Understanding the Difference Between Multicap and Flexicap Funds

When it comes to equity mutual funds, investors often come across a variety of fund categories tailored to meet different investment objectives. Two categories that frequently cause confusion are Multicap Funds and Flexicap Funds. While both invest across market capitalizations (large-cap, mid-cap, and small-cap stocks), they differ significantly in their investment approach and mandates. Understanding these differences is crucial for making informed investment decisions.

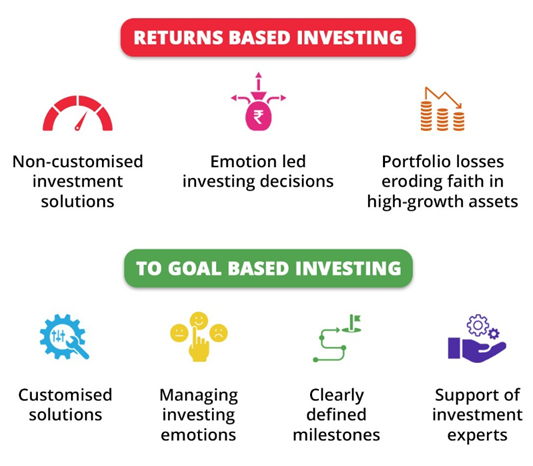

The Importance of Goal-Based Investing

Before diving into the choice between multicap and flexicap funds, it is essential to understand the significance of goal-based investing. Investing without clear goals is like setting sail without a destination. Your financial goals—whether it’s buying a house, funding your child’s education, or building a retirement corpus—should drive your investment strategy.

Goal-based investing ensures:

1. Clarity and Focus: Clearly defined goals help you choose investment instruments aligned with your financial needs and timelines.

2. Disciplined Approach: Goals encourage consistent investing and help you stay committed during market fluctuations.

3. Measurable Progress: With specific targets in mind, you can periodically evaluate your progress and make necessary adjustments.

Why an Investing Process Matters

An effective investing process is critical to achieving your financial objectives. It ensures that your portfolio is structured thoughtfully, taking into account your risk tolerance, time horizon, and financial aspirations.

A well-defined process includes:

• Assessing Risk Appetite: Understanding your comfort with market volatility and aligning investments accordingly.

• Asset Allocation: Diversifying across asset classes to optimize risk and return.

• Regular Reviews: Monitoring your portfolio to ensure alignment with your goals and market dynamics.

By following a structured investment process, you can make informed decisions about fund categories like multicap and flexicap, ensuring they complement your overall financial strategy.

What Are Multicap Funds?

Multicap funds are diversified equity mutual funds that are mandated to invest across large-cap, mid-cap, and small-cap stocks. According to SEBI’s categorization, multicap funds must allocate a minimum of 25% each to large-cap, mid-cap, and small-cap stocks at all times. This allocation structure ensures a balanced exposure to all market capitalizations.

Key Features of Multicap Funds:

• Mandated Allocation: The predefined allocation reduces the fund manager's discretion in altering the portfolio mix based on market conditions.

• Balanced Exposure: Investors get a blend of stability from large-cap stocks, growth potential from mid-cap stocks, and high-return opportunities from small-cap stocks.

• Risk-Return Profile: Multicap funds carry a moderate to high-risk profile depending on the market environment, making them suitable for investors with a long-term horizon and a moderate to high-risk appetite.

What Are Flexicap Funds?

Flexicap funds are also diversified equity mutual funds but with no fixed allocation mandate. Fund managers have the flexibility to dynamically allocate investments across large-cap, mid-cap, and small-cap stocks based on prevailing market conditions, valuation opportunities, and economic scenarios.

Key Features of Flexicap Funds:

• Flexible Allocation: Fund managers can increase or decrease exposure to any market capitalization segment as they deem fit.

• Dynamic Strategy: The flexibility allows the fund to adapt to changing market trends, potentially reducing downside risks and enhancing returns.

• Risk-Return Profile: Flexicap funds also carry a moderate to high-risk profile but can adapt more effectively to market fluctuations, making them ideal for investors seeking dynamic portfolio management.

Multicap vs. Flexicap: A Comparative Analysis

|

Feature |

Multicap Funds |

Flexicap Funds |

|

Allocation Mandate |

Fixed: Minimum 25% each in large-cap, mid-cap, and small-cap stocks |

No fixed allocation; dynamic allocation across market capitalizations |

|

Fund Manager Discretion |

Limited due to SEBI’s allocation rules |

High; full discretion to allocate as per market conditions |

|

Portfolio Stability |

Relatively stable due to predefined allocation |

Highly dynamic, changes with market trends |

|

Best Suited For |

Investors seeking balanced exposure to all market caps |

Investors looking for dynamic exposure and flexibility |

How to Choose Between the Two?

The choice between multicap and flexicap funds depends on your investment objectives, risk appetite, and market outlook:

1. Risk Tolerance: If you prefer a structured exposure with limited surprises, multicap funds may suit you better. If you’re comfortable with dynamic shifts in allocation, flexicap funds are a good fit.

2. Investment Horizon: Both funds are ideal for long-term investors, but flexicap funds may better capitalize on market cycles.

3. Market Conditions: In a highly volatile market, the flexibility of flexicap funds may help mitigate risks. Conversely, the structured approach of multicap funds ensures a balanced exposure.

Conclusion

Both multicap and flexicap funds offer diversification and long-term growth potential. However, their distinct allocation strategies cater to different investor preferences. Multicap funds’ predefined structure ensures balanced exposure, while flexicap funds’ adaptability allows fund managers to respond dynamically to market changes. By focusing on your financial goals and following a structured investing process, you can choose the category that aligns with your portfolio needs. For personalized investment advice, consider consulting an investment expert like FinEdge to achieve your financial goals effectively.

Your Investing Experts

Relevant Articles

How To Select The Best Mutual Funds For Long Term Goals

Mutual funds offer a compelling way to invest for long-term goals, leveraging professional management and diversification to potentially achieve significant returns. But with a vast array of options available, selecting the best mutual funds for the long term can feel daunting. This guide will equip you with the knowledge to confidently navigate the mutual fund landscape and learn how to select the best mutual fund aligned with your long-term aspirations.

Should You Continue Your SIP in Small Cap Mutual Funds

Investing in small cap funds requires patience and discipline, especially during market corrections. By staying committed to your SIPs and focusing on long-term goals, you can leverage the power of rupee cost averaging and compounding. Don’t let short-term market noise dictate your strategy—remain focused, stay the course, and trust that your disciplined approach will yield results over time.

Systematic Withdrawal Plans (SWP): A Reliable Way to Generate Regular Income

An SWP allows investors to withdraw a predetermined amount from their mutual fund investments at regular intervals, such as monthly, quarterly or annually. The beauty of SWPs lies in their flexibility—they provide consistent income while allowing the remaining investment to continue growing.

.png)

_(2).jpg)