Investing Insights

Are Robo Advisors Right for You? Here's a Checklist

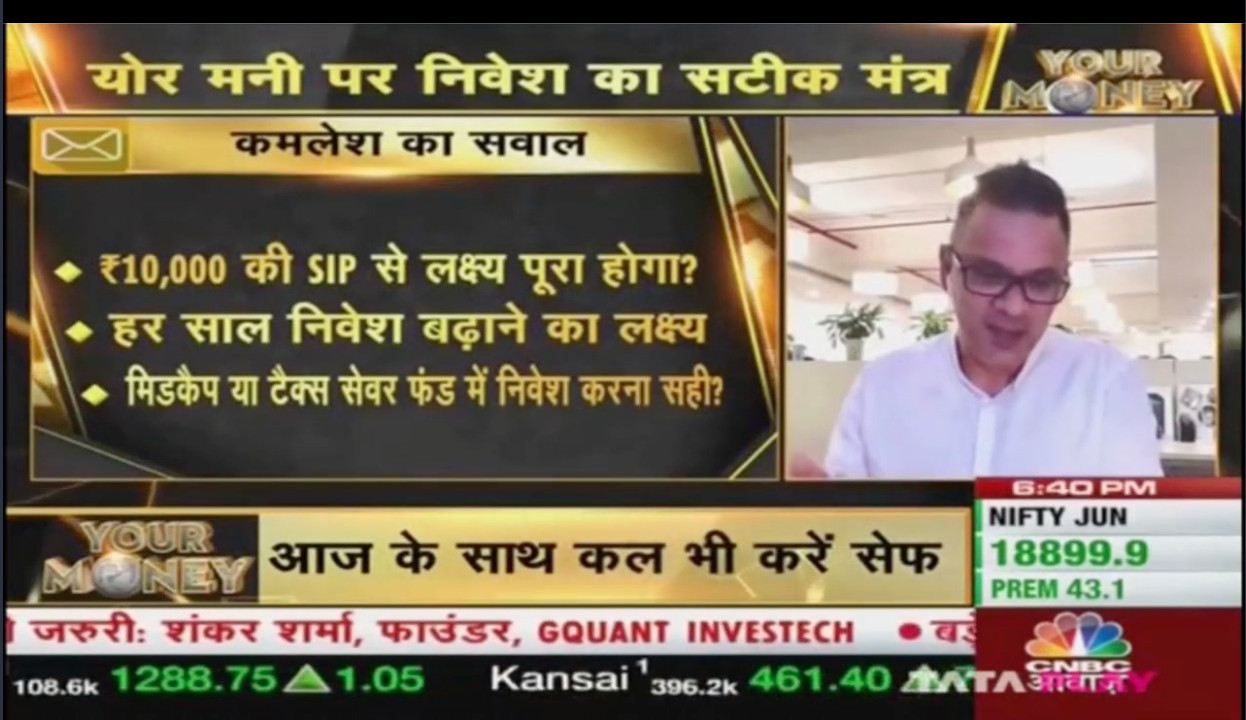

AMFI’s recent “Mutual Fund Sahi Hai” campaign has resulted in an interest in Mutual Fund Investments like never before. IPL watchers now enjoy the dual benefit of cricketing entertainment, coupled with Financial Education with respect to simplified Mutual Fund investing tips, tricks and fallacies! Along with the growing demand for Mutual Fund Investments, there’s been a steady rise in the number of Advisors – especially those who are choosing to leverage technology to create “robo advisory” platforms that do not have a human advisory element to them.

The Pros and Cons of Robo Advisors

Robo Advisors offer convenience and standardized advice, but they fall short when it comes to understanding personal goals and managing emotional aspects of investing. For a more holistic approach, consider Bionic Advisory platforms that combine the ease of technology with the guidance of a qualified human advisor, giving you the best of both worlds.

5 Clues That you Need a Financial Advisor

When to Seek a Financial Advisor: If you're unsure about your portfolio performance, have too many life insurance policies, or lack clear financial goals, it's time to consult a professional. (Financial Planning & Guidance) Investment Pitfalls & Expert Help: Relying on low-return assets, avoiding diversification, or making impulsive investment decisions can harm long-term wealth—an advisor can help you avoid these mistakes. (Smart Investing & Risk Management)

5 Reasons Why you Need a Financial Advisor

A Financial Advisor helps you avoid behavioral traps, stay organized, track market trends, prevent poor decisions, and stay aligned with financial goals.

5 Yearend Financial Planning Tips

End the year on a strong financial note by planning taxes early, tracking credit card spending, setting savings goals, canceling unused subscriptions, and eliminating poor investments. Smart financial decisions now can set you up for a prosperous new year.

3 Smartest Ways to Use Rs. 50,000 Cash

Got a ?50,000 windfall? Instead of splurging, use it wisely—pay off high-interest loans, invest in an ELSS via STP for tax savings, or build an emergency fund. Smart money moves today can secure your financial future!

Should You Invest Through a Robo Advisor?

Robo Advisors offer convenience and unbiased recommendations, but can they shield you from investment biases? A Bionic Model may be the answer! Combining technology with human expertise could be the key to smarter investing.

How to Save Tax Using ELSS Funds

ELSS funds offer tax-saving benefits with higher return potential and a shorter lock-in period than traditional options. Investing systematically can maximize gains and reduce market timing risks.

Why should you review your financial portfolio?

Regularly reviewing and rebalancing your financial portfolio is crucial to staying on track with your financial goals. Market fluctuations, changing financial objectives, and evolving economic conditions can impact your investments. A disciplined review every 6-9 months helps adjust asset allocation, optimize returns, and minimize risks. Stay informed and invest wisely.

The 3 D's of Financial Goal Achievement

Read this to know 3 D’s of Financial Goal achievement which improves the chance of achieving your long term goals for you & your family. To know more, visit FinEdge now!

The Rule of 72... and an interesting corollary for monthly savers!

Rule of 72 is an easy way to calculate how long it's going to take to double your money at given annual rate of return & vice versa. To learn more, visit FinEdge now!

All about Student Loans

With education expenses in India rising at the speed of knots, it’s no wonder that the popularity of student loans are on the rise. In fact, a recent article Economic Times article^ suggests that MBA costs are expected to rise at 15.26% per annum and other undergraduate expenses 12.59% in next five years. For undergraduate engineering courses, fees typically range from Rs 5-10 lakh, while for a five-year medical course at a private college this number could be upwards of Rs 50 lakh! For post-graduate management courses such an MBA or PGPM, fees could be more than Rs 10 lakh.

Latest Posts

Regular Savings Plan: A Balanced Approach to Stability and Growth

Jan 07, 2026

The Portfolio Health Check: 5 Signals Your Investments Need Attention

Jan 05, 2026

From Coffee to Crorepati: Small Lifestyle Tweaks Gen Z Can Make to Start Investing Early

Jan 02, 2026

Lessons From the World’s Best Investors to Carry Into the New Year

Dec 26, 2025

Why Consolidating All Your Investments on One Platform Makes Sense

Dec 24, 2025

The Importance of your Child’s Education Goal

Feb 28, 2024

Why Retirement Planning is Important

Nov 08, 2023

Oct 31, 2023

Investing Behaviour and the investing roller coaster

Oct 12, 2023

Investing Stories

.jpg)

_(1)1.jpg)

.jpg)

.jpg)

.jpg)