Investing Insights

Mayank is a co-founder at FinEdge and his experience of more than 20 years in the banking and financial services industry has been instrumental towards building the FinEdge platform.

He has held key positions across the Retail and Wholesale Banking verticals at Standard Chartered Bank, driving growth in segments managed by him.

Mayank is a post graduate in Marketing and Finance and has completed his Bachelor’s degree from Delhi University.

He has a keen interest in technology and likes to keep himself updated with the latest in the tech world.

When Playing It Safe Becomes Risky: Rethinking Risk in Equity Investing

Avoiding risk often feels prudent, especially when markets turn volatile. But in investing, staying away from equity entirely can quietly become the biggest risk of all.

The Power of Compounding: How Small Investments Turn into Big Wealth

Compounding is the single most powerful force behind long-term wealth creation. It rewards patience, discipline, and consistency more than any short-term strategy ever can. If you want your investments to grow exponentially instead of linearly, compounding must be at the centre of your approach.

The Portfolio Health Check: 5 Signals Your Investments Need Attention

Most investors assume that if their investments are performing reasonably well, there’s nothing to review. But portfolios don’t drift out of alignment overnight, they do so gradually. A portfolio health check isn’t about reacting to markets or chasing returns. It’s about ensuring your investments continue to reflect your goals, your life, and your temperament.

CAGR vs XIRR vs Absolute Return: Understanding Which Return Really Matters

When reviewing investment performance, investors often come across multiple return figures absolute return, CAGR, and XIRR. While these numbers may appear similar, they measure performance very differently. Understanding what each metric represents, and when to use it, is essential for making informed investment decisions and setting realistic expectations.

Financial Planning Before and After Retirement India: A Complete Guide to Building & Managing Your Retirement Life

Planning for retirement is not just about saving, it’s about understanding how your needs evolve. Financial planning before and after retirement India requires two different skill sets: building your corpus before retirement and managing it wisely afterward so it lasts 25–30 years.

How to Select the Best Financial Advisor: A Professional Step-by-Step Guide

Selecting the right financial advisor goes beyond credentials or returns, it’s about finding a partner who understands your goals, values transparency, and guides you with objectivity and discipline.

ETFs vs Index Funds: What’s the Difference and Which One Should You Choose?

When exploring passive investing options, most investors come across two common vehicles: ETFs and index funds. But what’s the actual difference between the two? And more importantly, which one is right for you? In this blog, we’ll break down the nuances of etf vs index fund—their structure, benefits, and how you can invest in each—so you can make a more informed choice aligned with your financial goals.

Investing Your Retirement Corpus Wisely: What to Do and What to Avoid

Retirement planning isn’t about picking the perfect product. It’s about building a structured roadmap that reflects your lifestyle, income needs, and long-term priorities. Yet, many investors delay it or make decisions without enough clarity. These mistakes may not show immediate consequences, but they often lead to shortfalls, stress, and financial insecurity in later years.

