Investing Insights

FinEdge is India's leading tech enabled investment management company and manages over 1400 crores of goal-based investments for its 20,000 clients spread across 1700 cities in the country.

Our team combines deep financial planning experience with behavioral insights to help investors make smart, goal-aligned decisions.

5 Steps to Reducing Financial Stress

Managing financial stress is crucial in today’s fast-paced world. A solid financial plan, adequate insurance, and responsible credit management can help you stay in control. Working with a qualified financial advisor ensures you make informed decisions and secure a stress-free financial future.

5 Mutual Fund Utilities That are Useful for Retirement Planning

Mutual funds offer a powerful toolkit for retirement planning, from SIP investments to systematic withdrawals. Features like SIP step-ups, insurance benefits, and STPs help you build and secure your retirement corpus efficiently. With the right strategy, you can ensure steady income and financial stability post-retirement.

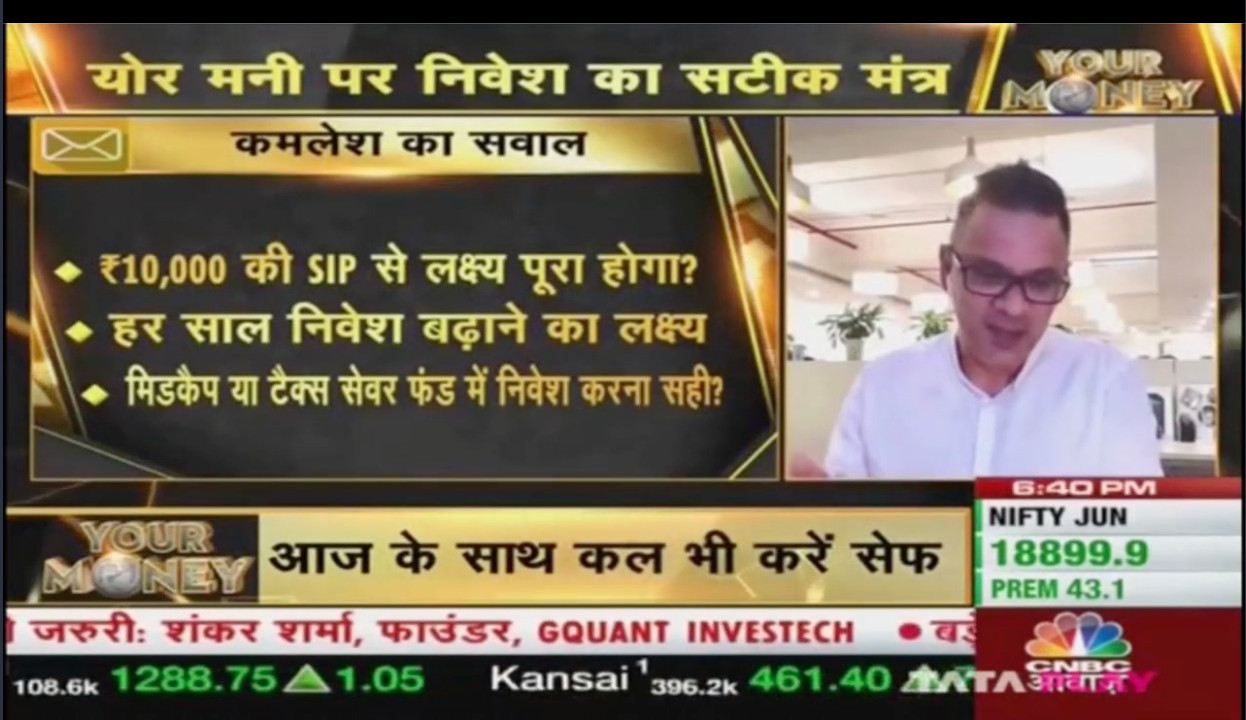

Considering an ELSS? Here are 5 Things to Keep in Mind

If you’re about to partake in the all too common financial-yearend scramble to save taxes, you may be flummoxed by the multitude of options at hand. Your insurance agent may be pushing life insurance as the best option, while your friend extols the benefits of a plain vanilla PPF account or even a tax saving FD with a bank. And yet, there’s an 80(C) instrument that not just has a relatively short lock in period of just 3 years – but has delivered a 5-year category average return exceeding 15% per annum and a 10-year annualised return of more than 17% per annum. These are tax saving mutual funds or ELSS (Equity Linked Savings Schemes. These numbers may seem tempting, but make sure you’ve understood a few things about ELSS funds before you say “Tax Saving Mutual Funds Sahi Hai” and jump in with both feet!

