Rupee Falling in 2025? Here’s How to Protect and Grow Your Investments!

Imagine you had been saving to buy the new iPhone. A few months ago, the price was Rs.80,000, but now, since the rupee has fallen against the dollar, the price has soared to Rs.85,000. You’re paying more for the same product simply because the rupee has depreciated relative to the dollar. This is exactly what happens when the rupee weakens—it makes everything we import (such as fuel, electronics, and raw materials) costlier.

The Impact of a Falling Rupee on Investments

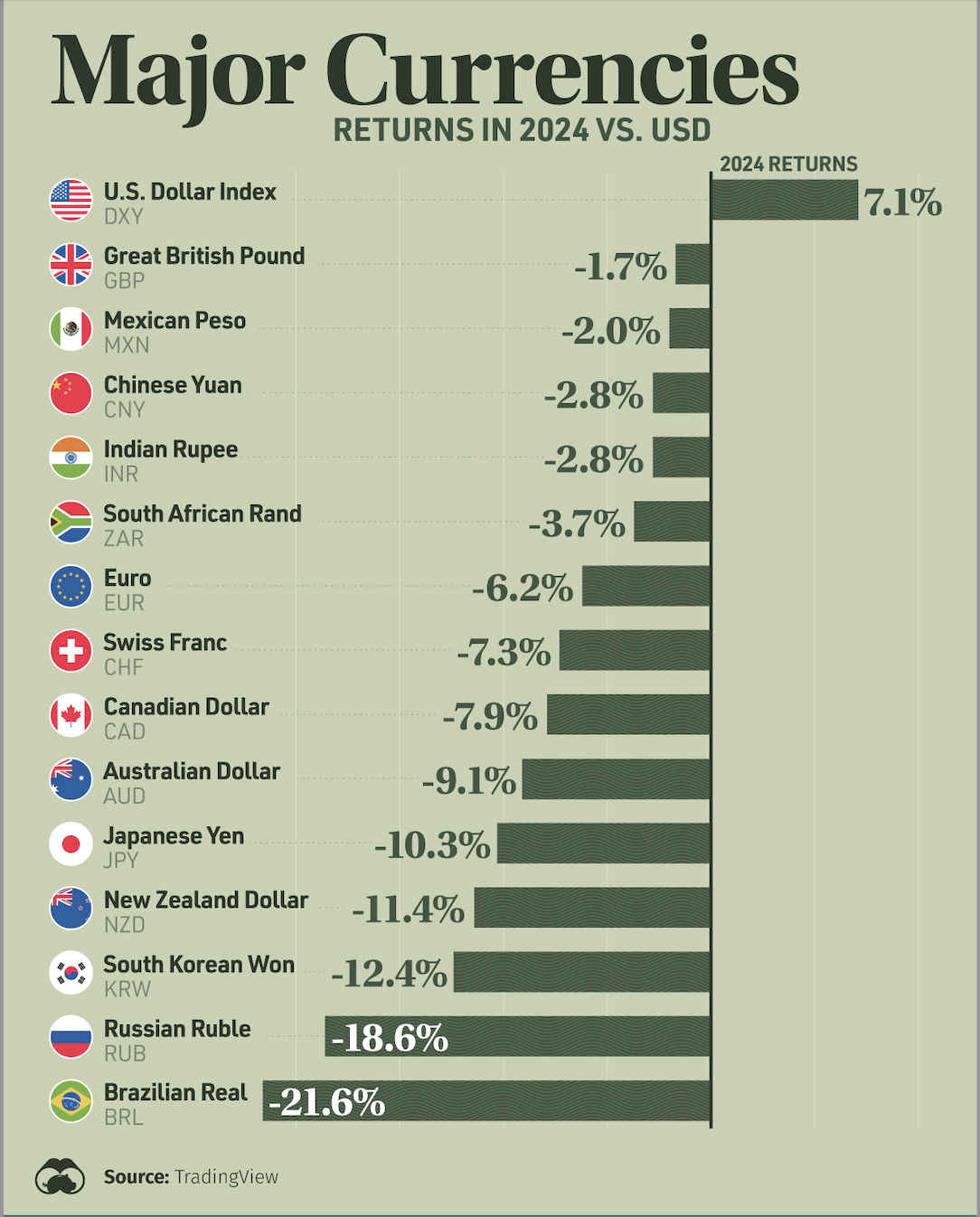

While the depreciation of the rupee has garnered significant attention, it remains among the best-performing major currencies globally, with most others depreciating more against the dollar. The Reserve Bank of India (RBI) has intervened with USD 77 billion, aligning with the Chinese Yuan, as both currencies have seen a 2.8% depreciation in 2024.

A falling rupee can:

-

Increase import costs, leading to inflationary pressures.

-

Impact corporate profitability and investor sentiment.

-

Cause foreign institutional investors (FIIs) to withdraw capital, as a weaker rupee erodes the value of their holdings.

Despite this, India’s strong macroeconomic fundamentals, domestic consumption-driven economy, and the ‘Make in India’ initiative create substantial long-term investment opportunities. With foreign reserves managed by the RBI and improving macroeconomic indicators, Indian markets continue to offer potential for growth.