How to Start SIP Investment: A Beginner-Friendly Guide for Long-Term Growth

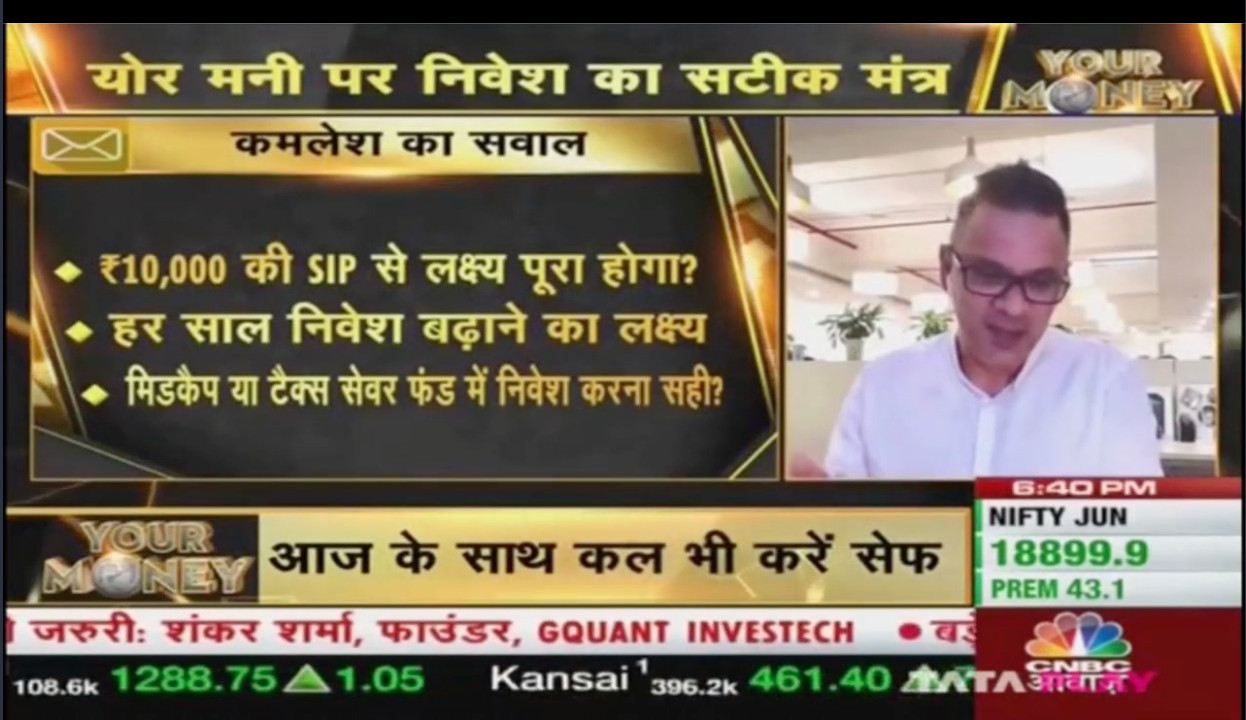

If you're wondering how to start SIP investment, you're not alone. SIPs, or Systematic Investment Plans, have become one of the most popular tools for long-term wealth creation in India. They’re simple, disciplined, and powerful - especially for those earning monthly incomes and looking to grow their savings through mutual funds. This guide explains how SIPs work, how to get started (both online and offline), and why they are trusted by millions of investors for goal-based financial planning.

Home Purchase Planning: Home Loan Checklist

Buying a home is both an emotional and financial milestone. Without a plan, it can quickly become a burden. A structured home purchase strategy lets you balance affordability with smart investing and debt management, helping you own your dream home without compromising your future goals.

The Impact of Inflation on Your Financial Future & Investment Strategy

Inflation may seem like a background number in the news, but its impact on your financial future is anything but minor. From education to retirement, rising costs can silently derail your most important goals, unless your investment strategy is built to outpace it.

Financial Planning for Single Women: Strategies for Long-Term Security

In today's world, not everyone prefers to get married and start a family. Some individuals, men as well as women, choose to stay single. They like to have a fulfilling career, focus on their passion like travel and go solo about it. In this article, we will understand how single women can do their financial planning and create long-term security for themselves.

Latest Posts

When Playing It Safe Becomes Risky: Rethinking Risk in Equity Investing

Jan 19, 2026

Army Day Special: Why Investment Planning Matters More Than Ever for Armed Forces Personnel

Jan 15, 2026

The Power of Compounding: How Small Investments Turn into Big Wealth

Jan 14, 2026

Which Financial Goal Should Be Your Priority While Investing?

Jan 12, 2026

Regular Savings Plan: A Balanced Approach to Stability and Growth

Jan 07, 2026

The Importance of your Child’s Education Goal

Feb 28, 2024

Why Retirement Planning is Important

Nov 08, 2023

Oct 31, 2023

Investing Behaviour and the investing roller coaster

Oct 12, 2023

.png)

.png)

.jpg)

.jpg)