Child Education Planning - Why Is It Important, and How to Plan For It?

Every parent aspires to send their children to the best college/institute for higher education. However, most of the time, the best college comes with a high price tag. Considering the higher number of students applying for admission and the limited supply of seats with good colleges, the competition is very high.

The demand-supply mismatch and other factors are leading to the education cost in India rising faster. In this article, we will understand the impact of inflation on the cost of education and how to plan for it.

Impact of Inflation on Education

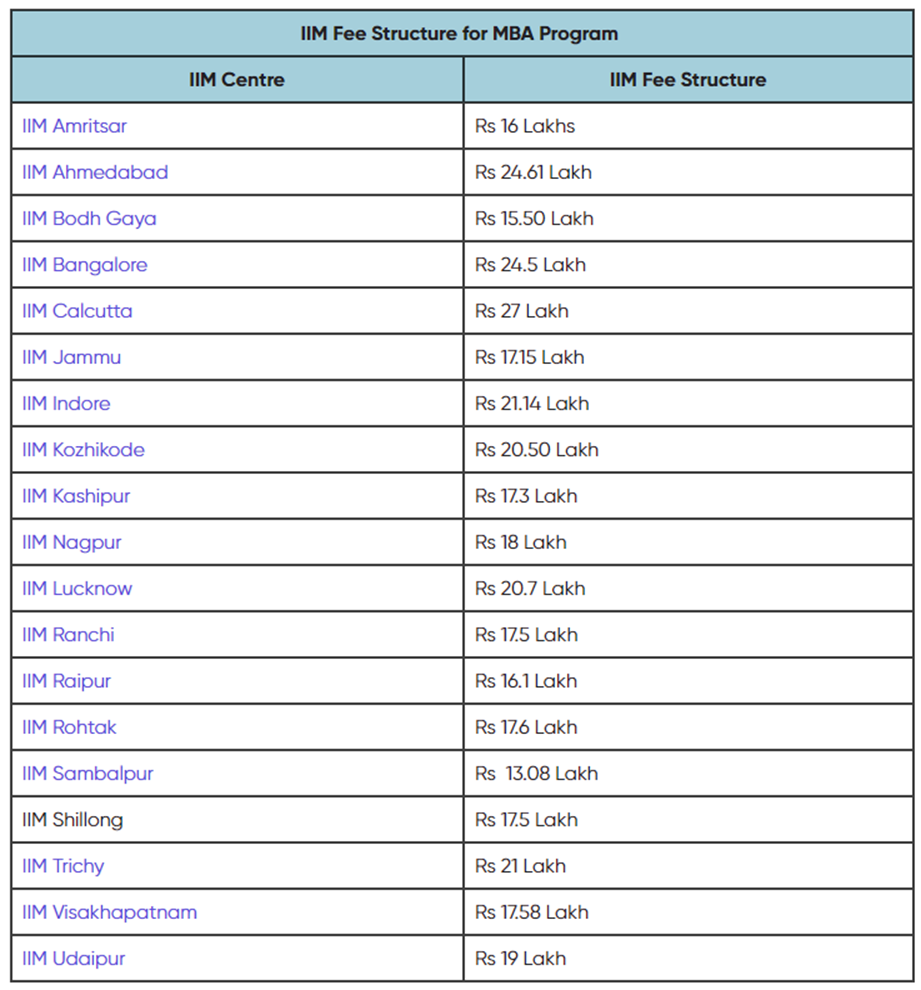

Before we understand the impact of inflation on the cost of education, let us look at the cost of doing an MBA from the IIMs.

Table: Cost of Doing an MBA From the IIMs

(Source: PW Live)

The above fee structure is for the academic year 2023-25.

Let us understand the impact of inflation on education with the help of an example. Jasmine's daughter, Kavita, is two years old. She wants her to take admission in a B-school for her higher education. Jasmine has 18 years to plan Kavita's higher education fund. As per the above table, the current MBA cost from IIM, Ahmedabad, is Rs. 24.61 lakhs. Let us work with a round figure of Rs. 25 lakhs and assume that the annual rise in education cost (inflation) will be 10% p.a.

