you choose to invest in mutual funds, your money gets added to this pool along with thousands of other investors. This mutual fund investment is managed by a professional fund manager and a team of analysts according to the fund’s investment mandate, and each fund carries a different risk-reward profile. For example, a small cap mutual fund investment may be more volatile that a debt mutual fund investment, but also has the potential to deliver much higher returns over the long term. Before you invest in mutual funds, it’s essential to consult a professional financial advisor on the type of mutual fund investment that best suits your unique goals and objectives.

How to Invest into Mutual Funds

Despite their widespread growth, many investors remain confused about how to invest into mutual funds! Should they invest a lump sum, or through Systematic Investment Plans? What about STP’s and SWP’s? Should they invest into mutual funds in one shot or gradually, over a period of time? Such questions about how to invest into mutual funds leave many investors confused. To keep it simple, there are basically two ways to start investing into mutual funds.

Systematic Investment Plans

If you want to save up systematically in the best mutual funds in a disciplined manner, for a clearly defined financial goal; then a SIP mutual fund investment is the perfect choice. With SIP’s, a fixed amount of money is debited from your account every month and channelized towards your mutual fund investment. Not only is this easy on the pocket, but it also reduced the risk associated with your mutual fund investment over the long term, through a process called “rupee cost averaging”. For goal based investments, SIP Mutual Funds Sahi Hai!

Lump Sum

If you are at an advanced stage of your wealth creation journey and wondering how to invest in a top mutual fund, a lump sum mutual fund investment can be considered as well. Of course, the risk associated with investing everything at a single market level will be higher, but you could potentially end up earning higher returns from your mutual fund investment too, if markets start to move up right after you invest. However, it is always advisable to make the lump sum mutual fund investment into a low-risk fund and then use a systematic transfer plan to move money into the high-risk fund in a staggered manner, because lump sums can be a high return investment but are also risky.

Systematic Transfer Plans (STP)

Sometimes, you may have a lump sum of money handy (such as an inheritance or a bonus), and would like to invest it in one shot. Here is where STP’s can come in handy. An STP allows you to invest a lump sum in one fund and provide a standing instruction to move the money to a different fund of the same AMC in a staggered manner. This helps you reduce the risk of investing all your money at or near market peaks, and also provides rupee cost averaging benefits to an extent.

Frequently Asked Questions - Mutual Fund Investments

How do mutual funds work?

Mutual Funds investments pool together funds from thousands of investors and assign a professional fund manager to take investment decisions on that “pool” of money, based on the fund’s mandate. Investors are assigned “units” of that mutual fund, which is similar to owning shares of a company.

How to choose the best mutual fund that suits your financial objective?

It’s simple! Base your decision on your time horizon and nothing else. If your goal is long term, embrace risks and remain invested through all market cycles. If its short term, go for a low risk mutual fund investment. A professional mutual fund advisor can be very helpful when it comes to setting financial goals and keeping you aligned to them.

How can I invest in the Best Mutual Funds through FinEdge?

To invest in mutual funds through FinEdge, you’ll need to set your financial goals first! We strongly discourage ad hoc mutual fund investments and encourage investors to have clear objectives. The entire process is online and paperless. Setting up a mutual fund investment account through FinEdge takes less than five minutes!

How do mutual funds help in financial planning?

Mutual Fund investments are fantastic for financial planning! Because of their versatility, they are the ideal solution for constructing a goal-based investment portfolio. SIP’s (Systematic Investment Plans) in the best mutual funds allow investors to gradually and steadily create wealth for their goals over time

Are mutual funds safe?

From a regulatory perspective, mutual fund investments are one of the safest investment instruments available today. Mutual Funds are closely monitored by SEBI and adequate checks and balances are in place to ensure a high degree of regulatory comfort for investors. However, it’s important to understand that every type of mutual fund carries its own degree of risk (and commensurate reward), and its critical to understand these risks before investing

Can I Create Wealth by Investing in Mutual Funds?

The power of compounding and professional management of diversified portfolios makes mutual funds an effective stategy for wealth creation over the long term. A disciplined approach to investing is crucial, as it aligns your risk tolerance with your investment goals.

What are the various types of mutual fund schemes?

Mutual Funds are classified on the basis of whether they invest into stocks, fixed income instruments or a mix of both. Further, there are sub classifications based on which specific segment (for example, mid-caps, tech stocks or government bonds) that they invest into. It’s important to understand specific risks associated with the type of fund before investing.

What is the average return on mutual funds?

Average Return on mutual funds would depend on the type of fund. Equity oriented funds have historically provided between 12% and 15% CAGR over long term investing time frames exceeding 8-10 years. Debt Funds have provided between 5% and 8%, depending upon the type of fund. It’s important to note that returns from mutual funds are not linear in nature, and there could be years of lower than average return followed by years of much higher returns, and so on.

Why should we invest into mutual funds?

We should invest into mutual funds because they have the potential to deliver higher returns than traditional instruments. Over long periods of time, this can make a huge difference to your wealth creation. You should set the right expectations and invest in a disciplined manner to reap long term rewards.

What are some mutual fund tax benefits?

ELSS Mutual Funds (Equity Linked Savings Schemes) provide tax benefits under Section 80C. This is the reason why people invest in mutual funds towards the end of the financial year. However, it is more sensible to start a SIP and invest into an ELSS systematically throughout the year instead of in one shot at the end of the year.

Why mutual funds are better than stocks?

A Mutual fund Investment provides the benefit of diversification and professional management. Also, people tend to approach stocks with a speculative mindset and invest for short term returns. By investing in mutual funds through SIP’s, one can benefit from rupee cost averaging and benefit from the stock market while reducing overall risk in the long run.