How to Create a Fund for Your Child’s Marriage Goal

Recently, in July 2024, Jefferies released a report on the Indian wedding industry. As per the report, the Indian wedding industry is valued at USD 130 billion, making it the second largest in the world after China at USD 170 billion.

An average Indian parent spends around Rs. 12.5 lakhs on a wedding for their child. A lavish wedding costs much more, and could make a hole in excess of Rs. 50 lakhs in your pocket. Once we consider inflation, the impact would be more significant. weddings are going to cost even higher. Hence, parents must plan for their child’s marriage expenses in advance. In this article, we will understand how to set up a fund for your child’s marriage, step-by-step.

What Is a Marriage Fund?

A marriage fund is a future projected corpus that needs to be created to bear all wedding expenses of your children. This fund would cater to expenses like venue, pre-wedding and marriage functions.

One big cost attached to any Indian wedding could be jewellery cost. And for this, one must take into account the impact of rise in gold and jewellery prices. One can include the cost of gold purchases while planning for the marriage fund. Considering the high price of gold and increased quantity of gold jewellery required in a marriage, it becomes essential for parents to plan for this important long term goal much in advance.

Why It’s Essential to Plan for Your Child’s Marriage Fund

In the earlier section, we saw how the average amount of money parents spend on their child’s marriage in India is Rs. 12.5 lakhs. While that is the average, most parents spend a much higher amount. Hence, it is important to save for your child’s big day and plan well in advance.

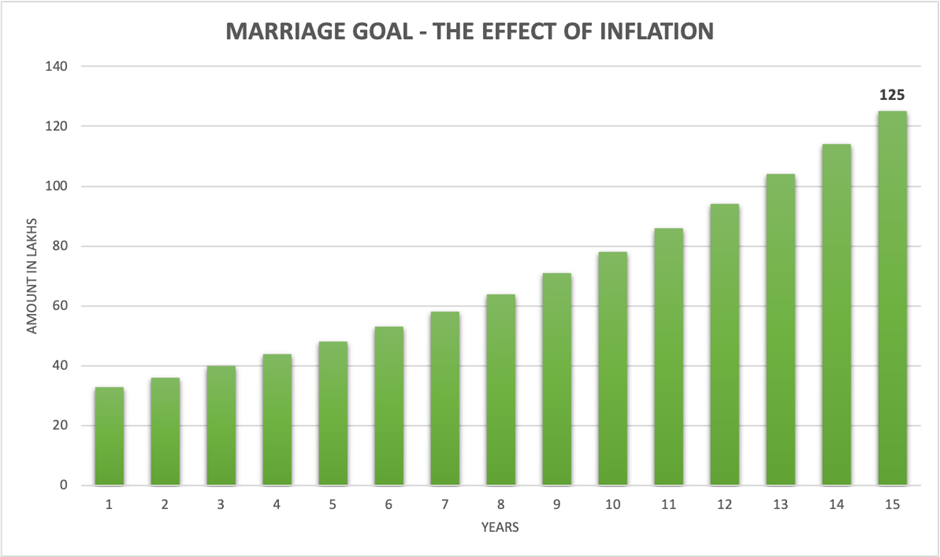

Let us understand the impact of inflation on the future cost of your child’s marriage with an example. Dinesh wants to accumulate money for his son’s marriage. The marriage is expected to happen after 15 years when his son turns 25 years old. According to Dinesh, the current cost of a marriage is approx. Rs. 30 lakhs. If marriage expenses increase by 10% yearly, the cost of his son’s wedding can rise from 30 lakhs to 1.25 crores in 15 years.

This would mean that after considering a moderate rate of inflation in the marriage industry, the expense borne by parents on their child’s marriage today would be almost 4 times in the next 15 years. Hence, it is essential to plan today and create adequate provisions for the future.

Creating the Best Investment Plan for Your Child’s Marriage

Now that we understand why it is important to plan for your child’s wedding on time, let us understand how to plan for such a fund.

A SIP will serve as a suitable investment method to help you fund your child’s marriage comfortably. Once you decide on the SIP amount, it will automatically get deducted from the bank every month. This automated mode of investing makes sure that you remain consistent and disciplined towards your goals.

The ideal situation would be to start early and keep a long-term horizon. That way the sum you invest every month will not be very high but you can build a substantial corpus in time for your child’s wedding.

Let us continue with the earlier example of Dinesh. He needs to accumulate Rs. 1.25 crores in 15 years. If Dinesh invests Rs. 25,000 monthly through a SIP, and assuming his investments grow at 12% CAGR, he will be able to accumulate Rs. 1.25 crores in 15 years.

A SIP in a mutual fund is a smart move, especially when compared to other conservative investments like recurring deposits, as SIPs have the potential to generate higher returns and beat inflation. By maintaining resilience and discipline in your investment process, you can benefit from rupee cost averaging and the power of compounding, ultimately enabling you to provide your child with a lavish wedding.