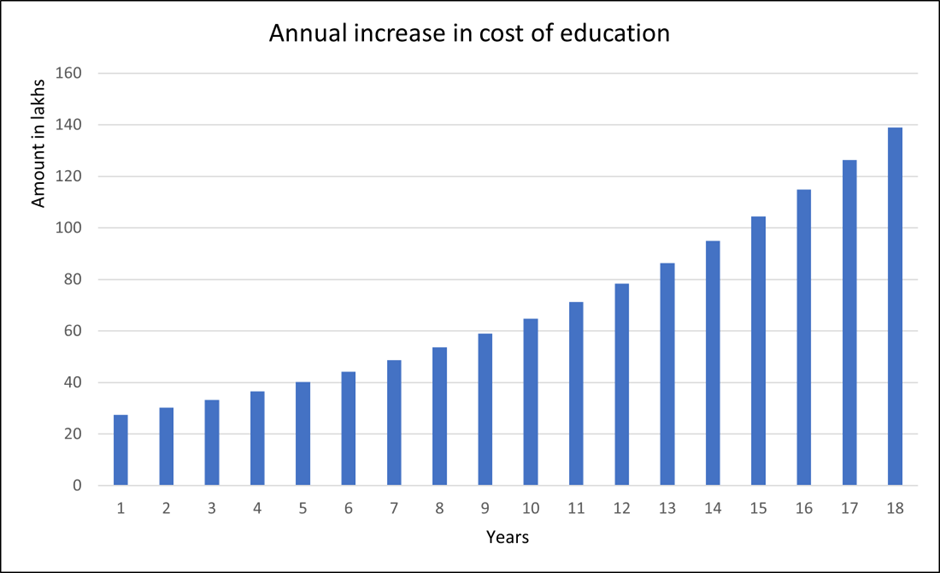

At a 10% increase in the annual cost of education, after 18 years, the cost of the MBA course will be a whopping Rs. 1.39 crores (Rs. 1,38,99,793).

Chart: Impact of Inflation on the Cost of Education

The above chart shows how the MBA course costing Rs. 25 lakhs currently will cost Rs. 1.39 crores after 18 years, if the annual increase in cost is 10% p.a. (inflation).

Building a Child Education Fund

In the above section, we saw how Jasmine will need Rs. 1.39 crores for Kavita's MBA. Jasmine has 18 years to build a higher education corpus for Kavita. Let us see how Jasmine can go about building this fund.

Jasmine has a long investment tenure of 18 years. She can invest in equity mutual funds through the systematic investment plan (SIP) mode. She can invest in large, mid, and small-cap funds. Let us take an average expected rate of return of 12% CAGR (compounded annual growth rate).

If Jasmine invests Rs. 2.23 lakhs (Rs. 2,22,611.54) every year, she can achieve her target. An annual investment of Rs. 2.23 lakhs, when broken down into monthly investments, the SIP will be Rs. 18,551 (Rs. 18,550.96) every month.

By investing Rs. 18,551 per month for 18 years with an expected return of 12% CAGR, Jasmine will be able to accumulate her corpus of Rs. 1.39 crores as follows.

Table Showing - Building a Child Higher Education Fund for Their Fututre

| Year | Corpus at the Start of the Year | Annual Investment | Expected Rate of Return | Corpus at the End of the Year |

