Multi-Generational Investment Planning Tips: Boomers, GenX, Millenials, GenZ

.jpg)

No matter your age, the right investment strategy can set you up for financial success. From starting small in your 20s to securing income in retirement, aligning your investments with your life stage ensures you make the most of every opportunity.

Financial priorities evolve with age. The way you invest in your 20s will—and should—look different from how you approach investments in your 50s. Whether you’re just starting out, managing growing responsibilities, or thinking about wealth preservation, investment planning should be customized to each life stage rather than following a generic formula.

By aligning your investment planning approach with your current financial needs and long-term goals, you can make the most of every opportunity. Here’s how different generations can make the most of their investments using SIPs, Step-Up SIPs, SWPs, and STPs to create wealth strategically.

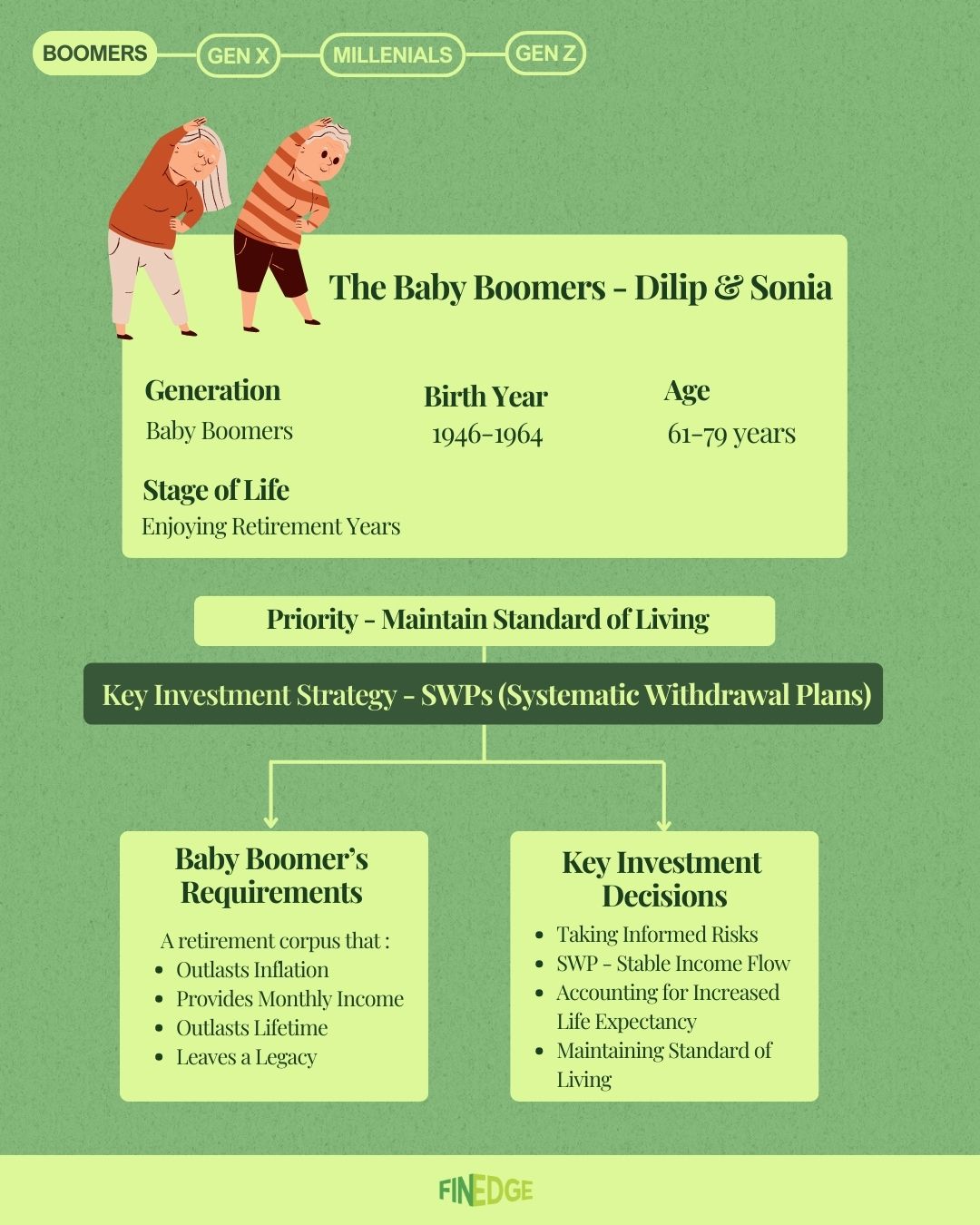

Baby Boomers & The Need for Income Generation

As Baby Boomers approach or enter retirement, their focus shifts from wealth accumulation to managing their investment corpus effectively. At this point, investments should generate consistent income while still offering growth potential to keep up with inflation.

