Should You Shift Every Year to Last Year’s Best-Performing Mutual Fund Schemes?

At the start of every calendar/financial year, most media houses, investment firms, etc., come out with the list of best-performing mutual funds in the year gone by. The list is presented in the order of returns. Some investors compare the returns of last year's best-performing mutual fund schemes to the schemes in their portfolio.

If their returns are lower, there is a feeling of disappointment and a fear of missing out (FOMO) on the best performers. As a result, they redeem their existing investments and invest in the last year's best performers. Some investors may repeat this activity every year. Should you shift your investments every year to last year's best-performing mutual fund schemes? Is this a good investment strategy? Let us discuss this in detail.

Is Switching Investments To Last Year’s Best Performers A Good Strategy?

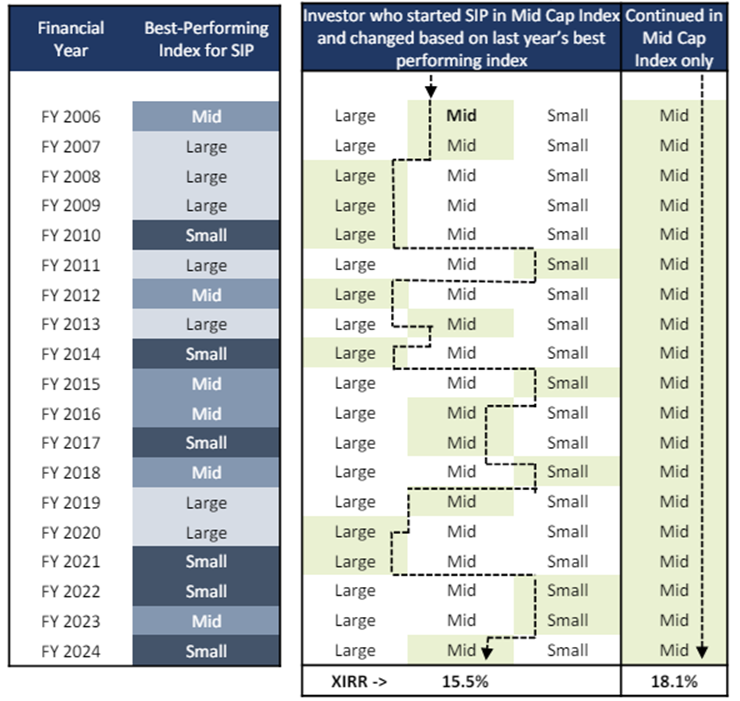

In May 2024, WhiteOak Capital Mutual Fund published a study. The study highlighted the returns that investors would earn in the following two scenarios:

- Starting a SIP in the mid-cap index and continuing with it for 19 years (FY 2006 to FY 2024)

- Starting a SIP in the mid-cap index and switching every year to the last year’s best-performing index for 19 years (FY 2006 to FY 2024)

During these 19 years, for the investor who switched every year to the last year’s best-performing index, the performance was as follows:

- SIPs in the large-cap index outperformed seven times

- SIPs in the mid-cap index outperformed six times

- SIPs in the small-cap index outperformed six times

So, what were the overall returns for the two investors?

- The investor who started a SIP in the mid-cap index and continued with it for 19 years earned a final XIRR of 18.1% (as of 1st April 2024)

- The investor who started a SIP in the mid-cap index and switched every year to last year’s best-performing index earned a final XIRR of 15.5% (as of 1st April 2024)

The study highlighted that the investor who switched investments every year to the last year’s best-performing index got a lower XIRR than the investor who continued with the mid-cap index.

Table: Mid-Cap SIP: Switching Every Year Vs Continuing

Note: The large-cap index is represented by the Nifty 100 TRI, the mid-cap index is represented by the Nifty Midcap 150 TRI, and the small-cap index is represented by the Nifty Smallcap 250 TRI.

In the above table, the section on the left side shows which index was the best-performing index in which year. The middle section shows how the first investor started investing with the mid-cap index and switched every year to the last year’s best-performing index. The section on the right side show how the second investor started investing with the mid-cap index and continued with it for 19 years.

Just like the above study, WhiteOak Capital Mutual Fund did another study. In this study, the two investors started by investing in the small-cap index.

- The first investor started a SIP in the small-cap index and continued with it for 19 years (FY 2006 to FY 2024)

- The second investor started a SIP in the small-cap index and switched every year to the last year’s best-performing index for 19 years (FY 2006 to FY 2024)

So, what were the overall returns for the two investors?

