Banks Have Raised FD Rates in June: Should You Invest or Stick to Mutual Funds?

Many banks have raised interest rates on fixed deposits in May and June 2024. Some small finance banks (SFBs) are offering up to 9% p.a. on their fixed deposits. In this article, we will discuss the net return on your fixed deposits after tax and inflation and whether you should consider investing in fixed deposits or mutual funds.

How Much Are Banks Offering on Fixed Deposits?

After the latest revision in fixed deposit interest rates in May and June 2024, most banks are offering interest rates in the 7-8% p.a. range for tenures in the 1-2 years range. Most small finance banks (SFBs) are offering interest rates in the 7.5-9% p.a. range for similar tenures. For a little longer tenure in the 2-5 years range, most banks are offering around 7-7.5% p.a. range.

While the headline interest rate looks good, let us understand how much you get after considering the impact of taxation and inflation.

Fixed Deposit Returns Post-taxation

It is important to note that the interest amount on fixed deposits is taxable. The exception is a deduction of up to Rs. 50,000 allowed for senior citizens under Section 80TTB. In the case of other individuals, the interest earned from fixed deposits is added to their overall income and taxed at their slab rate.

Let us consider the fixed deposit interest rate range of 7-8% p.a. and see the net returns after taxation.

|

Individual Tax Slab |

10% |

20% |

30% |

|

Fixed Deposit Interest Rate |

|

|

|

|

8.0% p.a. |

7.20% |

6.40% |

5.60% |

|

7.5% p.a. |

6.75% |

6.00% |

5.25% |

|

7.0% p.a. |

6.30% |

5.60% |

4.90% |

The above table shows the net returns you will earn after paying taxes on the interest amount. For an individual in the 30% tax bracket, after taxation, the net return on an FD with 7.0% p.a. interest falls to 4.90% p.a.

Impact of Inflation

Apart from taxation, you need to consider the impact of inflation also on your fixed deposit returns. Inflation erodes the purchasing power of your money.

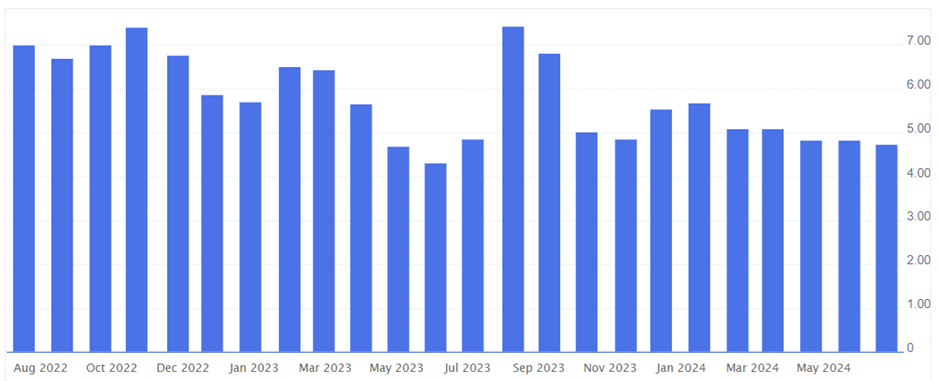

Chart: Monthly CPI Inflation for the Last Two Years

As seen in the above table, in the last two years, the average Consumer Price Index (CPI) inflation rate has been above 5%. While this is the general inflation rate, the personal inflation rate for individuals can be higher than 5%.

In the earlier section, we saw that in the case of an FD with a 7% interest rate, after taxation, the net return for an individual in the 20% bracket will be 5.6%, and in the 30% bracket will be 4.9%. After considering the inflation impact on the post-tax FD returns, the net return will be either low, zero or negative.

So, even though the 7% interest rate may look good, the returns after taxation and inflation impact are not that great.

Should You Consider Investing in Mutual Funds?

Fixed deposits are recommended for individuals with a moderate or low-risk appetite. However, we saw in the earlier section, individuals in the 20% and 30% tax bracket will make low, nil, or negative returns from fixed deposits paying 7% p.a.

So, should investors with moderate to low-risk appetite consider investing in equity mutual funds? For long-term financial goals with a time horizon of five years or higher, the selection of the investment product should be based on the investment time horizon rather than individual risk profile.

Equity mutual funds are volatile, risky, and vulnerable to sharp corrections in the short term. However, as the investment time horizon increases, the risk and volatility reduce. In the long run, the probability of negative returns reduces, and that of earning better returns increases.

WhiteOak Capital Mutual Fund analysed the XIRR rolling returns on a monthly basis for S&P BSE Sensex TRI for SIP investments between September 1996 to December 2023. The results were as follows.

|

Returns |

3 Years |

5 Years |

8 Years |

10 Years |

12 Years |

15 Years |

|

% Times More Than 8% return |

64% |

82% |

94% |

99% |

99% |

99% |

|

% Times More Than 10% return |

56% |

72% |

81% |

94% |

98% |

97% |

|

% Times More Than 12% return |

50% |

59% |

68% |

78% |

76% |

90% |

The above table shows:

- When the investment time horizon was 10 years and above, 99% of the time, the returns were more than 8%

- When the investment time horizon was 12 years and above, 97-98% of the time, the returns were more than 10%

- When the investment time horizon was 15 years and above, 90% of the time, the returns were more than 12%

So, the longer the investment time horizon, the higher the probability of earning decent returns in the 10-12% range. Please note the above returns are for the BSE Sensex 30 Index. Over the long term, the returns for mid and small-cap indices can be better, although with higher volatility.Does June

The above data shows, compared to FD, in the long run, equity mutual funds can give better inflation-beating returns. Also, the taxation of equity mutual funds is favourable compared to FDs. When the holding period of equity mutual funds is more than twelve months, the gains are categorised as long-term capital gains (LTCG).

The first Rs. 1,00,000 LTCG in a financial year is exempt from taxation. The incremental LTCG is taxed at 10% without indexation benefits. It is important to note that the LTCG is 10% for all individuals, irrespective of their income tax bracket.

How to Build an Investment Portfolio

You should consult a qualified and experienced financial advisor for your financial planning. They will categorise your financial goals into short, medium, and long-term based on the time horizon. Risk can be associated with goal tenors rather than the individual risk profile.

For long-term financial goals like retirement planning, the financial advisor will recommend investing in equity mutual funds. They can present the data on the kind of returns equities have delivered over the long term. It will help you take risk in an informed manner and sail through the short-term volatility and price corrections. In the long run, you can benefit from the power of compounding and earn inflation-adjusted better returns.

Your Investing Experts

Relevant Articles

Why Consolidating All Your Investments on One Platform Makes Sense

Many investors accumulate investments gradually, across employers, platforms, advisors, and products. Over time, what began as diversification can turn into fragmentation. Consolidating investments on one platform is not about reducing choice or control; it is about gaining clarity, aligning investments with goals, and improving decision-making across market cycles.

Why Successful Investing Follows a Clear Why–How–Where Framework

Investing decisions are often influenced by market trends, recent performance, or product recommendations. However, long-term investment success depends more on structure than selection. A clear Why–How–Where framework brings discipline to investing by ensuring that goals are defined first, planning comes next, and product choices follow. This approach helps investors build portfolios that are aligned with their objectives and sustainable over time.

Types of Gold Investments: A Complete Guide for Indian Investors

Gold continues to be one of India’s most trusted assets, but the way we invest in it has evolved. With multiple formats now available each serving a different purpose it’s important to know where gold truly fits into your financial plan. This guide simplifies your options so you can choose the format that aligns with your goals, behaviour, and long-term strategy.

.png)