Your Child’s Education Goal: A Step-by-Step Investment Guide

Every parent wishes for a bright and secure future for their child, and that includes a quality education. Achieving this goal requires advanced and proactive planning to ensure you’re financially prepared to support your child’s aspirations. In this article, we will explore why it is important to plan for your child's education and some best practices for the same.

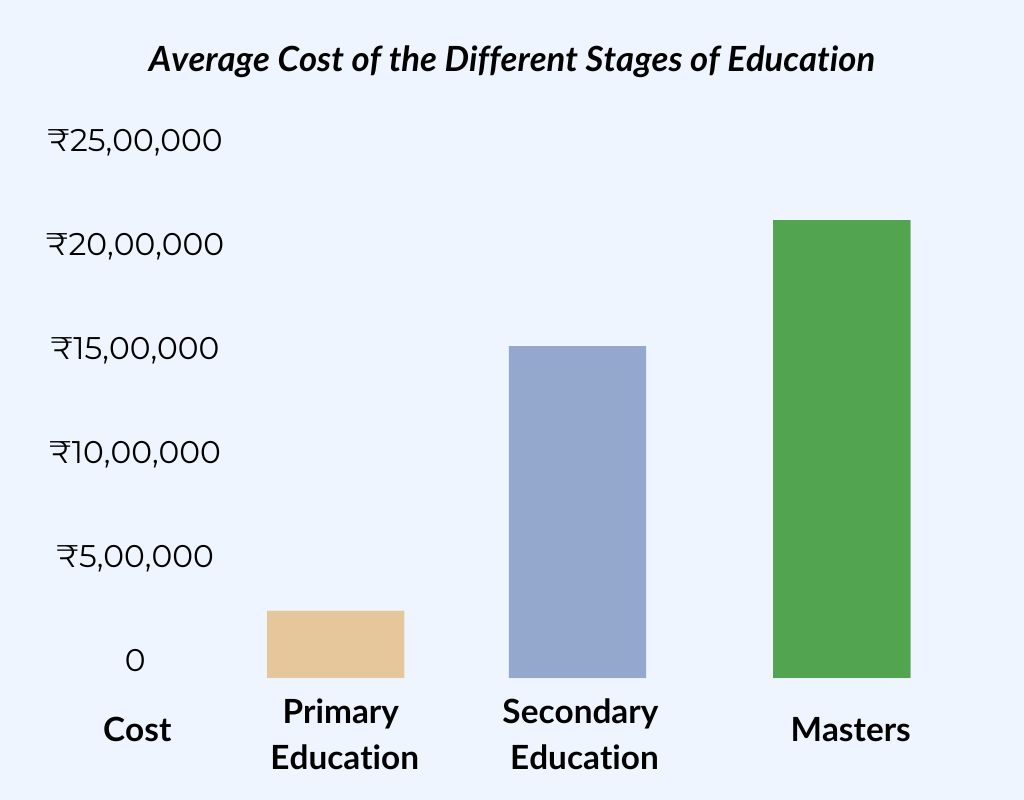

Education Cost

If we could break education into Primary (school level), Secondary Education (Undergraduate), and Specialisation (Master's or Professional Degree), then we can understand how education cost impacts a household’s monthly budget at each stage.

Primary Education: Primary education costs, including school fees, uniforms, books, extracurricular activities, and tuition, can vary significantly based on whether the child attends a public or private institution. In India, private schools often charge anywhere between Rs. 2,00,000 to 5,00,000 annually. Internationally, private primary education can cost anywhere between $10,000 to 50,000 annually, depending on the country.

Secondary Education (Undergraduate): Undergraduate education is one of the most expensive stages. In India, pursuing an engineering or medical degree in a private institution can cost between Rs. 5,00,000 to 25,00,000 over 4-5 years. For international education, undergraduate costs in countries like the USA, UK, or Australia can range from $50,000 to 1,00,000 annually, excluding living expenses.

Specialization (Masters or Professional Degree): A professional degree like an MBA, law, or medicine further amplifies the financial burden. In India, premier institutes like IIMs and IITs charge around Rs. 20,00,000 for a two-year program. The same amount can rise exponentially if one opts for a premier private-level institution like ISB or SP Jain Institute. Internationally, top-tier universities charge upwards of $75,000 annually, and this does not include accommodation, insurance, or additional living costs.

Inflation in Education

When we think of inflation, our minds often go to food and fuel prices. But did you know that education costs are rising much faster?

The National Sample Survey Office report from 2020 showed that spending on education had almost doubled between 2010 and 2020. Now, education inflation is around 11-12%, much higher than the general inflation rate of 4-7%. This means that the same education could cost you double the amount in just 7 years.

The graph below shows how an education costing Rs. 5,00,000 today, can be impacted by an 11% inflation rate in the next 15 years.

Assumed Inflation: 11%

In the above graph, you can see that a Rs. 5 lakh education today could cost nearly Rs. 25 lakhs in 15 years, which is 5 times the original amount.

This graph only considers tuition fees, not other essential expenses like housing, travel, food, and study materials. Such costs require smart and proactive financial planning.

Factors to be Considered When Planning Your Child’s Education

Higher education costs involve more than just tuition fees. To create a solid plan, you need to think about the type of education, location, and other extra costs.