| 1 | 0 | 22,26,12 | 12% | 249,325 |

| 2 | 24,93,25 | 222,612 | 12% | 528,569 |

| 3 | 52,85,69 | 222,612 | 12% | 841,322 |

| 4 | 841,322 | 222,612 | 12% | 1,191,606 |

| 5 | 1,191,606 | 222,612 | 12% | 1,583,923 |

| 6 | 1,583,923 | 222,612 | 12% | 2,023,319 |

| 7 | 2,023,319 | 222,612 | 12% | 2,515,442 |

| 8 | 2,515,442 | 222,612 | 12% | 3,066,620 |

| 9 | 3,066,620 | 222,612 | 12% | 3,683,939 |

| 10 | 3,683,939 | 222,612 | 12% | 4,375,337 |

| 11 | 4,375,337 | 222,612 | 12% | 5,149,702 |

| 12 | 5,149,702 | 222,612 | 12% | 6,016,992 |

| 13 | 6,016,992 | 222,612 | 12% | 6,988,356 |

| 14 | 6,988,356 | 222,612 | 12% | 8,076,283 |

| 15 | 8,076,283 | 222,612 | 12% | 9,294,762 |

| 16 | 9,294,762 | 222,612 | 12% | 10,659,458 |

| 17 | 10,659,458 | 222,612 | 12% | 12,187,918 |

| 18 | 12,187,918 | 222,612 | 12% | 13,899,793 |

The above table shows how Jasmine can accumulate money for Kavita’s MBA in 18 years.

How Can You Build a Higher Investment for Children Education?

The above example shows how Jasmine can build a higher education fund for Kavita's MBA. However, every child's higher education need not be the same. So, as per your requirement, you can take the following steps to build a higher education fund for your child.

1. The Current Cost of Education

The first step is to shortlist the course you would like your child to enroll for at the time of higher education. These days, many parents leave it to their children to decide the course they would like to enroll in. In that case, you can make a list of a few courses in demand and consider the cost of the course that costs the highest.

2. Future Cost of Education

Once you know the cost of the course, based on the inflation rate and the number of years left for your child to enroll, calculate the future cost of the course. If you are not sure of the inflation rate applicable to the particular course, you can take 10% p.a.

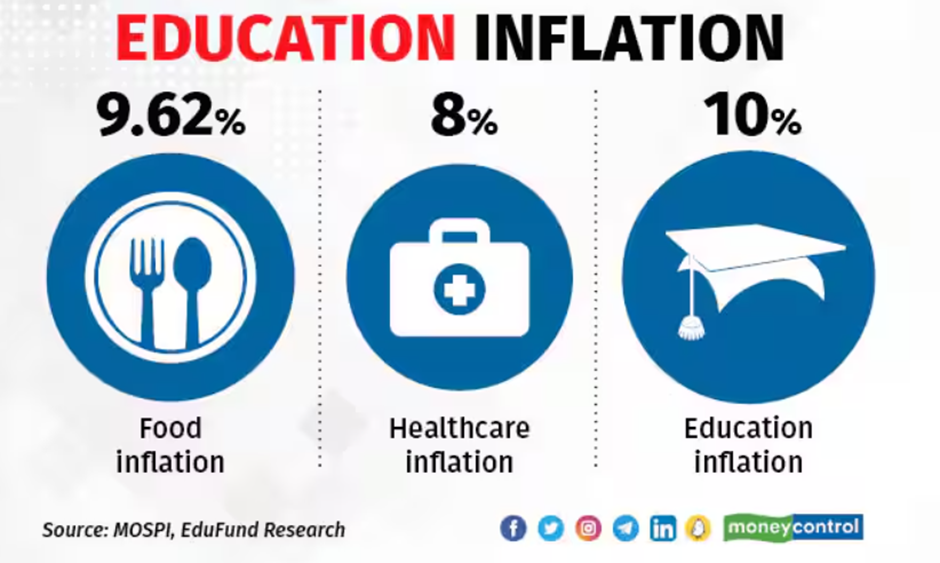

Education Inflation Rate Between 2012 to 2020

(Source: Moneycontrol)

The above image shows how education inflation has increased at a rate of 10% between 2012 to 2020. The education inflation rate (10%) was higher than that of food (9.62%) and healthcare (8%) during this period. It emphasizes why parents should plan for their child’s higher education right from the time the child is born or is young.

