Nifty PSU stocks Rose More than 100% Last Year: Should You Invest?

The Nifty PSE Index gave an eye-popping 113.39% return (as of 30th April 2024) in the last one year. With this kind of performance, the index has grabbed the attention of investors. Many of them are looking to invest in it. In this article, we will explore the Nifty PSE Index, its constituents and the sectors they are spread across, its returns, who should invest and how much.

What Is the Nifty PSE Index?

The Nifty PSE Index comprises 20 Public Sector Enterprises (PSEs) listed on the National Stock Exchange (NSE). In these companies, the Central Government or State Government holds 51% or more of the company’s outstanding share capital, directly or indirectly.

The top ten companies by weightage include the following.

|

Company Name |

Weight |

|

NTPC Ltd. |

13.89% |

|

Power Grid Corporation of India Ltd (PGCIL) |

11.07% |

|

Oil & Natural Gas Corporation Ltd (ONGC) |

8.88% |

|

Coal India Ltd. |

8.34% |

|

Bharat Electronics Ltd. |

6.74% |

|

Hindustan Aeronautics Ltd. |

5.94% |

|

Power Finance Corporation Ltd. |

5.16% |

|

REC Ltd. |

5.05% |

|

Indian Oil Corporation Ltd. |

4.99% |

|

Bharat Petroleum Corporation Ltd. |

4.67% |

(Source: Niftyindices)

Note: The above data is as of 30th April 2024.

Does the Index Provide Diversification?

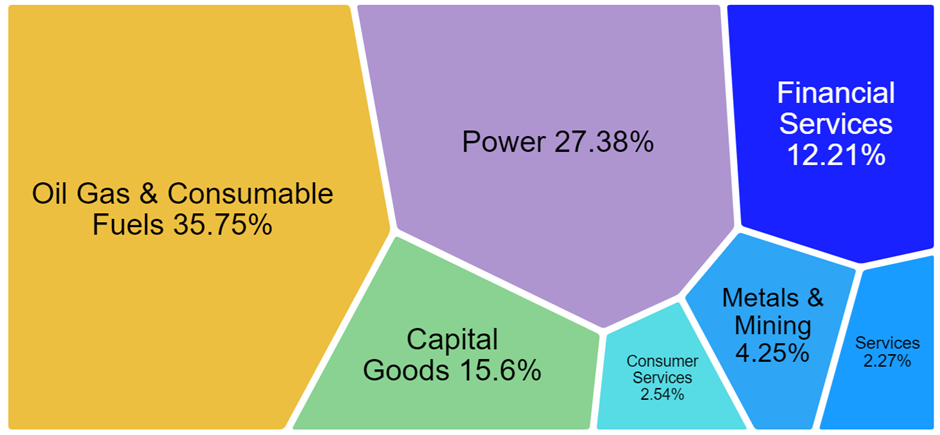

The index has a well-diversified portfolio of 20 companies spread across seven sectors.

(Source: Niftyindices)

Note: The above data is as of 30th April 2024

Performance of the Nifty PSE Index

Now that we understand the Nifty PSE Index, its constituents, and sectoral spread, let us look at the performance of the Nifty PSE Index. Let us look at the returns and compare it with other indices.

|

Index |

1-Year |

3-Year |

5-Year |

10-Year |

|

Nifty PSE Index |

107.9% |

47.6% |

24.4% |

16.2% |

|

Nifty 50 Index |

30.1% |

16.3% |

15.3% |

14.2% |

|

Nifty 100 Index |

34.8% |

17.0% |

15.5% |

14.7% |

|

Nifty 500 Index |

40.5% |

19.3% |

17.2% |

15.8% |

(Source: Aditya Birla Sun Life Nifty PSE ETF presentation)

Note: The above data is as of March 2024

As seen in the above table, the Nifty PSE Index has outperformed the other indices like the Nifty 50, Nifty 100, and the Nifty 500 by a decent margin in the 1, 3, and 5-year returns category. In the 10-year category, the index has outperformed, but with a low margin.

How Is the Index Expected to Perform in Future?

The future performance of the index will depend on the performance of its constituents. Let us discuss some of them.

1) NTPC Ltd.

NTPC Ltd. has the highest weightage of 13.89% in the Nifty PSE Index. NTPC is India's largest power-generating company. Its thermal power business is doing well and expanding. It has a total installed capacity of 75 GW as of March 2024. The company has embarked on a massive expansion plan to add 60 GW of renewable energy capacity by 2032. If the company executes the expansion plan well, it will do well in revenues and profits and create wealth for its shareholders.

