Silver Prices Are at a Record High: Should You Invest?

In April 2024, the silver prices made headlines by crossing all-time highs to touch Rs. 85,000 per kg. Silver has the dual benefit of being a precious metal and industrial metal. High inflation and geopolitical uncertainty have boosted the demand for precious metals.

On the other hand, high industrial applications of silver have also boosted its demand. A combination of these factors has led to silver prices skyrocketing. In this article, will look at the how silver has performed as an asset class and whether you should invest in it.

How Has Silver Performed as an Asset Class?

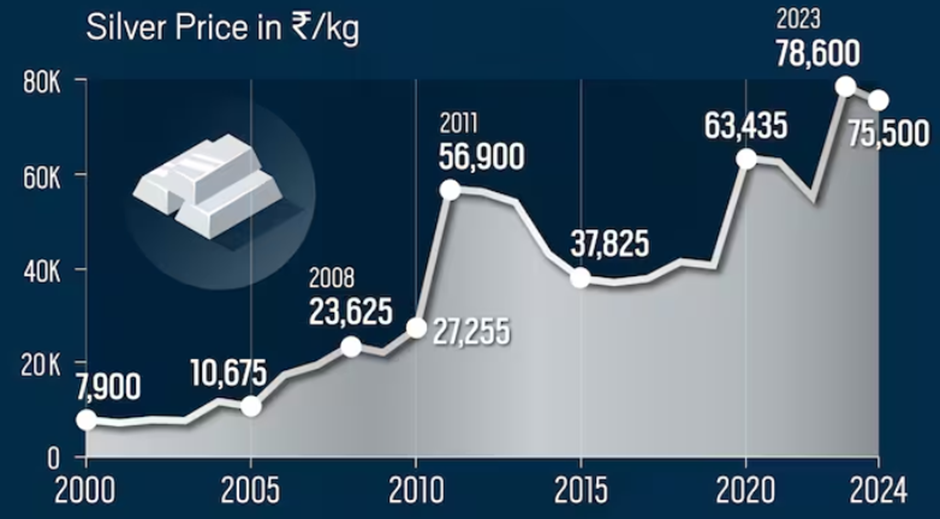

Silver as an asset class has performed well in the last two decades. The price of silver has risen from Rs. 7,900 per kg in 2000 to above Rs. 85,000 per kg in April 2024.

Silver Price Performance

(Source: Indiatoday)

Note: The above data is as of 9th April 2024.

The above chart shows how silver as an asset class has given returns of 9.85% CAGR over the last 24 years. These are good returns.

Now, let us compare the performance of silver with other asset classes.

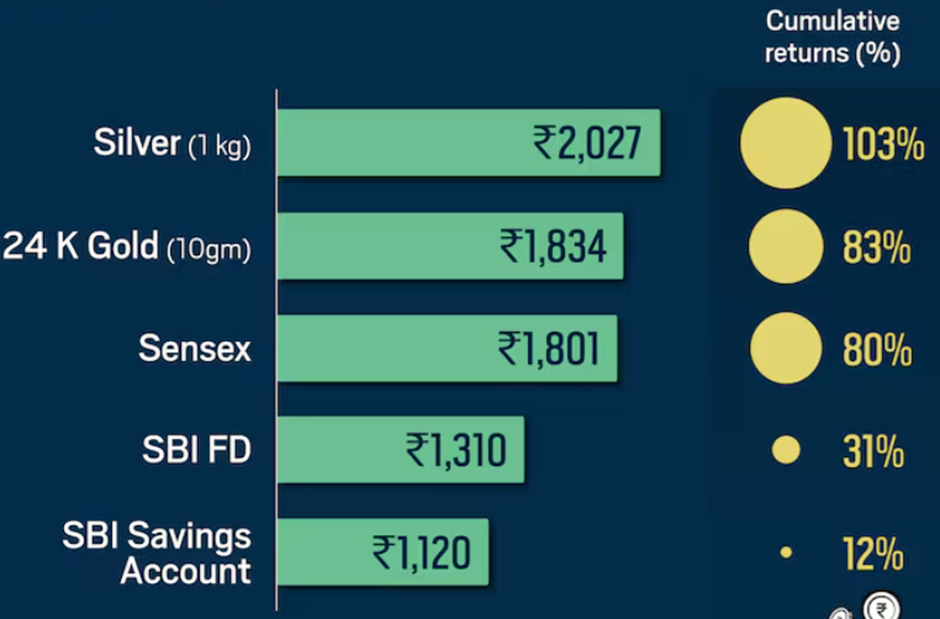

(Source: Indiatoday)

Note: The above data is based on returns calculated from 1st January 2020 to 9th April 2024.

