Chasing Returns vs. Wealth Creation

Creating Wealth from your investments is all about return maximization, right? Wrong! It may surprise you to know that your pernicious little habit of always trying to maximize portfolio returns may in fact be what is impeding your ability to generate long-term wealth. Here’s are four reasons why.

What Is the Difference Between Chasing Return vs Wealth Creation

By chasing returns, you are attempting to invest in investments that have recently performed well, which entails higher risk and potential loss due to timing issues and market volatility. By contrast, wealth creation focuses on long-term growth, diversification, and patience, with a steady accumulation of assets over time through disciplined investing.

Creating Wealth from your investments is all about return maximization, right? Wrong! It may surprise you to know that your pernicious little habit of always trying to maximize portfolio returns may in fact be what is impeding your ability to generate long-term wealth. Here’s are four reasons why.

You’ll end up Churning & Burning

The most direct and visible side-effect of perennial return-chasing is excessive churn. You’ll forever be moving in and out of investments; chasing the next hot tip or trying to invest in the “next big thing”. Resultantly, you’ll never stay in an asset class long enough for its cycle to really play out to your advantage. Remember, financial markets seldom dance in tandem with economic cycles. By constantly re-jigging your portfolio with the flavour of the month or trying to trade the news, you’ll probably miss out on the best investment periods altogether. Over time, you’ll be left wondering why you worked so hard to earn lower than fixed-deposit returns!

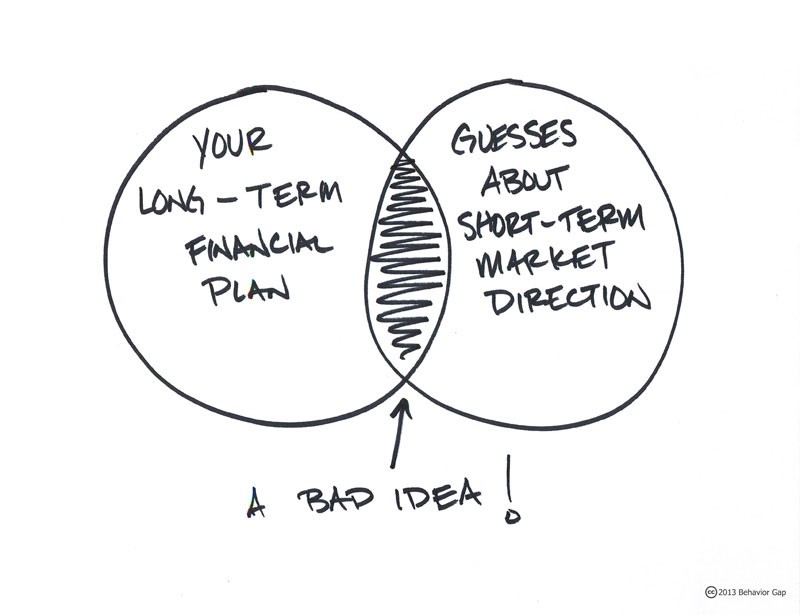

Your Behaviour Gap will be as wide as the Grand Canyon

It’s a well know fact that return chasing encourages short-term thinking, which in turn triggers a host of biases that create a wide behavioural gap in your long-term returns. Ironically, the very act of chasing returns is what ends up reducing your long-term portfolio growth the most. Every time your investments slip into the red, the loss aversion bias gets you all riled up. When markets turn volatile, the action bias comes to the fore and forces you to “do something” with your portfolio. You keep starting and stopping your SIP’s instead of letting them flow passively. You're forever trying to time the markets. As a result, you neither benefit from compounding nor rupee cost averaging, negating all chances of creating wealth from your investments.

You’ll usually end up catching the Bull by its Tail

It goes without saying that return-chasers are not forward looking. In fact, they invest for the future with their eyes fixed on the rear-view mirror – as dangerous an investment habit as any. As a result of this tendency, return chasers tend to be overtly enamoured by short term past returns, and end up investing into assets that have already gone up in price. When GILT funds rallied spectacularly in 2008, return chasers jump right in; only to earn a negative 10% return in the next year. When small and midcaps rallied in 2017, they lined up to invest in 2018 just before the spectacular fall. Gold just crossed Rs. 50,000? Bring it on, baby! Wealth Creation actually entails taking the exact opposite stance – that is, going against the grain and investing in an asset that is nearing the end of a bad cycle (ergo, often reflecting poor short to medium-term returns) basis their future outlook.

You’ll probably be flying blind

In his inimitably comical style, the record-breaking Baseball star Yogi Berra once said: “If you don’t know where you are going, you might end up someplace else”. This rings especially true for return chasers, as they seldom invest with a solid Financial Plan in place. Without the tether of future Financial Goals to keep them in check, return chasers usually take investment decisions in an indisciplined and ad hoc manner, without a cool and rational mind. They tend to be mercurial and erratic, and their investments may not even be aligned correctly to their time horizons. As a result, they rarely create wealth from their investments - and often wind up an embittered lot, having had poor initial experiences with volatile growth assets that actually afford them a shot at generating long term growth.

Do you want to transition from being a return chaser to being a wealth creator? Get in touch with us today.

Your Investing Experts

Relevant Articles

Three biases that could impact your Financial Planning

When it comes to financial planning, behavioral biases can be your biggest obstacle. The sunk cost bias, conservatism bias, and action bias often prevent investors from making rational decisions, leading to poorly diversified portfolios, missed opportunities, and unnecessary costs. Recognizing and addressing these biases is key to successful financial planning.

5 Behavioural Biases That Influence Our Investment Decisions

Human behaviour takes shape over a period of time based on various factors. Some of these include what we see, read, watch, and learn from people in our lives, television, social media, etc.

5 Behavioural Traps That Could Hurt Your Mutual Fund Investments

Learn 5 key biases impacting long-term mutual fund returns to boost your investment success.

.png)