The Microcap Index Was the Best-Performing Index in 2023-24: Should You Invest in It?

In FY 2023-24, the Nifty Microcap 250 Index gave a whopping 85.12% returns. It was the best-performing index in FY 2023-24 amongst broad market capitalisation indices. In this article, we will understand what is Nifty Microcap 250, how it has performed, how much you should allocate to it, and how to invest in it.

What Is the Nifty Microcap 250 Index?

Microcaps are stocks beyond the large (top 100 stocks), mid (150 stocks), and smallcap (250 stocks) stocks in terms of market capitalisation. The Nifty Microcap 250 Index comprises 250 microcap stocks ranked 501 to 750 in terms of market capitalisation. Due to their small size (base), they have the potential to grow their sales and profits faster than big companies. As a result, their share prices have the potential to rise faster than big companies, making them an ideal choice for those exploring a microcap index fund.

However, due to their small size, these companies can be more volatile and illiquid compared to large companies. They are also prone to manipulation by operators. While they can rise faster than big companies in a bull market, they can fall harder than big companies in a bear market. However, the Nifty Microcap 250 Index CAGR reflects their potential for high returns over time. Hence, microcaps fall in the high-risk – high-return potential category. They are meant for investors with an aggressive risk profile.

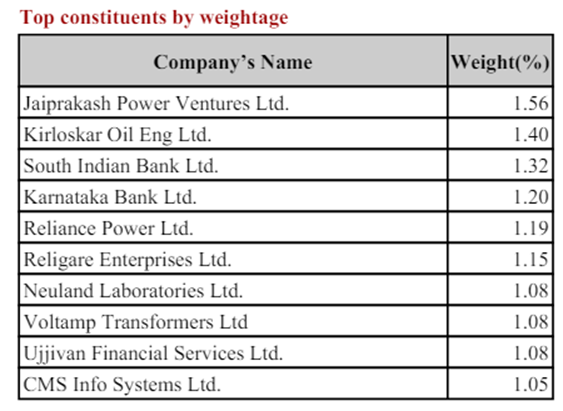

Table: Nifty Microcap 250 Index – Top 10 Constituents by Weightage

(Source: NIftyindices)

Note: The above data is as of 30th April 2024

The above table shows, the highest constituent has a weightage of only 1.56%. In comparison, HDFC Bank, the biggest stock in the Nifty 50, has a weightage of 11.48%. The top 10 constituents of the Nifty Microcap 250 Index have a total weightage of only 12.11%. In comparison, the top 10 constituents of the Nifty 50 Index have a total weightage of 56.63%.

Thus, the microcap index is well-diversified, with 250 constituents compared to the Nifty's 50 constituents. Also, the weightages to individual constituents are well spread out, making it suitable for investors exploring a microcap index fund.

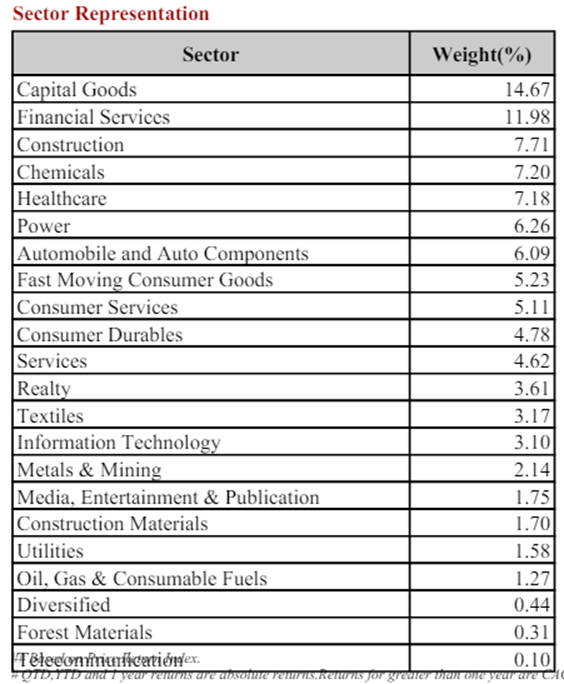

Table: Nifty Microcap 250 Index – Sectoral Representation

(Source: Niftyindices)

Note: The above data is as of 30th April 2024

The above table shows that the Nifty Microcap 250 Index has companies from 22 sectors. In comparison, the Nifty 50 has companies from only 13 sectors. Thus, the Nifty Microcap 250 Index has wide representation from most sectors of the economy.

Nifty Microcap 250 Index Performance

As discussed at the start of the article, the Nifty Microcap 250 Index has been the best performer in FY 2023-24, with a staggering 85.12% return.

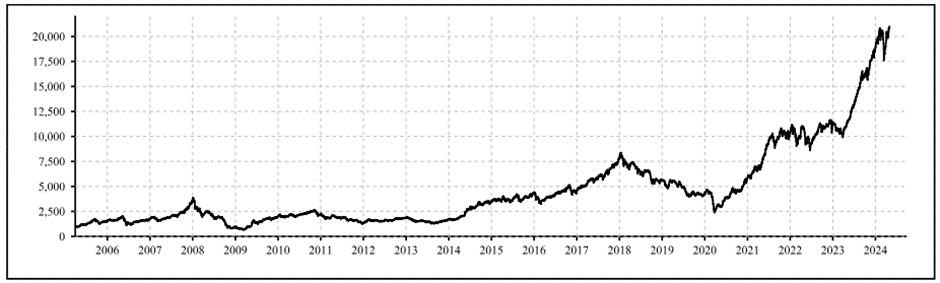

Chart: Nifty Microcap 250 Index Performance

(Source: NIftyindices)

The Nifty Microcap 250 Index has a base date of 1st April 2005 and a base value of 1,000. As of 2nd May 2024, the index is trading at levels of 21,020. In 19 years, the index has multiplied investor wealth by a whopping 21 times, reflecting a Nifty Microcap 250 Index CAGR of 17.38%.