The above chart shows the value of a Rs. 1,000 investment in each of the above asset classes made on 1st January 2020. The returns are cumulative as of 9th April 2024.

As per the above chart, silver as an asset class has beaten other asset classes such as fixed income (fixed deposits), Sensex 30, and gold in terms of returns. In a little over the last four years, silver prices have more than doubled, with a cumulative return of 103%.

Why Are Silver Prices Going Up?

In the earlier section, we saw how silver has performed well in the short as well as long term. Let us now understand what are the factors behind the current rally in silver prices.

1) Demand–Supply Gap

Silver, apart from being a precious metal, is also an industrial metal. So, apart from investment demand, it also has a lot of industrial demand. Silver is being increasingly used in industrial applications like photography, medicine, solar panels, electric vehicles, etc. In the future, due to a shift towards clean energy, the demand for solar panels and electric vehicles is going to be high.

As per the Silver Institute website, in 2024, the silver demand is expected to be 1,219 million ounces and the supply is expected to be 1,003 million ounces. That leaves a deficit of 216 million ounces. The demand–supply gap is expected to keep prices buoyant.

2) High Inflation

Inflation in many parts of the world is still beyond the tolerance bands of central banks. After trending down throughout 2023, in the US, the CPI inflation has edged up in the last three months. In January 2023, the US inflation was at 3.1%. In February 2024, it climbed higher to 3.2%. In March 2024, it further climbed higher to 3.5%.

During times of high inflation, the demand for precious metals like gold and silver rises. They are considered as a hedge against inflation. Hence, the high inflation numbers are expected to increase the demand for silver and lead to higher prices.

3) Geopolitical Uncertainty

Currently, two wars are going on in various parts of the world. The Russia – Ukraine war started more than two years back and is showing no signs of ending. The Hamas–Israel war began in October 2023 and is threatening to become a wider conflict with more countries getting involved. It has also led to disruption of global sea trade passing through the Red Sea.

During such uncertain times, the demand for gold and silver goes up. They are considered a safe haven against uncertainty. The global uncertain events are expected to keep the demand high for silver and the prices are expected to stay higher.

4) Festive Demand

In India, the summer season sees a lot of weddings. During this time, there is a lot of gold and silver demand in the form of jewellery. During wedding season, people buy jewellery in the form of mangalsutra, bangles, necklaces, earrings, bracelets, etc. There is silver demand for silverware, such as utensils, idols, puja items, etc.

In May, we have Akshay Tritya, which sees a lot of gold and silver buying. It is considered an auspicious occasion for buying gold and silver. Silver is a popular gift item for weddings, birthdays, anniversaries, festivals, housewarming, etc. All the above factors are expected to keep the silver demand buoyant, thus increasing prices.

How Much Should You Allocate to Silver?

The allocation to precious metals like gold and silver may be in the 5-15% range. It depends on your age, risk profile, financial goals, investment time horizon, etc. Some people have a financial goal like accumulating silver for a child’s wedding. In that case, you may estimate the quantity of silver you want to accumulate and start a SIP in a silver mutual fund.

Ways of Investing in Silver

Some of the popular ways of investing in silver include the following.

1) Silver Jewellery

Silver jewellery is the oldest and one of the most popular ways of investing in silver. However, please note that silver jewellery is for consumption rather than investment purposes. Jewelry involves making charges.

2) Silver Coins and Bars

You can accumulate silver for investment by buying silver coins and/or bars. They must be stored safely, which may entail bank locker charges. You will also need to purchase insurance to protect it from theft and damage. Physical silver is bulky and hence may take more storage space.

3) Silver ETFs

Some mutual fund houses offer silver exchange-traded funds (ETFs). They are listed on the stock exchanges like the NSE. You can log into your trading account and place buy or sell orders. When you buy silver ETF units, the amount gets debited from your bank account, and the units are credited to your demat account. When you sell them, your demat account is debited with the units and your bank account is credited with the sale proceeds. You have to do the buying and selling of silver ETF units as there is no SIP option.

