Gold Prices Have Hit an All-Time High: What Is Driving the Rally, and Should You Invest?

The financial year 2023-24 was one of those rare years when most asset classes did well. Equities gave good double-digit returns. The interest rates on many fixed-income products, like bank fixed deposits, corporate bonds, etc., were at multi-year highs. Gold also did well on the back of high inflation, geopolitical instability, etc.

In FY 2024-25, gold has made a strong start by hitting all time high multiple times in April. In this article, we will understand what is driving the rally in gold and whether and how you should invest in it.

How Has Gold Performed as an Asset Class?

In FY 2023-24, gold gave good returns of 12.47%. Gold started FY 2024-25 on a solid note. In April 2024, gold prices hit all-time highs on multiple occasions. The gold prices crossed Rs. 70,000 per tola. Gold has given good double-digit returns in the first four months of the calendar year.

Let us see how it has fared in the long term and compare its returns with the Nifty 50.

|

Time Horizon |

Nifty 50 returns |

Gold returns |

|

5 years |

13.95% |

16.21% |

|

10 years |

12.78% |

8.88% |

|

20 years |

12.72% |

11.96% |

(Source: Moneycontrol)

The table above shows that gold has outperformed the Nifty 50 Index in the last five years with superior returns of 16.21% CAGR. However, over a 10-year period, gold returns have lagged the Nifty 50 Index returns. Over the long period of 20 years, there is not much of a difference between gold and Nifty 50 with the latter slightly outperforming. Even though lower than the Nifty 50 Index, over the last 20 years, gold has given good returns of 11.96% CAGR.

What Are the Factors Behind the Gold Price Rise?

In the earlier section, we saw how gold has given good returns of 12.47% in FY 2023-24 and how the prices hit all-time highs multiple times in April 2024. Let us look at some of the factors behind the recent run-up in gold prices.

1) Geopolitical Wars

Currently, two wars are going on. The Russia-Ukraine war started in February 2022 and is still raging on. The Hamas-Israel war began in October 2023. It is threatening to get into a wider conflict with countries like Iran getting involved. The war has also disrupted global trade that passes through the Red Sea.

All the above events have led to a lot of uncertainty. During such times, gold acts as a safe haven against uncertainty. During these times, gold has done well by giving good returns: 16.06% in FY 2022-23 and 12.47% in 2023-24 (Source: Moneycontrol).

2) Central Bank Buying

In February 2024, when Russia attacked Ukraine, as part of sanctions, the US and its allies decided to freeze Russia’s foreign reserves. It was an unprecedented move and created a lot of anxiety among several central banks. Hence, they decided to diversify their foreign reserves among other currencies and gold.

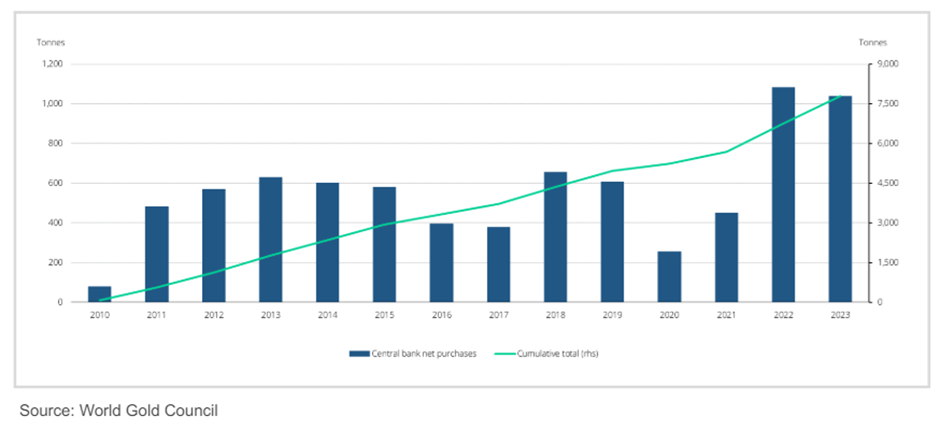

Since then, many central banks have bought a lot of gold. In calendar years 2022 and 2023, two years in a row, central banks bought more than 1,000 tonnes of gold.

(Source: Carpe Diem (May 2024) report from ASK Private Wealth)

The chart above shows how the central banks' gold buying has increased in the last two years. Amongst global central banks, the Chinese central bank has been the biggest buyer of gold in the last couple of years. In 2023, the Chinese central bank bought 225 tonnes of gold, contributing to more than 20% of the gold bought by all central banks globally.