One of the most effective strategies is a Systematic Withdrawal Plan (SWP), which allows you to withdraw a fixed amount at regular intervals while keeping a portion of your funds invested. This approach allows for steady cash flow while ensuring the remaining investments continue to grow and beat inflation.

For example, if you have accumulated a retirement corpus of Rs. 1 crore through a SIP plan in a mutual fund over 25 years, you can set up an SWP of Rs. 50,000 per month to generate a steady income while your remaining investments continue to grow.

SWPs enable you to maintain a well-balanced portfolio with an optimal asset allocation as being overly conservative can lead to a shortfall in funds over time.

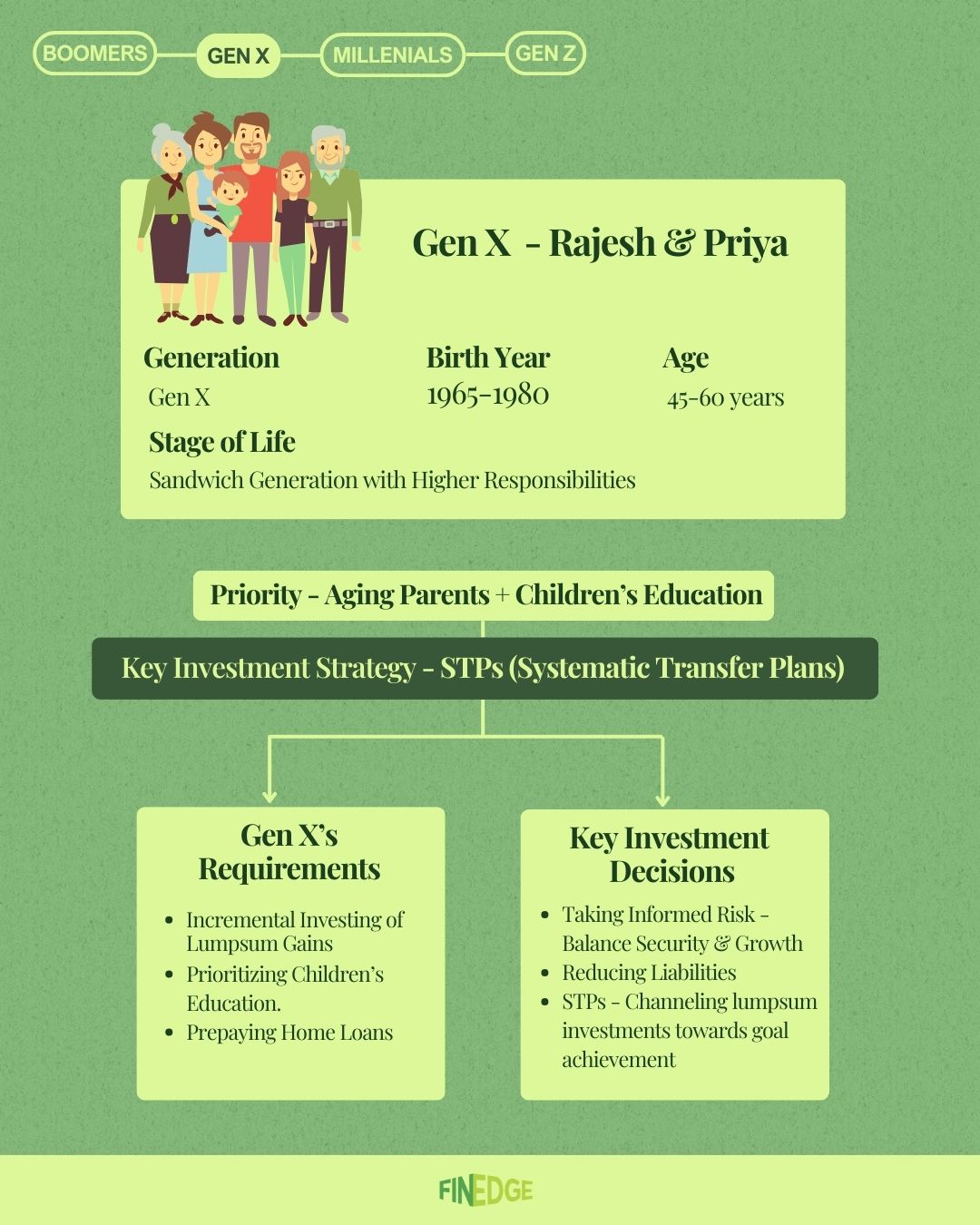

Gen X: Managing Responsibilities While Building Wealth

As they navigate their peak earning years, Gen X investors often find themselves balancing multiple financial responsibilities—supporting children’s education, aging parents, repaying loans, and planning for long-term financial stability. Many in this generation also receive lump sum funds from bonuses, asset sales, or inheritances, making it crucial to invest wisely.