- The investor who started a SIP in the small-cap index and continued with it earned a final XIRR of 16.0% (as of 1st April 2024)

- The investor who started a SIP in the small-cap index and switched every year to last year’s best-performing index earned a final XIRR of 15.1% (as of 1st April 2024)

The study once again highlighted that the investor who switched investments every year to last year’s best-performing index got a lower XIRR than the investor who continued with the small-cap index.

Investors should continue with their investments in the same scheme rather than switching every year to last year’s top performers.

How Did The Previous Winners Fare In The Subsequent Years?

In a study, mutual fund schemes that were top performers over three years were analysed. They examined how these top-performing mutual fund schemes performed over the next three years. Here are the results.

|

Previous 3-Year Period |

Ranking |

Subsequent 3-Year Period |

Ranking |

|

2009-11 |

1 |

2012-14 |

38 |

|

2010-12 |

1 |

2013-15 |

103 |

|

2011-13 |

1 |

2014-16 |

1 |

|

2012-14 |

1 |

2015-17 |

7 |

|

2013-15 |

1 |

2016-18 |

2 |

|

2014-16 |

1 |

2017-19 |

6 |

|

2015-17 |

1 |

2018-20 |

175 |

|

2016-18 |

1 |

2019-21 |

22 |

|

2017-19 |

1 |

2020-22 |

165 |

|

2018-20 |

1 |

2021-23 |

190 |

Note: The above data is for diversified equity funds, including large-cap, mid-cap, small-cap, flexi-cap, large & mid-cap, multi-cap, ELSS, value, focused, and dividend yield funds.

The above table shows the following:

- There is only one instance where the fund that ranked 1st in the previous 3-year period was able to maintain the same rank in the subsequent 3-year period.

- In four instances, the funds that ranked 1st in the previous 3-year period were able to maintain their ranking in the top 10 in the subsequent 3-year period.

- In two instances, the funds that ranked 1st in the previous 3-year period; their ranking fell to 22nd and 38th position in the subsequent 3-year period.

- Finally, in four instances, the funds that ranked 1st in the previous 3-year period; their ranking fell beyond 100 in the subsequent 3-year period.

- In 2018-20, the fund that ranked 1st; its ranking fell to 190th (out of 213 funds) in the subsequent 3-year period.

The report highlights that:

- Only 1 out of the four top-ranking funds, or an average of 27%, continue to remain in the top quartile in the subsequent 3-year period

- Only 1 out of the five top-ranking funds, or an average of 21%, continue to remain in the top quartile in the subsequent 5-year period

Hence, you should not select mutual funds for investment based on the last one- or three-years performance. If you invest in last year’s best performers, based on past data, the probability of these funds underperforming in the subsequent years is more than outperforming.

What Should Investors Do?

Rather than picking last year’s best performers, you should choose funds that are expected to provide good returns consistently over the long term. Once you choose such funds, you should stay with them for the long term instead of switching every year. You should work with an investment expert who can design a financial plan based on your financial goals. The investment expert will recommend funds where the expected rate of return is likely to help fulfill the financial goals.

They will recommend a diverse portfolio comprising large, mid, and small-cap funds. All MF schemes go through periods of outperformance and underperformance from time to time. So, even though some schemes may underperform for some time, they will make up by outperforming at other times. As long as the average returns from the funds are equal to or higher than the expected rate of return, you don't need to chase last year's best-performing funds. The next time someone asks you to invest in an MF scheme based on last year's performance, remember the disclosure: “The past performance of the mutual funds is not necessarily indicative of future performance of the schemes.”

Your Investing Experts

Relevant Articles

Why Comparing Investment Returns Can Be Misleading

At some point, most investors have compared their investment returns with a friend, a colleague, or a number they saw online and wondered why their outcomes looked different. While this instinct is natural, return comparisons are often incomplete and, in many cases, misleading. Understanding why returns differ is far more important than comparing the numbers themselves.

CAGR vs XIRR vs Absolute Return: Understanding Which Return Really Matters

When reviewing investment performance, investors often come across multiple return figures absolute return, CAGR, and XIRR. While these numbers may appear similar, they measure performance very differently. Understanding what each metric represents, and when to use it, is essential for making informed investment decisions and setting realistic expectations.

Responsible Credit Card Usage: Three Principles Every Consumer Should Follow

Credit cards are powerful financial tools when used correctly, offering convenience, rewards, and short-term liquidity. But when used without discipline, they can quickly turn into high-interest liabilities. Understanding a few essential principles can help you manage your cards responsibly, maintain a strong credit score, and avoid stress caused by compounding debt.

.png)

.png)

.png)