The continuous buying by global central banks has contributed to the up move in gold prices in the recent past.

3) High Inflation

Throughout 2023, inflation across the globe was trending down on the back of high interest rates maintained by central banks. However, in 2024, the inflation downward trend has either stagnated or slightly reversed.

For example, in the US, the CPI inflation has increased month-on-month in the last three months. In January 2024, the inflation rate was 3.09%. In February, it increased to 3.15%; in March, it further increased to 3.48%.

A high inflation rate augurs well for gold prices. It can be seen in the rise in gold prices in the last few months.

How Much Gold Should You Add?

The percentage allocation of gold to your investment portfolio depends on factors like age, risk profile, financial goals, investment time horizon, etc. You may consider making a 5 to 15% portfolio allocation to gold. If you have a specific goal, like accumulating gold for your child's wedding, decide the quantity you want to accumulate and start a SIP in a gold mutual fund.

Ways of Investing in Gold

Now that you understand why and how much you should invest in gold, let us look at the ways of investing in gold. Some of these include the following.

1) Gold Bullion and Jewellery

With physical gold, you can accumulate gold coins and bars for investment purpose. If you need gold for consumption purposes, jewellery is the way to go. However, physical gold is not the best way to invest in gold as it involves making charges. It also involves locker charges for keeping it safe, and insurance charges for protection against theft, damage, etc.

2) Gold ETFs

You may consider gold exchange-traded funds (ETFs) for buying gold in electronic format. Mutual funds offer gold ETFs, with the minimum investment amount being one unit, usually equivalent to one gram of gold. The gold ETF units are listed on a stock exchange like NSE.

The buying and selling of gold ETF units is done through the trading and demat account provided by a stock broker. With gold ETFs, liquidity can be a challenge. Also, you need to consider the demat account opening and AMC charges, brokerage fees, depository charges, and other levies. There is no SIP option with gold ETFs.

3) Gold Mutual Funds

Gold mutual funds solve the SIP and liquidity challenge seen in gold ETFs. You can buy and redeem the gold MF units with the AMC at any time. For a long-term financial goal, like accumulating gold for a child’s wedding, you can start a SIP in a gold mutual fund. With a fixed amount monthly SIP, you can accumulate fractional units.

4) Sovereign Gold Bonds (SGBs)

Sovereign gold bonds (SGBs) are government securities denominated in grams of gold. The RBI issues them on behalf of the Government of India. The bonds track the price of gold. The RBI comes out with the subscription dates regularly. The investors can subscribe when the issue is open.

The minimum subscription is one gram of gold, and the bond tenure is eight years. The bond pays a 2.5% interest rate per annum. The interest amount is taxable at the individual's slab rate. On maturity, the bonds can be redeemed with the RBI. The maturity proceeds are exempt from capital gains tax.

Add Sparkle to Your Portfolio With Gold

You should diversify your investment portfolio with equity mutual funds, fixed income, gold, etc. Various asset classes take turns to outperform each other every year. When your portfolio has different asset classes, you can earn better risk-adjusted returns. With wars, high inflation, geopolitical uncertainty, central bank buying, etc., gold is expected to do well in future. Thus, by adding gold, you can sparkle to your portfolio.

Your Investing Experts

Relevant Articles

Difference Between Sensex and Nifty: A Simple, Clear Explanation

When people talk about the Indian stock market, two names appear everywhere: Sensex and Nifty. They are the most widely tracked market indices in the country. Yet many investors still look for a clear explanation of the Sensex and Nifty difference, how each is calculated, and what companies form part of these indices.

Election Results Shock Markets: Does Asset Allocation Make Sense in Times Like These?

On 4th June 2024, the stock markets fell sharply in response to the election results. While the markets recovered over the next few sessions, days like these emphasise the importance building a diversified portfolio. In this article, we will discuss what is asset allocation, the types of asset classes and their role, and how having a diversified investment portfolio can give better risk-adjusted returns.

Gold Prices Have Hit an All-Time High: What Is Driving the Rally, and Should You Invest?

The financial year 2023-24 was one of those rare years when most asset classes did well. Equities gave good double-digit returns. The interest rates on many fixed-income products, like bank fixed deposits, corporate bonds, etc., were at multi-year highs. Gold also did well on the back of high inflation, geopolitical instability, etc.