A Systematic Transfer Plan (STP) can be an excellent way to manage these windfall gains. Instead of investing a large sum in equity all at once, STPs enable you to gradually transfer funds from a low-risk fund to equity, reducing market timing risk.

For example, if you receive a bonus of Rs. 10 lakh, instead of investing it all at once in an equity fund, you can park it in a debt or arbitrage mutual fund and transfer Rs. 1 lakh monthly into an equity mutual fund throgh an STP. This staggered approach reduces risk while ensuring your money grows.

At this stage, maintaining a strong equity allocation while ensuring adequate liquidity for immediate needs can set the foundation for long-term financial success.

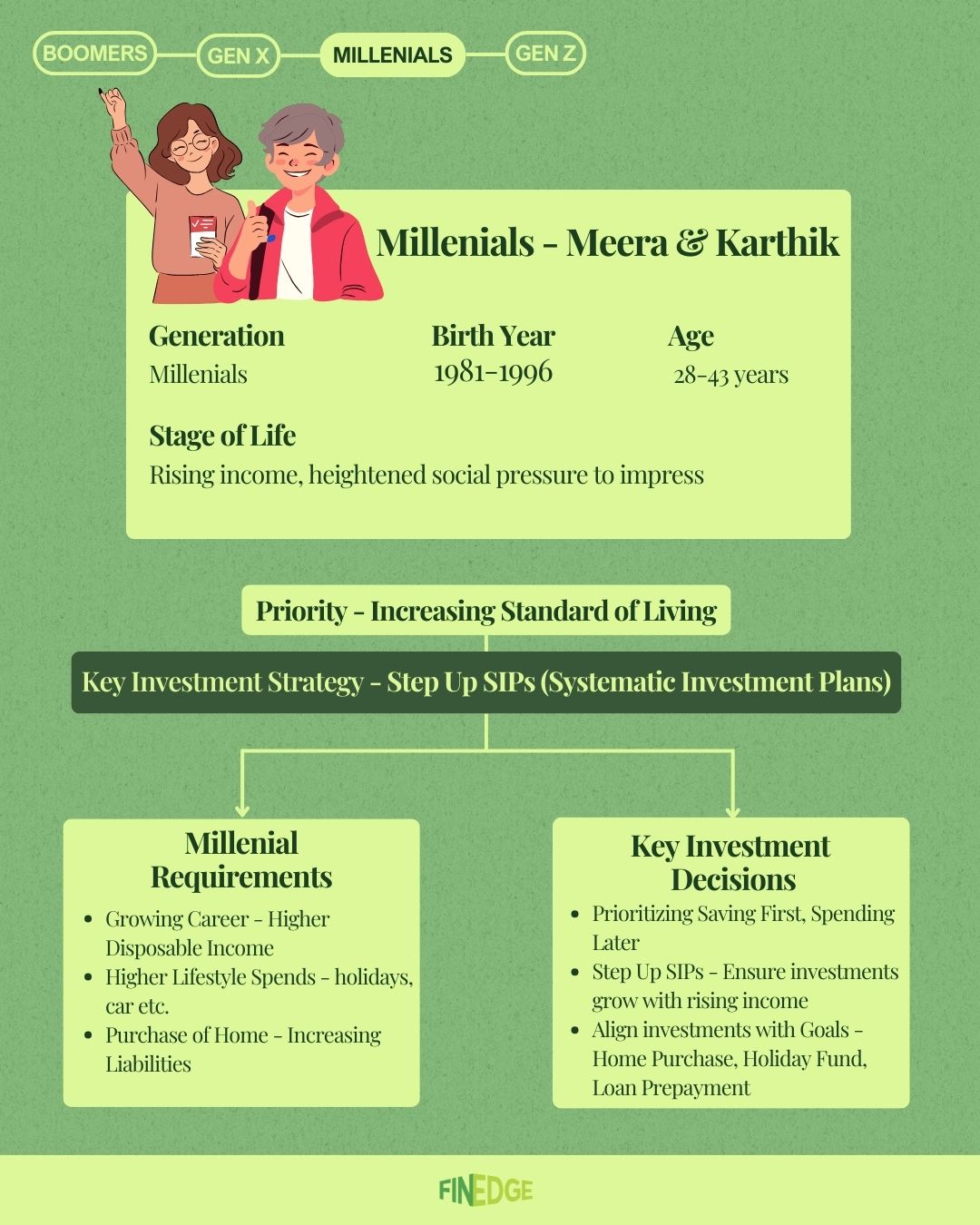

Millennials: Scaling Investments with Rising Incomes

Millennials are at a stage where career growth and income are on the rise, but so are financial temptations—lifestyle upgrades, travel, and social spending. The key to successful investing at this stage is prioritizing savings before spending.

A powerful way to achieve this is through Step-Up SIPs. Unlike regular SIPs, step up SIPs plans automatically increase your investment contributions each year, ensuring that as your income grows, so do your savings.

Let’s say you start investing Rs. 5,000 per month in a mutual fund through an SIP when you are 30 years old, with an assumed annual return of 13%. If you invest a fixed Rs. 5,000 per month for 20 years, your corpus would grow to Rs. 57 lakhs. With a step up SIP of 10% each year, your corpus could grow to over Rs. 1 crore in the same timeframe.

