Investing Insights

Is Insurance a Good Investment?

You invest regularly to achieve your financial goals. While doing so, you should buy life insurance as it is your family's financial backup in the event of your untimely death. It is recommended that you keep the two (investments and insurance) separate, as each has a distinct purpose. However, many people end up mixing the two in a single product in the form of a participating life insurance policy or a ULIP (unit-linked insurance plan). Is it a good idea to keep insurance and investments separate or buy a bundled product? Let us discuss.

Importance Of Taking Informed Risk When Investing

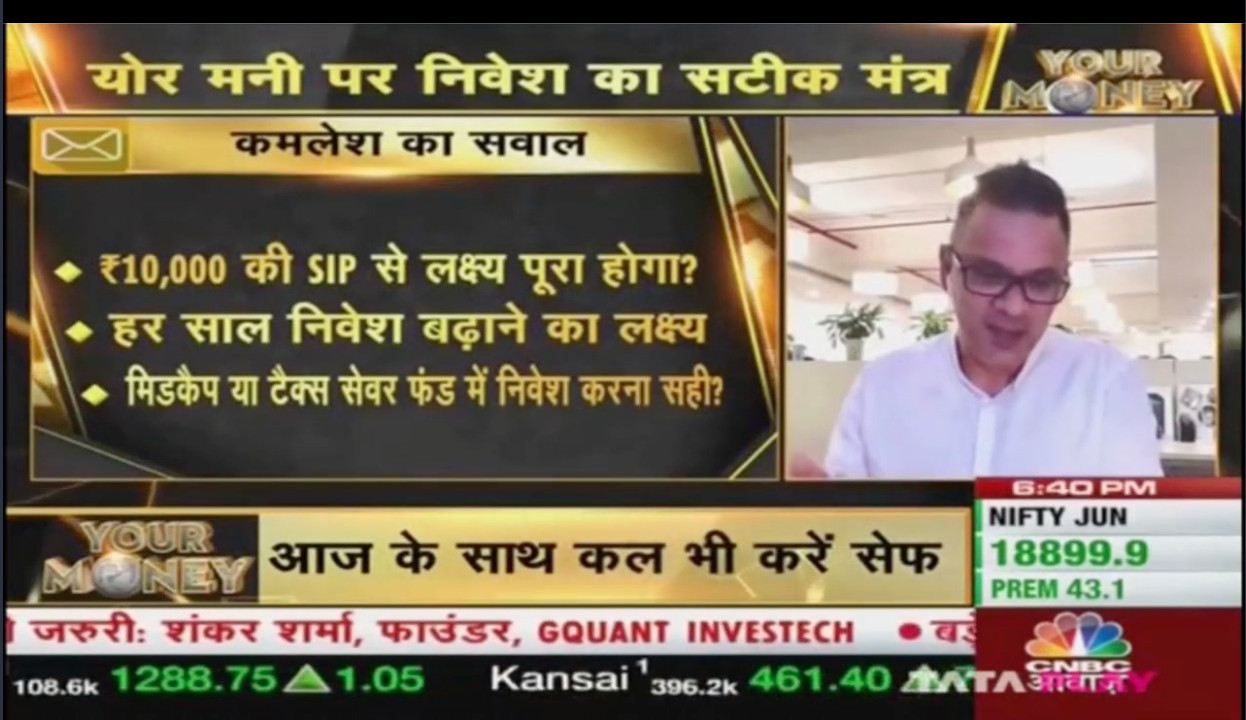

Investors often align financial product choices with their risk profiles, such as favoring equities for aggressive strategies and debt for conservative ones. However, prioritizing investment time horizon over risk profile can lead to more informed decisions, ensuring suitability for both short-term and long-term goals.

5 Reasons Why You Should Occasionally Review Your Portfolio

Enamoured by AMFI’s impactful “Mutual Funds Sahi Hai” campaign, new investors flocked to Mutual Funds in droves between 2015 and 2018. As first timers, many of these investors are unaware about the importance of regularly having their portfolios reviewed by a professional Financial Advisor.

Should you invest into NFO’s (New Fund Offers)?

AMFI's ad campaign boosts mutual fund interest, but investors must cautiously assess NFOs amidst SEBI's re-categorization.

Three personal finance lessons you wish you learned in school!

Most of us learned about algebra and the water cycle in school—but not how to budget, invest, or grow our wealth. Here are three personal finance lessons you probably wish you were taught early, and how learning them now can still change your life.

How Financial Advice is helpful in Investment Planning

With the widespread proliferation of FinTech based DIY (Do it Yourself) investment planning platforms, the role of a financial advisor has taken a backseat in the minds of some people. While the convenience and ease of transactions that these DIY financial advice platforms provide cannot be disputed, the ultimate efficacy of financial advice is the end outcome – which is, does it enable you to achieve your financial goals or not? And anecdotal evidence suggests that platforms that remove the financial advisor from the investment planning process are usually found wanting when it comes to this litmus test.

The Dilemma of investing as an NRI

India has been a bright spot in the world economy and has been projected to grow on an average, at a staggering 7% for the next 15 years. According to a PwC report, India is slated to be the 2nd largest economy by 2050 only behind China. What this means is that by investing in the equity market, one could accrue the benefits of long term investing by virtue of the rapid growth in the economy. Investing has never been easy and must be done by way of advice from a professional, who takes into account ones risk tolerance, financial goals or objectives, tenor of investment etc. and then recommends the best possible investment.

Should you surrender your LIC Policy, make it paid up, or continue?

Read this blog to know what you should do with your LIC policy, make it paid up, or continue it or surrender it. To know more, visit FinEdge now!

7 Ways Smart Spenders Save and Invest Their Money

Smart spenders balance saving and spending, prioritizing financial goals while enjoying guilt-free expenses. They invest in SIPs, follow a budget, avoid impulse buys, and leverage tax-saving mutual funds for wealth creation.

Three Smart Things To Do With Rs 50,000

Read this blog to learn 3 powerful ways in which you can put your 50,000 Rs to good use towards your financial betterment. To know more, visit FinEdge now!

5 Reasons why Goal Based Investing leads to success

Read this blog to learn 5 reasons of how goal based investing can help you get multiple benefits. To learn about goal based investing, visit FinEdge now!

What Are Bonds in India?

From government to corporate and tax-free bonds, understand what bonds really mean and how they function within India’s financial ecosystem.

Latest Posts

Which Financial Goal Should Be Your Priority While Investing?

Jan 12, 2026

Regular Savings Plan: A Balanced Approach to Stability and Growth

Jan 07, 2026

The Portfolio Health Check: 5 Signals Your Investments Need Attention

Jan 05, 2026

From Coffee to Crorepati: Small Lifestyle Tweaks Gen Z Can Make to Start Investing Early

Jan 02, 2026

Lessons From the World’s Best Investors to Carry Into the New Year

Dec 26, 2025

The Importance of your Child’s Education Goal

Feb 28, 2024

Why Retirement Planning is Important

Nov 08, 2023

Oct 31, 2023

Investing Behaviour and the investing roller coaster

Oct 12, 2023

Investing Stories

.jpg)

.jpg)

_(1)1.jpg)

.jpg)

.jpg)

.jpg)