Sectors That Benefit from a Weaker Rupee

Export-driven sectors such as IT and Pharmaceuticals are likely to benefit from a depreciating rupee as it increases their revenue in domestic currency.

For instance, if an Indian pharma company exports medicines to the U.S., they earn in dollars. When the rupee weakens, the same revenue converts into more rupees, boosting revenue and increasing profit margins.

However, challenges remain. The IT sector faces headwinds due to AI-driven disruptions. While these sectors may see short-term gains, other economic and sector-specific factors influence long-term performance.

A well-diversified portfolio is essential. Investors should avoid chasing short-term currency-driven trends and instead focus on investments that align with their financial goals and risk appetite.

Protecting Your Portfolio from Currency Volatility

Currency fluctuation is often overemphasized for most investors. Currency risk only becomes significant if a large portion of a portfolio is invested overseas. However, for those investing in India, the economy is a huge manufacturing hub, making it less dependant or imports, making it resilient to short-term rupee movements. Regardless of rupee depreciation, India remains one of the most promising investment destinations globally. According to a Jefferies report, India is poised to become the world’s third-largest economy in the next five years. It is the only major economy projected to grow above 7%, backed by strong fundamentals and a phenomenal domestic consumption story.

Indian equities provide also strong diversification and growth potential, supported by economic reforms and infrastructure development. Instead of investing based on short-term currency movements, focusing on India’s long-term economic potential is a more effective approach.

Hence, investing in domestic funds limits your exposure to risks like liquidity contraints, currency fluctuations and taxation which can impact returns negatively. Additionally, the key to facing challenges while investing is:

-

Maintain realistic expectations – Currency movements are only one factor affecting investments.

-

Avoid short-term speculation – Investing based on short-term rupee movements can lead to unnecessary risk.

-

Stay focused on financial goals – A disciplined, goal-based investment strategy helps mitigate market volatility.

Key Takeaways for Investors

-

Short-term currency fluctuations should not drive investment decisions. A disciplined, goal-based investment approach ensures long-term financial success.

-

A falling rupee impacts different sectors in different ways. While some industries face challenges due to higher import costs, export-driven sectors like IT and Pharmaceuticals may benefit.

-

India remains a strong investment destination. With solid economic fundamentals, high domestic consumption, and structural resilience, Indian markets continue to offer long-term growth potential.

-

Diversification and resilience are key. A well-balanced portfolio aligned with financial goals can help navigate economic fluctuations, including currency movements.

- Stay Goal Aligned. Focus on the investment process— a customized, process-oriented approach will help you overcome short-term volatility.

FAQs

1. Should I be bothered about the rupee depreciation?

For a long-term investor, the current cycle of Rupee depreciation should be treated like just another event in the long investing journey. Short-term currency fluctuations are a part of economic cycles and should not drive impulsive investment decisions. A goal-based, diversified investment strategy ensures that your investments remain on track despite any adverse movement of currency or change in economic sentiment.

2. If I am planning for my Retirement Goal due in 15 years, how does the rupee depreciation impact it?

Retirement is a very important goal and is usually long-term in nature. If the goal is 15 years away, one could witness multiple market cycles driven by macroeconomic or geo-political factors. The importance of an investing process that is personalized and takes into account risk factors based on the tenor of your goals becomes even more relevant.

3. How does the rupee depreciation affect my goal for my child's education abroad?

Rupee depreciation can make foreign education more expensive, but a strategic, goal-based approach can help you stay ahead. For example, if fees are $30,000 and the rupee depreciates from Rs.75 to 87 per dollar, the cost rises from Rs.22.5 lakh to Rs.26.1 lakh—an increase solely due to currency fluctuations. To mitigate the impact of such currency fluctuations, consider adopting a more aggressive investment strategy.

4. Can an investment expert help me see through the market cycle when the rupee is depreciating?

An investment advisor can help you navigate through market cycles and help you focus on your long-term goal achievement rather than taking impulsive decisions. They also ensure that your investment behaviour is on track, by avoiding greed and fear based investment decisions. A disciplined, process-driven approach will prevent short-term currency related volatility from derailing a long-term financial plan. You can, with expert guidance - maintain a resilient portfolio and stay aligned with financial goals.

Your Investing Experts

Relevant Articles

Income Tax Changes in Budget 2025 & RBI's Rate Cut: A Boost for Growth & Investments

Lower taxes, cheaper loans, and a push for private sector growth—how the latest Union Budget and RBI’s rate cut are shaping India’s economic future.

How Understanding Risk Is Critical While Investing and Ways to Mitigate Risk in Investing

When it comes to investing, the risk involved and the potential reward go hand in hand. The higher the risk involved, the higher the reward expectation. However, can the risk be reduced or mitigated while keeping the reward potential still high? The answer is yes. In this article, we will understand what risk is, why understanding it is critical, and ways of mitigating it.

Budget 2024: What to Expect – Tax Exemptions, Deductions, Change in Slabs or Status Quo?

With the new Government in place and the continuation of Nirmala Sitharaman as the Finance Minister, the Union Budget is expected to be presented in July 2024. The expectations from the Finance Minister are running high from all sections of taxpayers. In this article, we will look at what can a common man expect from the budget.