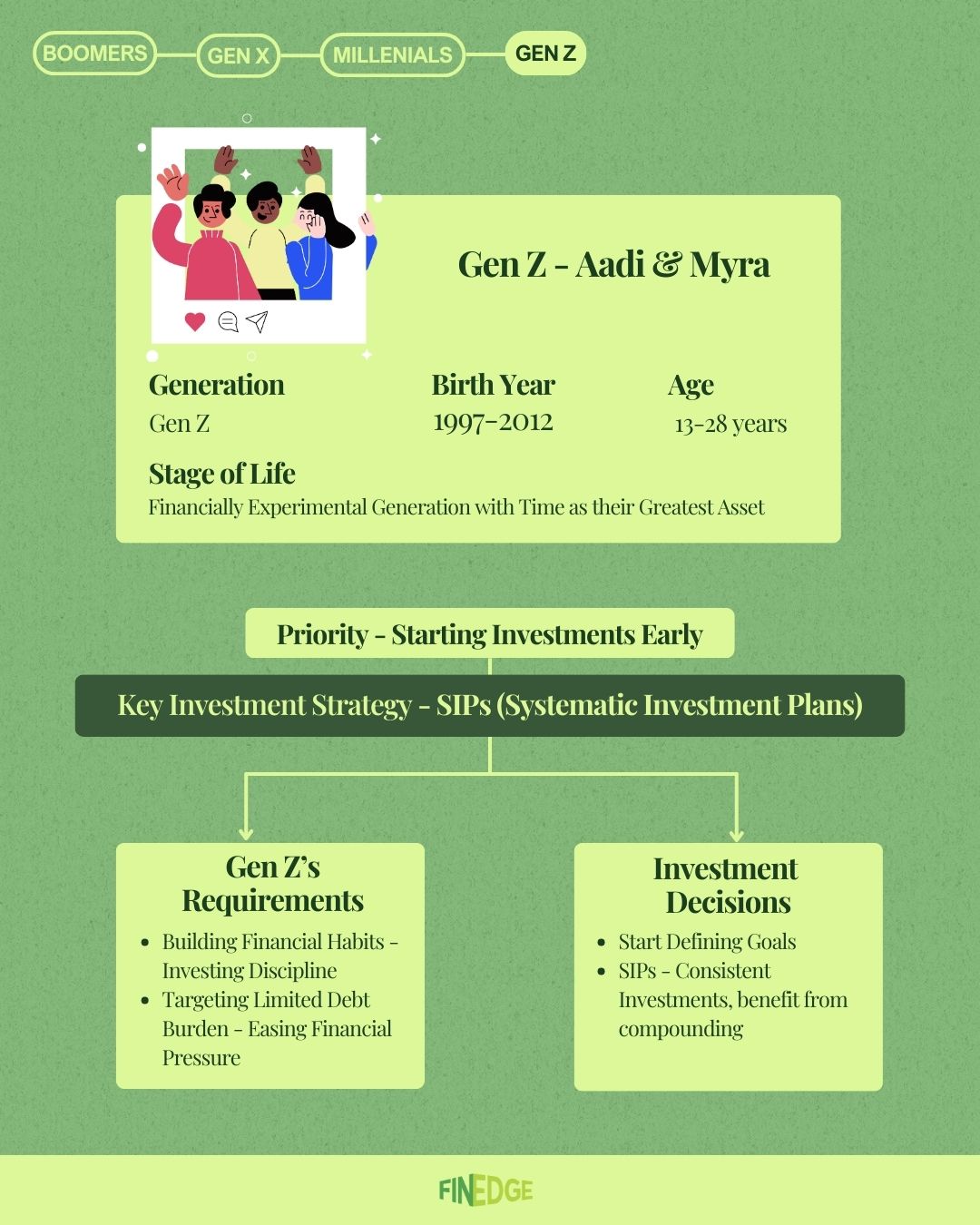

Gen Z: Laying the Foundation for Long-Term Wealth

For Gen Z investors, the biggest advantage is time. Starting early—even with small amounts, can lead to substantial wealth accumulation over the years. While this generation is comfortable experimenting with new investment avenues, establishing consistent, disciplined investing habits is crucial.

Systematic Investment Plans (SIPs) can be a great starting point. These allow for regular, automated investments, making investing a habit. Even modest contributions, if started early, can grow exponentially thanks to the power of compounding.

For example, if you start an SIP of Rs. 3,000 per month in an equity mutual fund when you are 20 years old with an assumed 13% annual return, your corpus could grow to Rs. 15 lakh by age 35. And, of course, you can increase contributions through Step-Up SIPs.

For Gen Z, the focus should be on long-term wealth creation with a strong equity allocation, while also exploring other financial instruments in a balanced, informed manner.

Final Thoughts: A Personalized Approach to Investing

Investment planning isn’t about following trends—it’s about making decisions that align with your life stage, financial goals, and risk tolerance. Whether you're focusing on long-term wealth accumulation, managing responsibilities, or securing financial independence, the right strategy can make all the difference.

FAQs

When should I start investing for my retirement?

The best time to start is as early as possible. You can begin with small amounts and gradually increase them over time. A comfortable retirement is essential after years of hard work, so don’t wait—starting early allows you to benefit from compounding, ensuring financial security with minimal stress.

How is SWP beneficial for my retirement plan?

SWPs enable you to first invest in inflation-beating instruments, ensuring that when you retire, you are able to maintain your standard of living. As you will no longer be earning a monthly salary, SWPs allow you to generate monthly income for your retirement to cover your expenses. Additionally, while you withdraw parts of your money on a regular basis, your remaining corpus remains invested and continues to grow in value.

What is the best way to invest a lump sum amount?