Tips on How You Can Create a Fund for Your Child’s Marriage

Quantify the Marriage Goal: While planning the goal, one must first calculate all current day expenses and account for inflation. This will define a number that you would need to achieve for this goal. Add your child's marriage as a goal to your investment Plan. Setting clear goals fosters a sense of discipline and clarity, ensuring you stay on track to achieve your financial objectives

Investing Beliefs: Understanding your investment beliefs is important as they ultimately determine the method you follow to achieve your goal. An ideal belief system is driven by a strategic process and creates investing resilience, rather than emotionally driven decisions.

Develop a Savings Habit: Your current day savings habits are going to go a long way in paving the path to secure your financial future. Keep a check on your expenses and any expense that can be curtailed should ideally be used for investing towards your goals.

Start Early: The key is to start investing early. You should start investing for your child’s wedding as soon as they are born. The earlier you start investing, the lower the monthly amount you will have to invest.

Time Horizon: When planning for your child's wedding, it's crucial to establish an approximate time horizon for when the wedding is likely to take place. Knowing this timeframe provides clarity about the minimum period you have to prepare financially. For instance, if you start planning when your child is 10 years old and expect them to get married around or after the age of 25, you have a 15-year time horizon.

Step Up SIP: We saw how wedding expenses can increase from Rs. 30 lakhs to 1.25 crores in 15 years. While the Rs. 1.25 crore number looks high, it can be achieved with a monthly SIP investment of Rs. 25,000/- in equity mutual funds. Additionally, to speed up the process of Goal Achievement, you should opt for a step-up SIP. Stepping up allows you to increase the monthly investment amount by a specified amount or percentage on an annual basis. In a step-up SIP option, you can opt for increasing the monthly SIP amount by 10% on an annual basis. This will help you to accumulate an additional Rs 80 lakhs that can be channelised towards other goals like your retirement.

Prioritise Goals: You will likely be close to retirement when your child gets married. Planning for a fund for a lavish wedding should not come at the cost of your security and comfort during retirement. Ensure you invest smartly and prioritize your financial goals.

Consult an Expert: Indian weddings often involve multiple events and can require a significant amount of money. Balancing wedding planning with other financial goals, such as retirement and your child's education, can be overwhelming. In such cases, seeking the help of a financial expert can be helpful. An expert can help you navigate these various goals and establish a process-driven approach to ensure you are adequately prepared for each financial milestone.

Enjoy the Big Fat Indian Wedding

Most people desire that their family wedding should be no less than any other Big Fat Indian Wedding. They want it to be the talk of the town, and people should remember it for a long time to come. Such lavish weddings cost a bomb. However, if you plan for it well in advance and start accumulating money from early on, the dream can be accomplished comfortably. For your child's wedding, start investing from the time they are born. By the time they are ready to get married, you will have accumulated the required amount to enjoy the Big Fat Indian Wedding!

FAQs

At What Rate Do Marriage Expenses Increase Yearly?

The yearly increase in marriage expenses depends on inflation in the industry. Usually, the price rise in this industry is very high owning to the seasonal nature and a high emotional bent towards this goal. Though a moderate assumption, for your calculations, you can consider marriage expenses inflate at rate of 10%.

How Will I Know the Future Amount Required for My Child’s Marriage?

You can assume the current cost of marriage. Based on the number of years when you will need the money and post accounting for inflation, you can calculate the future cost of your children’s marriage.

Where Should I Invest to Accumulate Money for My Child’s Marriage?

Your investments should be an outcome of a process that takes into account your unique financial situation, goals, investing beliefs, and risk profile. As discussed above, an SIP in a Mutual Fund would be an ideal investment vehicle for this long term goal. However, do take the help of an investment expert who would be able to guide you on your investments based on the above mentioned factors. Depending on your investment horizon and risk appetite, an investment allocation in Debt or Equity Mutual funds can be suggested.

How Important Is a Child’s Wedding Goal in Comparison to Other Goals Like Retirement?

When planning a fund for your child’s marriage, it's crucial to consider factors like your income and the number of children you have. While a memorable wedding day is important, it's essential to balance this with other financial goals, such as your retirement. Prioritizing the marriage goal should not compromise your long-term financial security, especially retirement as there would be substantial financial needs in the later years of life.

Your Investing Experts

Relevant Articles

How the 50/30/20 Budget Rule Can Help You Achieve Financial Goals

Struggling to balance living well today and saving for tomorrow? The 50/30/20 budgeting rule offers a simple framework to manage your expenses, build financial discipline, and start investing meaningfully, even if you’re just getting started. It’s a practical first step toward long-term financial confidence.

How Long-Term Investing Can Reduce the Risk of Low Returns

Most investors want better returns with minimal risk. But what’s the secret? Time. The longer you stay invested, the more likely you are to avoid negative returns and achieve your goals. This blog explores why long-term investing, especially through SIPs, is your best defence against market volatility.

What is Financial Leakage? How to Stop This to Achieve Your Goals

Financial leakages may seem small, but over time, they can significantly hold back your ability to build wealth. Plugging these gaps early can free up more money for your financial goals, without needing to earn more or compromise on essentials.

.jpg)

.jpg)

.jpg)