Let us now compare the performance of the Nifty Microcap 250 Index with the other major indices.

|

Index |

1 year |

5 years |

Since inception |

|

Nifty 50 |

25.13% |

13.98% |

11.56% |

|

Nifty Next 50 |

64.25% |

18.48% |

16.38% |

|

Nifty Midcap 150 |

58.19% |

24.59% |

16.64% |

|

Nifty Smallcap 250 |

68.57% |

24.34% |

15.57% |

|

Nifty Microcap 250 |

86.82% |

31.62% |

17.28% |

(Source: Niftyindices)

Note: The above returns are as of 30th April 2024.

The above table shows the Nifty Microcap 250 Index has delivered superior returns of 17.28% CAGR over a 5-year horizon compared to other broad market capitalisation indices.

Who Should Invest in Microcap Index Fund?

Microcaps, a high-risk – high-return potential category, are meant for investors with an aggressive risk profile. While they have the potential to give superior returns during good times, they can experience deep drawdowns during corrections. Also, the time to recovery may be higher than largecaps.

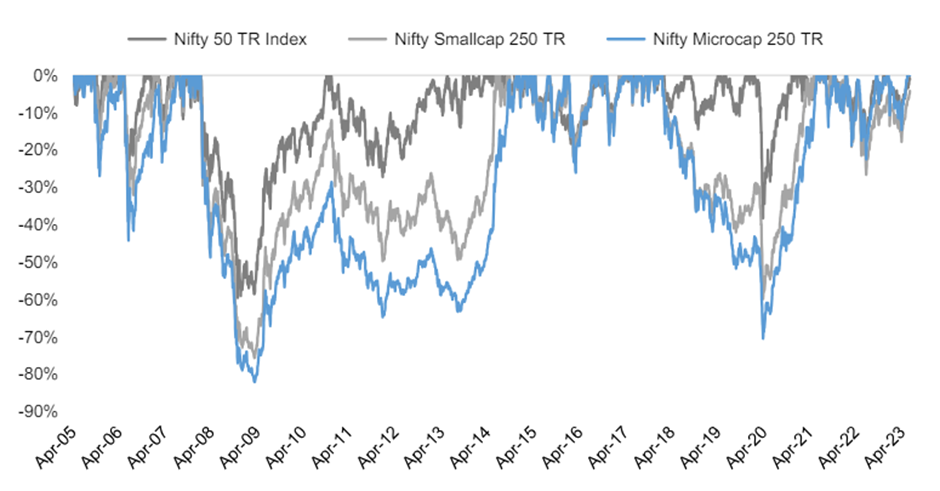

Chart: Nifty Microcap 250 Index Drawdowns

(Source: Motilal Oswal AMC)

The above chart shows the Nifty Microcap 250 Index has deeper drawdowns during an overall stock market correction. Also, the Nifty Microcap 250 Index drawdowns last longer than other indices.

If your investment time horizon is higher than seven years, you may allocate a small percentage of your overall equity portfolio to micro-caps. Usually, financial goals like building a fund for a child's higher education and marriage and retirement for self and spouse have a long investment horizon. So, you may allocate some money towards microcaps along with other equity funds for these goals.

How to Invest in Microcap Index Fund?

As of 2nd May 2024, one AMC is offering an index fund on the Nifty Microcap 250 Index. Other AMCs provide some exposure to microcaps through their other equity schemes like flexicap, multicap, and smallcap schemes.

Give a Boost to Your Portfolio With Microcaps

We have seen how the microcap index has outperformed the other broad market indices. However, based on the recent outperformance, you need not go overboard on microcaps. You may allocate some portion of your equity portfolio to microcaps. In the long run, microcaps can boost your portfolio returns and help you reach your financial goals faster than planned.

Your Investing Experts

Relevant Articles

Difference Between Sensex and Nifty: A Simple, Clear Explanation

When people talk about the Indian stock market, two names appear everywhere: Sensex and Nifty. They are the most widely tracked market indices in the country. Yet many investors still look for a clear explanation of the Sensex and Nifty difference, how each is calculated, and what companies form part of these indices.

Understanding Foreign Institutional Investors (FIIs) and Their Role in the Indian Stock Market

Foreign Institutional Investors (FIIs) are among the biggest movers of the Indian stock market. Their buying or selling patterns often set the tone for market sentiment, liquidity, and long-term growth, making them vital to understanding how global money shapes India’s financial ecosystem.

Election Results Shock Markets: Does Asset Allocation Make Sense in Times Like These?

On 4th June 2024, the stock markets fell sharply in response to the election results. While the markets recovered over the next few sessions, days like these emphasise the importance building a diversified portfolio. In this article, we will discuss what is asset allocation, the types of asset classes and their role, and how having a diversified investment portfolio can give better risk-adjusted returns.

.png)