2) Power Grid Corporation of India Ltd.

As we saw in the earlier section, just like NTPC, many other power producers are working on adding thermal and massive renewable energy capacity. India aims to add 500 GW of renewable energy installed capacity by 2030. All this massive power capacity generated will have to be transmitted from power plants to customers, which is done by Power Grid Corporation of India Ltd. (PGCIL).

PGCIL, India's largest power transmission company, transmitting 45% of India's power, has the second highest weightage of 11.07% in the Nifty PSE Index. PGCIL is expected to spend a massive Rs. 1.90 lakh crores on the power transmission business by 2032. If the company executes the business plan well, it will do well in revenues and profits and create wealth for its shareholders.

3) Defence Companies

The PSE Nifty Index has defence companies like Bharat Electronics Ltd. (6.74% weightage) and Hindustan Aeronautics Ltd. (5.94% weightage) among the top ten constituents. The Government has a huge focus on strengthening India’s defence sector. The Finance Minister allocated Rs. 6.21 lakh crores to the defence sector in Budget 2024.

As a result, companies like Bharat Electronics Ltd. (BEL) and Hindustan Aeronautics Ltd. (HAL) are regularly getting huge orders from the Government and the Armed Forces. As of 1st April 2024, BEL is sitting on an order book of Rs. 76,000 crores, out of which orders worth Rs. 35,000 crores were secured in FY 2023-24.

Similarly, HAL is sitting on an order book of Rs. 94,000 crores as of 31st March 2024. Besides the huge current order book, HAL and BEL are regularly getting new orders. Their deal pipeline is robust.

Thus, these companies have visibility for the next few years. As they execute the current order book, it will translate into revenues and profits and create wealth for their shareholders.

4) Other Companies

Apart from the above companies, the Nifty PSE Index has other companies that are either leaders or among the top companies in their industry. For example, ONGC is India's largest oil-producing company, Coal India is India's largest coal-producing company, LIC is India's largest life insurance company, and IRCTC is the largest railway ticketing company.

HPCL, BPCL, and IOC, which are a part of the Nifty PSE Index, control a major share of India’s oil refining and marketing market.

Most companies that are a part of the Nifty PSE Index either have huge expansion plans or order book visibility for the next few years or are the largest/among the top companies in their industry with moats. These companies are expected to do well in the future. As a result, the Nifty PSE Index is expected to do well in the future.

Who Should Invest in the Nifty PSE Index?

The Nifty PSE Index, an equity index, is suitable for investors with an aggressive risk profile. You should invest through the SIP mode for the long term to benefit from the power of compounding and create wealth for yourself.

How Much Should You Invest in the Nifty PSE Index?

The Nifty PSE Index is categorised as a sectoral/thematic index. Hence, it is cyclical in nature and subject to economic/business cycles. Hence, you should limit your total exposure to this index and other sectoral/thematic indices to 5-10% of the overall portfolio.

You should first invest in large, mid, small, and flexi-cap funds as part of your equity allocation. Once you are done investing in broad market capitalisation equity funds, you may allocate a small portion of your portfolio to sectoral/thematic funds. Investment in the Nifty PSE Index may be a part of this small allocation.

Your Investing Experts

Relevant Articles

Rupee Falling in 2025? Here’s How to Protect and Grow Your Investments!

Imagine you had been saving to buy the new iPhone. A few months ago, the price was Rs.80,000, but now, since the rupee has fallen against the dollar, the price has soared to Rs.85,000. You’re paying more for the same product simply because the rupee has depreciated relative to the dollar. This is exactly what happens when the rupee weakens—it makes everything we import (such as fuel, electronics, and raw materials) costlier.

Income Tax Changes in Budget 2025 & RBI's Rate Cut: A Boost for Growth & Investments

Lower taxes, cheaper loans, and a push for private sector growth—how the latest Union Budget and RBI’s rate cut are shaping India’s economic future.

How Understanding Risk Is Critical While Investing and Ways to Mitigate Risk in Investing

When it comes to investing, the risk involved and the potential reward go hand in hand. The higher the risk involved, the higher the reward expectation. However, can the risk be reduced or mitigated while keeping the reward potential still high? The answer is yes. In this article, we will understand what risk is, why understanding it is critical, and ways of mitigating it.