Instead of investing a large sum all at once, consider using a Systematic Transfer Plan (STP). This approach gradually moves your funds from a low-risk mutual fund to an equity fund, reducing the risk of market timing. It also ensures your money stays invested rather than sitting idle, reducing the temptation to spend impulsively.

How do I choose the best mutual fund for my age?

The right mutual fund depends on your financial goals, risk tolerance, and investment horizon. If you’re unsure, consulting an expert is the best approach. An expert can help analyze your cash flow and investment capacity to create a customized plan aligned with your goals. FinEdge’s Dreams into Action (DiA) platform offers expert-guided, convenient, and structured investment planning, ensuring you make informed decisions personalized to your needs.

Your Investing Experts

Relevant Articles

Your Child’s Education Goal: A Step-by-Step Investment Guide

Every parent wishes for a bright and secure future for their child, and that includes a quality education. Achieving this goal requires advanced and proactive planning to ensure you’re financially prepared to support your child’s aspirations. In this article, we will explore why it is important to plan for your child's education and some best practices for the same.

Top Wealth Management Strategies for Long-Term Success

The goal-planning process, like a retirement fund, has two important aspects: Wealth creation and wealth management. During your working years, you create wealth by building a retirement fund. During the retirement years, you manage the wealth created so that it sustains you during the retirement years. In this article, we will understand what wealth management is, how it differs from wealth creation, and the best wealth management strategies.

A Step-by-Step Guide to Personal Financial Planning

Some individuals follow a return-centric approach to investing. They chase returns by selecting mutual funds based on the last one and three-year returns. However, that is not the right approach. The appropriate approach is to identify your financial goals and invest towards fulfilling them. It keeps you focused on your investments for the long term till the goals are achieved. The personal financial planning journey can help you map all your financial goals, invest towards them, and review them till they are achieved. In this article, we will understand what is personal financial planning and how to go about it.

.jpg)