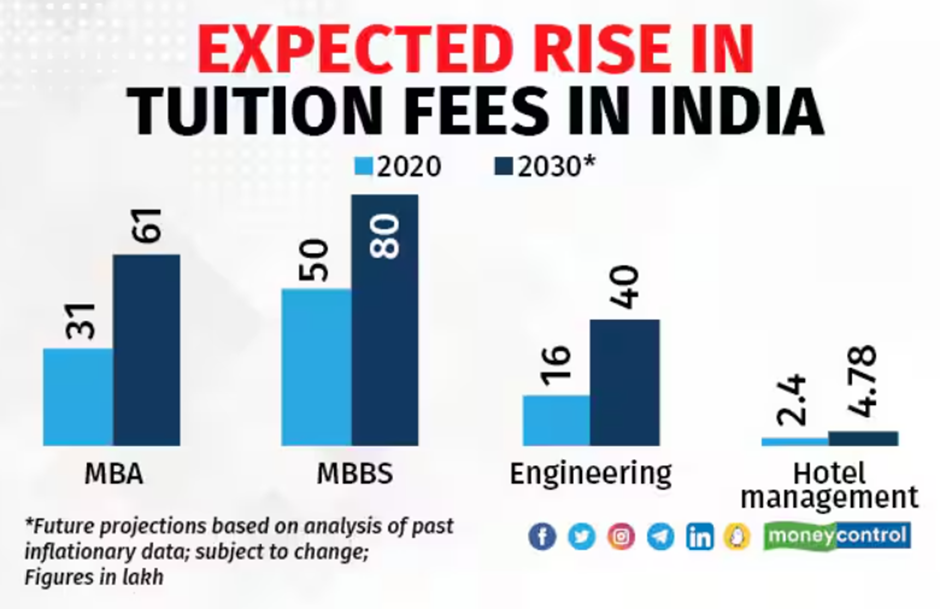

Expected Rise in Tuition Fees

(Source: Moneycontrol)

The above chart shows how the tuition fees for various courses are expected to rise by 2030. While the tuition fees for MBA and hotel management are expected to double, for engineering, it is expected to more than double.

When calculating the future cost of an international course, consider the Indian Rupee depreciation along with inflation. For example, in 2007-08, the INR depreciated 21.5% against the USD. Similarly, in 2010-11, the depreciation was 12.7%, and in 2018-19, it was 8.2%. You don’t want the INR depreciation to play spoilsport in your child’s international education dreams. Hence, it is important to consider INR depreciation when planning for it.

You can work with an investment expert to calculate the future cost of the course. The number arrived at will be your target goal for your child’s higher education.

3. Make an Investment Plan

Now, you know the target amount to be accumulated. You can work with an investment expert and get a goal plan made for yourself. The investment expert will consider the investment time horizon, expected rate of return, and the amount to be accumulated to arrive at the monthly investment. You can then start investing in mutual funds through the systematic investment plan (SIP) route.

4. Regular Review

You can consult your investment expert to review the goal plan once every six months to one year to track the progress made. During the review, if some financial product is consistently underperforming compared to expectations, it can be replaced with another suitable financial product.

If some new financial product has been introduced in the market, the investment expert can review it and recommend whether it needs to be added to the investment portfolio. If there are any taxation related changes, the investment expert can advise on it. Thus, the investment expert can handhold you till you accomplish the goal of building a fund for your child’s higher education.

Every Child Deserves the Best Education

As a parent, you will aspire the best for your child. By working with an investment expert, you can start building a higher education fund for your child as soon as the child is born or at a young age. When you start early, you have time on your hands and can benefit from the power of compounding with equity mutual funds. In the long run, equities have the potential to give inflation-beating high returns and accomplish your goals. With proper planning, you can achieve your goal of enrolling your child in the best university that you have always dreamt of.

Your Investing Experts

Relevant Articles

Multi-Generational Investment Planning Tips: Boomers, GenX, Millenials, GenZ

No matter your age, the right investment strategy can set you up for financial success. From starting small in your 20s to securing income in retirement, aligning your investments with your life stage ensures you make the most of every opportunity.

Your Child’s Education Goal: A Step-by-Step Investment Guide

Every parent wishes for a bright and secure future for their child, and that includes a quality education. Achieving this goal requires advanced and proactive planning to ensure you’re financially prepared to support your child’s aspirations. In this article, we will explore why it is important to plan for your child's education and some best practices for the same.

Top Wealth Management Strategies for Long-Term Success

The goal-planning process, like a retirement fund, has two important aspects: Wealth creation and wealth management. During your working years, you create wealth by building a retirement fund. During the retirement years, you manage the wealth created so that it sustains you during the retirement years. In this article, we will understand what wealth management is, how it differs from wealth creation, and the best wealth management strategies.

.jpg)

.jpg)