How are Mutual Fund Returns Calculated?

We invest in financial products to achieve our financial goals. Based on factors like how much we want to invest, for how long, and the target amount, it is the expected returns that help us understand whether we can achieve our goal. The returns can be measured using different ways like absolute returns, compounded annual growth rate (CAGR), etc. In this article, we will understand what is absolute return, CAGR, how they are calculated, and which one you should use.

What Is Absolute Return?

Absolute return measures the total return, i.e. profit or loss made on an investment. For example, you invest Rs. 10,000 at a net asset value (NAV) of Rs. 10 in a mutual fund scheme. You get Rs. 15,000 at an NAV of Rs. 15 on redemption. In this case, you made a gain of Rs. 5,000 on your original investment of Rs. 10,000. So, that is a 50% absolute return on your investment.

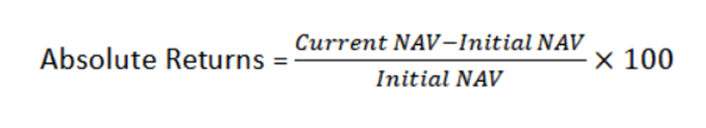

The formula for calculating the absolute return is as follows.

Let us apply the above formula to the earlier discussed example.

Current NAV (Rs. 15) – Initial NAV (Rs. 10) = Rs. 5

Rs. 5 / Initial NAV (Rs. 10) = 0.5

0.5 X 100 = 50%

Thus, the absolute return will be 50%.

Let us understand the concept of absolute return with the practical example of the Nifty 50 Index performance. The Nifty 50 Index started with a base value of 1,000. As of 13th September 2024, the index is trading above 25,000 levels.

The index has gained 24,000 points over the initial value of 1,000 points. Thus, the absolute gain will be 2400% (24000/1000) X 100. It is a huge return.

However, the absolute return doesn’t consider two important points:

- The investment time horizon

- Compounding

All financial goals have to be achieved in a specific timeline. Hence, when you measure the investment returns, you should consider the investment time horizon. Also, compounding is essential as it helps you earn returns on earlier returns. Both the parameters of investment time horizon and compounding are considered for calculating returns using the CAGR method.

What Is CAGR?

The term CAGR stands for compounded annual growth rate. The CAGR measures the annual growth rate of an investment over a specified period. CAGR is also referred to us annualised return. Over a longer-term investment horizon, there may be some years when equity mutual funds may give negative returns and some years when they may give extraordinary returns. However, CAGR evens out these fluctuations in returns over time.

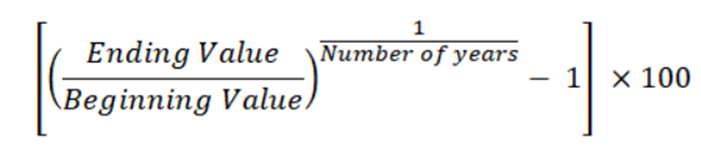

The formula for calculating CAGR is as follows:

The CAGR method of calculating returns has some benefits over the absolute returns method. Some of these include smoothening out volatility and comparing returns across different time periods.

Differences Between Absolute Returns and CAGR

Some of the differences between the absolute returns and CAGR include the following.

|

Absolute returns |

Compounded Annual Growth Rate (CAGR) |

|

It shows the total gain or loss made in an investment without considering the investment time horizon. |

It shows the annualised gain made in an investment during a specified time horizon. |

|

It is useful to calculate returns for investments spanning multiple years. |

It is useful to calculate returns for investments with a tenure of up to one year. |

|

It cannot be used to compare the annualised returns of two or multiple investment products. |

It can be used to compare the annualised returns of two or multiple investment products. For example, comparing the annualised returns of a large-cap active fund with other large-cap active funds or the benchmark Nifty 50 Index. |

|

It is simple to calculate and easy to understand. |

It is a bit complex to calculate. However, you need not calculate it manually as there are online calculators available where you need to input the parameters, and you get the CAGR. |

|

As it doesn’t consider the investment time horizon, it just shows the overall gain or loss. |

It evens out the big falls and rises and presents the annualised growth rate over a period of time. Evening out is important for considering the long-term returns of a volatile asset class like equities. |

The Impact of Time on Returns and Financial Goals

With long-term financial goals like accumulating money for a child’s higher education or own retirement, the investment time horizon plays a significant role. In equity mutual funds and other asset classes, compounding works better in the long run. Hence, the longer the investment time horizon, the better the compounding, and the higher the amount you will accumulate.

For example, assume you invest Rs. 1 lakh in an equity mutual fund. If the money grows at:

- 15% CAGR for three years, the amount accumulated will be Rs. 1,52,087

- 13% CAGR for five years, the amount accumulated will be Rs. 1,84,243

The above table shows, in the second instance, the money grows at a lower CAGR of 13% than the earlier 15%. However, the amount accumulated in the second instance is still higher at Rs. 1.84 lakhs than the earlier Rs. 1.52 lakhs. It is because, in the second instance, the investment time horizon of five years is higher than the earlier three years.

Thus, the longer the investment time horizon, the better the compounding (even if at a lower rate) and the higher the amount accumulated. Hence, for long-term financial goals, you should invest in equity mutual funds. It gives your money time to grow and benefit from the power of compounding and create wealth for you.

CAGR vs Absolute Returns: Which Metric Should You Use?

Whether you should use CAGR or absolute returns depends on the investment time horizon. For investments with a tenure of up to one year, absolute return should be used. For investments with a tenure of more than one year, CAGR is a better method. CAGR is also a better method to evaluate whether your investments are growing faster than the annual inflation rate and delivering the expected rate of growth required to accomplish your financial goals.

Finally, you should work with an investment expert who can help you identify your financial goals, make a goal plan to achieve them, recommend the appropriate mutual funds that can deliver the expected CAGR, review the progress of goals, and handhold you till the financial goals are achieved. Along with working with an investment expert, you should do your own research and keep yourself updated with the personal finance industry.

Your Investing Experts

Relevant Articles

When Is the Right Time to Start Investing for Your Goals?

When is the right time to start investing for your goals? Many believe the answer depends on market stability, income comfort, or economic certainty. In reality, the right time is when your goals are clear and you are prepared to act with discipline. Wealth is rarely created by waiting. It is built through consistent participation guided by a defined investment process.

How to Adjust Your Investments After a Salary Raise

A salary hike is more than a pay revision, it is an opportunity to realign your financial direction. The smartest response to higher income is not immediate lifestyle expansion, but a structured review of your goals, debt position, and investment contributions. When handled thoughtfully, each raise can accelerate wealth creation rather than simply increase monthly expenses.

Why Mid-Cap Allocation Needs More Discipline Than Large Cap

Mid-cap allocation demands more discipline than large cap because it comes with sharper market swings. While mid caps offer higher long-term growth potential, they also test investor patience during downturns. The key is not choosing one over the other, but understanding how each behaves across market cycles.

.png)