What is Insurance - Really?

As we approach the last month of the fiscal year, the inevitable mad scramble for saving taxes is bound to commence sooner than later. Tragically, the month of March is also synonymous with countless instances of the “buyers regret” syndrome, with clients succumbing to the age-old fallacy of buying insurance to save taxes – only to regret their decisions deeply later on. This unfortunate outcome really stems from a poor understanding of what insurance really is. Is it an investment? Is it a savings tool? Is it an income generator? All of these? None of these?

3 Things All Mutual Fund SIP Investors Should Do Right Now

Mutual Fund SIPs require patience and understanding of market cycles to deliver long-term growth. Staying committed to your goals and avoiding knee-jerk reactions during market volatility will help you achieve greater returns. Stick to your SIP strategy, and let compound growth work its magic.

How Indexation Works in Debt Mutual Funds

Debt mutual funds, especially when held for more than three years, are not only a great low-risk alternative to fixed deposits but also offer significant tax advantages. By leveraging indexation, you can reduce your taxable profits, making debt funds a smart choice for long-term investors looking to maximize after-tax returns.

The 5 Things That Every Good Financial Advisor Does

A good Financial Advisor does more than just manage your investments—they act as a filter to protect you from poor products, help keep you aligned with your goals, review your portfolio, ensure your risks are covered, and save you from your own emotional investment mistakes. Having a trusted advisor on your side can truly accelerate your journey to financial freedom.

4 Facts About Debt Mutual Funds Every Investor Should Know

With returns from equity mutual funds disappointing investors in 2018, there’s been a renewed interest in their safer cousin – debt oriented mutual funds, of late. However, it rings true that most investors are misinformed about the nature of debt oriented mutual funds. To avoid buyer’s regret later, acquaint yourself with these five facts about them before you decide to invest.

3 Golden Rules of Mutual Fund SIP Investing

Read this blog to know 3 golden rules of investing in Mutual Fund SIP, since mutual fund SIPs have become incredibly popular in recent years. To know more, Visit us Now!

3 Smart Tax Saving Moves to Make

With the fiscal yearend barely around the corner, you may be wondering how to put your idle savings to good use while reducing your tax burden at the same time. All too often, unsuspecting investors fall into the trap of purchasing fruitless endowment insurance plans that are sold in the guise of low risk investments that generate high returns, only to discover later that they weren’t really value creating at all. Avoid them at all costs and consider these three “smart” tax saving moves instead.

3 Ways in Which Debt Mutual Funds Score Over Fixed Deposits

Debt Mutual Funds offer tax efficiency, better returns over time, and easy liquidity—making them a smarter choice than FDs for long-term, low-risk investments. Before investing, seek expert advice to navigate the nuances effectively.

3 Tips for Mutual Fund Investors to Invest in Range Bound Markets

Range bound markets can test your patience. But with a clear strategy, guided by your goals—like a Retirement Plan or your Children’s Education Plan—you can make the most of this phase. Here's how to stay ahead even when the NIFTY is moving sideways.

Latest Posts

3 Stages of Your Income Generation Plan Explained

Jan 21, 2026

When Playing It Safe Becomes Risky: Rethinking Risk in Equity Investing

Jan 19, 2026

Army Day Special: Why Investment Planning Matters More Than Ever for Armed Forces Personnel

Jan 15, 2026

The Power of Compounding: How Small Investments Turn into Big Wealth

Jan 14, 2026

Which Financial Goal Should Be Your Priority While Investing?

Jan 12, 2026

The Importance of your Child’s Education Goal

Feb 28, 2024

Why Retirement Planning is Important

Nov 08, 2023

Oct 31, 2023

Investing Behaviour and the investing roller coaster

Oct 12, 2023

.png)