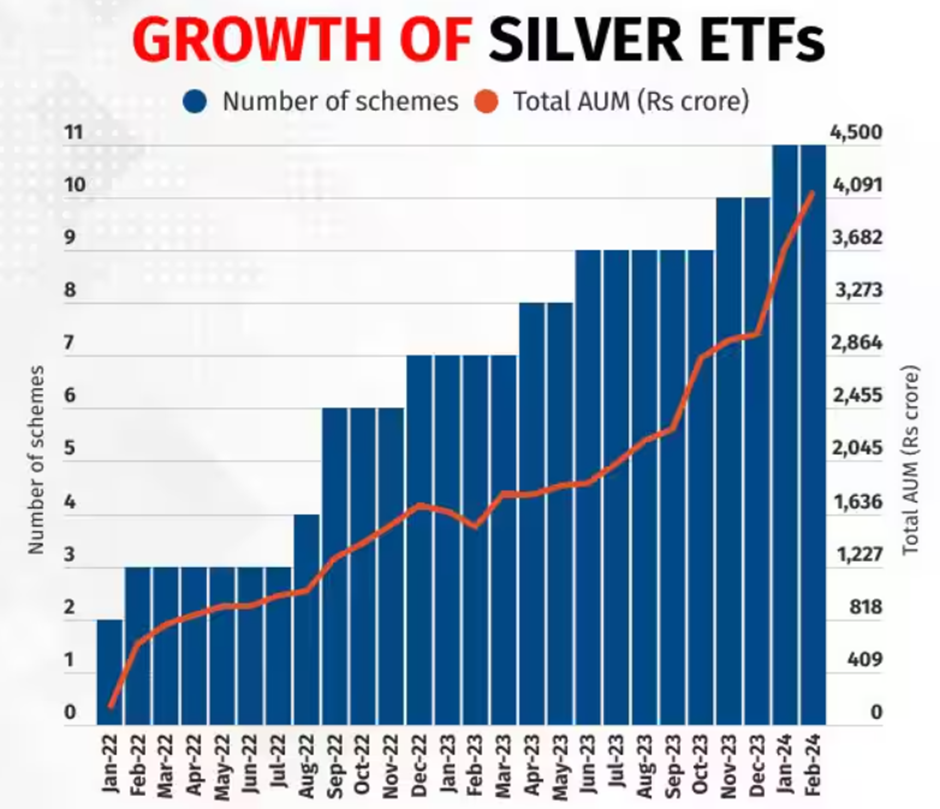

Growth of Silver ETFs in India

(Source: Moneycontrol)

The above chart shows how silver ETFs have grown in popularity in India over the last few years. Silver ETF schemes have increased from 2 in January 2022 to 11 in February 2024. During this period, the AUM of silver ETFs has grown from Rs. 123 crores in January 2022 to Rs. 4,144 crores as of February 2024.

4) Silver Mutual Funds

In the above section, we saw there is no SIP option in silver ETFs. However, you have the SIP option in silver mutual funds offered by AMCs. Through a silver mutual fund SIP, you can invest a specified amount on a specified monthly date for a specified time horizon. It is an excellent way to accumulate silver for a financial goal, like a child's wedding.

Taxation of Silver ETFs and Mutual Funds

Silver ETFs and mutual funds are taxed similar to debt securities. The capital gains from silver ETFs and mutual funds, irrespective of the holding period, are added to an investor’s overall income. The capital gains are taxed at the individual’s slab rate.

Add Shine to Your Portfolio With Silver

In the last couple of years, precious metals like silver and gold prices have seen a good rally. The inflation hedge and safe haven demand for gold and silver are expected to continue in future. However, silver has the additional benefit of industrial demand. As the world moves ahead to tackle climate change, the adoption of solar energy and electric vehicles will grow rapidly. Silver is used a lot in these two sectors and many other sectors. All these factors are expected to keep the silver demand and prices buoyant in future. Hence, you can add shine to your investment portfolio with silver.

Your Investing Experts

Relevant Articles

Difference Between Sensex and Nifty: A Simple, Clear Explanation

When people talk about the Indian stock market, two names appear everywhere: Sensex and Nifty. They are the most widely tracked market indices in the country. Yet many investors still look for a clear explanation of the Sensex and Nifty difference, how each is calculated, and what companies form part of these indices.

Understanding Foreign Institutional Investors (FIIs) and Their Role in the Indian Stock Market

Foreign Institutional Investors (FIIs) are among the biggest movers of the Indian stock market. Their buying or selling patterns often set the tone for market sentiment, liquidity, and long-term growth, making them vital to understanding how global money shapes India’s financial ecosystem.

Election Results Shock Markets: Does Asset Allocation Make Sense in Times Like These?

On 4th June 2024, the stock markets fell sharply in response to the election results. While the markets recovered over the next few sessions, days like these emphasise the importance building a diversified portfolio. In this article, we will discuss what is asset allocation, the types of asset classes and their role, and how having a diversified investment portfolio can give better risk-adjusted returns.

.png)