Income Tax Changes in Budget 2025 & RBI's Rate Cut: A Boost for Growth & Investments

Lower taxes, cheaper loans, and a push for private sector growth—how the latest Union Budget and RBI’s rate cut are shaping India’s economic future.

The 2025 Union Budget was presented in the Parliament on 1st February 25, with a special focus on the middle class, recognized as the backbone of nation building. In this article, I would like to talk about the Budget and the subsequent meeting of the RBI Monetary committee and how both these events are meant to complement one another to pave the path to ‘Viksit Bharat’.

On the Budget front, key changes have been introduced in tax slabs, standard deductions and rebates to ease their tax burden.

To follow this, after a gap of 5 years, the RBI has cut interest rates from 6.5% to 6.25% - bringing it down by 0.25%.

The Impact of Changes in the Income Tax for Individuals

Income Tax Benefits for Individuals

- There will be no income tax payable up to income of Rs. 12 lakh under the new regime.

- This limit will be Rs.12.75 lakh for salaried tax payers, due to standard deduction of Rs. 75,000

- The rebate threshold under the new tax regime has been raised from Rs. 7 lakh to Rs. 12 lakh, and the rebate amount increased from Rs. 25,000 to Rs. 60,000. This means that if your income (excluding special rate income) is up to Rs. 12 lakh, you won’t have to pay any tax.

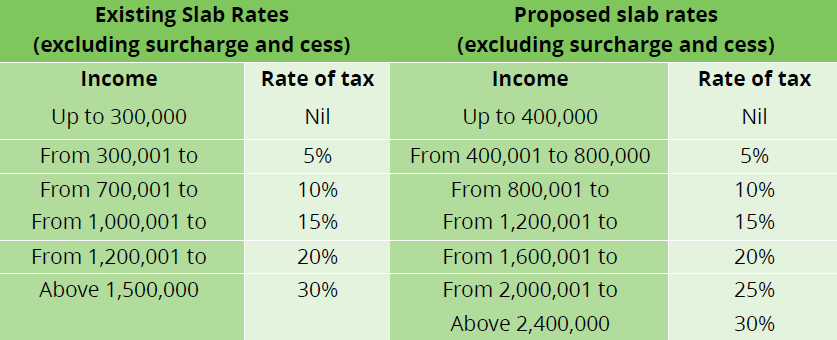

The revised tax rate structure for non-corporate taxpayers opting for the new/ default tax regime is as under:

(Source : Budget 25 presented by Finance Minister Mrs. Nirmala Sitharaman)

The new income tax slabs under new tax regime will allow taxpayers to save up to Rs 1.14 lakh in a financial year. The new tax regime continues to remain the default tax regime.

The tax rebate under Section 87A has been proposed to be hiked to Rs 60,000. The proposed hike in tax rebate under Section 87A will ensure that there is zero tax payable on incomes up to Rs 12 lakh. Current income tax laws allow zero tax on net taxable incomes up to Rs 7 lakh. This makes them eligible for current tax rebate of up to Rs 25,000.

The new income tax slabs proposed under new tax regime have hiked the income tax basic exemption limit to Rs 4 lakh from current limit of Rs 3 lakh.

No changes have been proposed in the deductions available under the new tax regime. For the upcoming fiscal year 2025-26, the individual will continue to claim standard deduction of Rs 75,000 from salary income. There is no change in the surcharge levied on the income tax liability under the new tax regime for FY 2025-26.

Rate Cut by Reserve Bank of India (RBI)

The Reserve Bank of India’s Monetary Policy Committee (MPC) has cut the repo rate by 0.25% to 6.25%.

Repo rate is the rate at which RBI lends to banks. This cut often translates to lower lending rates charged by banks to end borrowers whether it is individuals borrowing for a Home Loan or car purchase or a company that intends on borrowing for a planned capital expenditure.

What is the RBI Signaling with this rate cut?

- Shift from Government to Private Sector-Led Growth – After five years of high government capital expenditure, the RBI is nudging the private sector to step up investments.

- Boost to Consumption – Income tax cuts will leave more disposable income in consumers’ hands, increasing spending.

- Encouragement for Private Sector CapEx – The rate cut will improve liquidity, making borrowing cheaper for businesses.

- Support for Price Stability and Growth – Lower interest rates will help maintain inflation stability while fostering economic expansion.

The RBI Rate Cut and Budget 2025: Paving the way for growth in the economy

- More disposable income = Higher consumption : The tax cuts will increase consumer spending, leading to higher demand for goods and services.

- Boost in private investment : With higher demand, private sector companies are likely to increase capital expenditure (CapEx). The rate cut encourages this by making borrowing cheaper.

- Job creation and economic expansion : Increased Capital Expenditure will lead to job creation, fueling a positive cycle of growth.

What About Home Loan or Car Loan EMIs?

One significant outcome of a rate cut from the RBI is the expectation of lowering interest rates of existing or newer loans. However, lower loan EMIs won’t happen immediately as Banks usually pass on the benefits after 2-3 consecutive rate cuts. That said, if we have entered the rate cut cycle, loan EMIs are bound to come down if not now, but in the times to come.

Conclusion

RBI and the government of India are working closely to follow a two pronged approach of igniting private investments and boosting demand. The 2025 Budget’s tax reforms and RBI’s rate cut are aimed at stimulating growth in the economy. Lower taxes benefit the middle class, while businesses get incentives to invest, driving economic expansion. For investors, this is a chance to focus on their long term goals, that would fortunately be coinciding with the vision of the government to make India ‘Viksit Bharat’ or ‘Developed India’ by 2047.

Your Investing Experts

Relevant Articles

Rupee Falling in 2025? Here’s How to Protect and Grow Your Investments!

Imagine you had been saving to buy the new iPhone. A few months ago, the price was Rs.80,000, but now, since the rupee has fallen against the dollar, the price has soared to Rs.85,000. You’re paying more for the same product simply because the rupee has depreciated relative to the dollar. This is exactly what happens when the rupee weakens—it makes everything we import (such as fuel, electronics, and raw materials) costlier.

How Understanding Risk Is Critical While Investing and Ways to Mitigate Risk in Investing

When it comes to investing, the risk involved and the potential reward go hand in hand. The higher the risk involved, the higher the reward expectation. However, can the risk be reduced or mitigated while keeping the reward potential still high? The answer is yes. In this article, we will understand what risk is, why understanding it is critical, and ways of mitigating it.

Budget 2024: What to Expect – Tax Exemptions, Deductions, Change in Slabs or Status Quo?

With the new Government in place and the continuation of Nirmala Sitharaman as the Finance Minister, the Union Budget is expected to be presented in July 2024. The expectations from the Finance Minister are running high from all sections of taxpayers. In this article, we will look at what can a common man expect from the budget.

.png)