Investing Insights

Is COVID-19 Triggering These Behavioural Biases in You?

The COVID-19 market crash was more than a financial shock, it was a psychological one. For many investors, it exposed deep-seated behavioural biases that quietly shape our decisions, often at our own cost. Whether it's abandoning your SIPs during a dip or chasing trends at the wrong time, understanding these patterns is the first step toward better investment outcomes. Let’s unpack the most common behavioural traps triggered by market turbulence, and how to avoid them.

5 Behavioural Biases That Influence Our Investment Decisions

Human behaviour takes shape over a period of time based on various factors. Some of these include what we see, read, watch, and learn from people in our lives, television, social media, etc.

Chasing Returns vs. Wealth Creation

Creating Wealth from your investments is all about return maximization, right? Wrong! It may surprise you to know that your pernicious little habit of always trying to maximize portfolio returns may in fact be what is impeding your ability to generate long-term wealth. Here’s are four reasons why.

5 Behavioural Traps That Could Hurt Your Mutual Fund Investments

Learn 5 key biases impacting long-term mutual fund returns to boost your investment success.

Why people lose money in Equity Mutual Funds

Read this blog & know why people lose money in Equity Mutual Funds. Know the top 5 reasons why investors tend to lose money in Equity Mutual Funds. Visit FinEdge now!

Riding the SIP Wave: How to benefit from Volatile Markets

In recent months, equity mutual funds (especially SIP’s) have seen increased inflows and a renewed interest from the retail investor community. Whereas a lot of these SIP’s have been started with the intention of continuing them for 5 to 10 years or more, the truth is that not all of them will actually successfully complete their tenure. In this brief article, we’ll summarize a few key factors to keep in mind while planning for your future goals using SIP’s. Let’s begin with our “three golden rules” of SIP investing!

5 Money Habits of the “Financially Wise”!

Ever wondered how the truly “financially wise” approach their day to day personal finances? This week, FinEdge presents 5 money habits that are nearly universal to all those who are en route to financial Nirvana!

FOMO, Panic, Overconfidence: Understanding Your Investing Triggers

Your investment behavior often matters more than the markets. Whether it's fear in a downturn, overconfidence after a win, or FOMO triggered by someone else's success; emotional investing leads to decisions that aren’t aligned with your goals. In this blog, we explore these triggers and how to build a more grounded, goal-oriented approach.

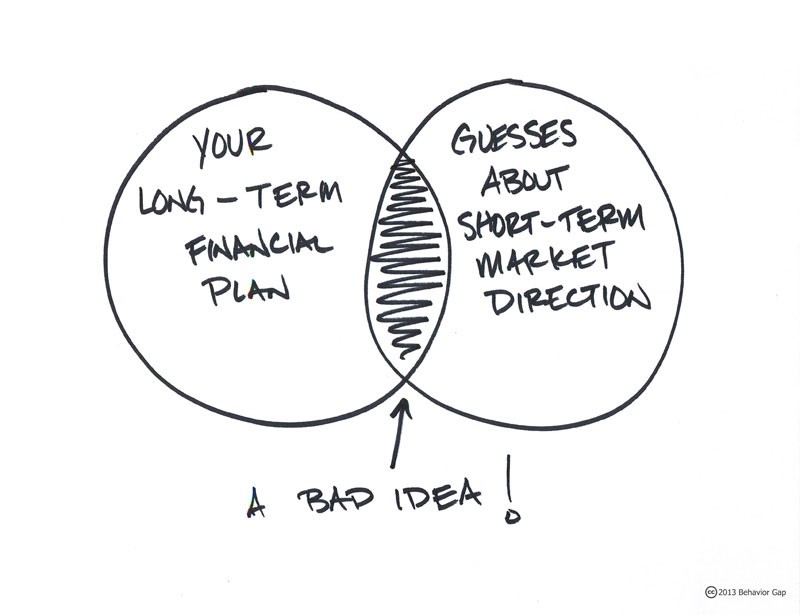

Why Most Investors Underperform Their Investments (Returns Gap Explained)

Many investors fail to achieve the full potential of their investments, not because they chose the wrong funds, but because of how they behave during market ups and downs. This difference in expected vs. actual returns is called the returns gap, and understanding it is crucial for long-term success.

Investing in Volatile Markets: How to Build Resilience and Stay on Track

Investing in volatile markets is never easy, especially when headlines scream panic and portfolios turn red. But market cycles are not the problem. The real challenge lies in how investors react. Building investing resilience, the ability to stay aligned with your goals and decisions through ups and downs, is essential for lasting success. In India, as retail participation grows, so does the need for calm, process-led investing.

Why DIY Investment Platforms Are Failing Indian Investors

While DIY investment platforms promise low-cost, tech-enabled convenience, many Indian investors are learning the hard way that investing success needs more than just automation. Beneath the sleek dashboards and algorithm-driven suggestions lies a troubling trend: falling short of financial goals, impulsive exits, and a growing number of SIP stoppages. So, what’s really going wrong? The short answer: these platforms often fail to offer what investors need most; personalization, emotional guidance, and behavior alignment.

Long-Term Investing: Why the Right Behaviour Matters More Than the Best Product

Kalpen Parekh is the Managing Director and CEO of DSP Asset Managers Pvt. Ltd. With over two decades in investment management, he has previously led teams at IDFC Mutual Fund, Birla Sun Life AMC, ICICI Prudential AMC, and L&T Finance. A passionate advocate of evidence-based investing, Kalpen believes that investor behaviour and long-term discipline are the true sources of alpha. He holds a Master’s in Finance from Narsee Monjee Institute of Management Studies and a Bachelor’s in Chemical Engineering from Bharati Vidyapeeth, Pune.

Latest Posts

AI Investment Platforms – Helpful, But Not the Whole Story

Sep 12, 2025

What Are Mid-Cap Funds? Risks, Returns, and Should You Invest?

Sep 10, 2025

What is Rupee Cost Averaging? (With Example)

Sep 08, 2025

Why Do Most Investors Struggle with Wealth Creation?

Sep 03, 2025

What Are Small-Cap Funds? Risks, Returns, and Should You Invest?

Sep 01, 2025

The Importance of your Child’s Education Goal

Feb 28, 2024

Why Retirement Planning is Important

Nov 08, 2023

Oct 31, 2023

Investing Behaviour and the investing roller coaster

Oct 12, 2023

Investing Stories

.jpg)

_(800_x_575_px)_(2).jpg)

.jpg)

.jpg)

_(1)1.jpg)

.jpg)

.jpg)

.jpg)