Key Points to Consider:

•Type and Duration of Course: Different courses have different costs. For instance, a 5-year MBBS degree will cost more than a 1-year master’s program.

• Public vs. Private Institutions: Private universities have emerged in India. While public universities tend to cost between Rs. 1 and 3 lakhs, varying according to the course, private universities can charge anything upwards of Rs. 15 lakhs per annum.

• Studying Abroad: International education is expensive. In the US, costs often go over Rs. 1 crore, and even in Europe, this can be upwards of Rs. 70 lakhs. The lower value of the rupee, in comparison to higher currencies, can make the experience of studying abroad even more costly.

Additional Costs:

•Travel: Regular commuting or the higher costs of international flights need to be planned for.

• Accommodation: Hostel fees or off-campus housing, especially abroad, can be significant.

• Daily Expenses: Groceries, meals, and miscellaneous costs are often overlooked but accumulate rapidly.

• Visas and Entrance Exams: Fees for international visas, medical checks, and entrance tests, including preparation, can add up.

Education Loans vs Saving\Investing

When planning for your child's higher education, the choice between taking an education loan or saving/investing in advance is crucial. Let’s understand the impact of each:

Education Loan

Advantages:

o Provides a moratorium period of 6 months to a year, allowing your child time to secure a job before starting repayment.

o Offers certain benefits, like a 0.5-0.75% interest concession for girl students, which can slightly ease the financial burden.

o There are tax exemptions under section 80E. However, these exemptions are on the interest part of the EMI, not the principal.

Challenges:

o Starting one’s career with the stress of debt repayment may limit financial flexibility.

o Example: Let’s say you take a loan of Rs. 20,00,000 at a 9.5% assumed interest rate and a tenure of 10 years. In this case, the EMI would be Rs. 25,880. Over the loan tenure, total repayment would amount to Rs. 31,05,541, including Rs. 11,05,541 in interest, which is substantially more than the principal.

Saving and Investing in Advance

Let’s say your child is currently 8 years old, you have around 10 years to prepare for their undergrad expenses, estimated at Rs. 20,00,000. By investing Rs. 10,000 per month, through a Systematic Investment Plan (SIP) with an assumed annual return of 13%, you could accumulate a corpus exceeding Rs. 20,00,000 in 10 years.

Benefits:

o Debt-Free Start: Your child begins their career without the pressure of loan repayment.

o Avoid paying interest and instead benefit from the power of compounding.

o Encourages financial discipline and aligns your investments with long-term goals.

While education loans are helpful and necessary at times when savings are insufficient, goal-based investing is a more effective and ideal way to plan for your child’s education. It eliminates debt-related stress and helps you direct that money towards meeting other financial goals like retirement.

Tips For Child Education Planning

In an interview with CNBC TV18 India, FinEdge CEO Harsh Gahlaut emphasized the importance of taking “informed risk” and shared valuable insights on how to approach the important goal of funding your child’s education:

1. Beat Inflation

For long-term goals that are 10 or more years away, relying on conservative instruments like insurance, fixed deposits, or PPFs may not suffice. To beat double-digit inflation and preserve the real value of your money, it’s important to opt for an aggressive approach that gives you the maximum benefit in the long run.

2. Commit to Your Goal

The journey to achieving a significant financial goal will have its ups and downs. Market fluctuations may tempt you to make impulsive decisions. Staying focused on your goal and resisting the urge to act on short-term concerns is crucial for goal achievement.

3. Expertise

With an overwhelming amount of financial information readily available, it’s easy to choose products that don’t align with your unique needs. This is where an experienced investment expert makes a difference. A trusted advisor can assess your financial situation, risk tolerance, and objectives to create a personalized plan. They also guide you during uncertain times, keeping your best interests at the forefront.

4. Staggered Approach

A staggered approach will allow you to invest in a disciplined manner, without having to time the market. It ensures consistency and reduces the financial burden by allowing you to invest in smaller amounts and stepping it up as your capacity grows.

5. Start Early

For a goal as significant and heavily impacted by inflation as education, starting early is critical. Saving alone isn’t enough—you need to grow your wealth over time. An early start allows you to benefit from the power of compounding, which can help you comfortably achieve your target amount. The earlier you begin, the more comfortable your journey becomes.

Your Investing Experts

Relevant Articles

Understanding the Financial Planning Pyramid: Building Your Finances the Right Way

Most people juggle several financial goals at once, an emergency fund, retirement planning, a child’s education, or even short-term lifestyle goals like travel. Without a proper framework, it becomes difficult to decide what to tackle first. The Financial Planning Pyramid offers a simple and effective way to bring structure to your financial life. It ensures that essential protections are in place before you start saving and investing for long-term wealth.

Personal Finance Ratios You Should Understand Before You Start Investing

Successful investing begins long before you pick funds or set return expectations. It starts with understanding your financial foundation, how much you earn, how much you spend, and how much is left to invest consistently. These simple but powerful personal finance ratios offer a clear view of your financial health and help you make informed, goal-aligned decisions.

How to Categorise Financial Goals: Short, Medium, and Long-Term Goals Explained

Before we get into strategies and structures, it’s important to understand the value of categorising financial goals. Every individual has a unique set of aspirations, but not all goals carry the same urgency or impact. By breaking them down clearly, you can build a systematic, purpose-driven investment plan tailored to your life.

.png)

.jpg)