Tax savings through mutual funds: 5 ELSS that may fetch you good returns and great savings

ELSS mutual funds offer a compelling way to save taxes while building wealth over the long term. With a lower lock-in period compared to other tax-saving instruments and the flexibility of SIPs, they make for a great investment option. Whether you're looking for tax savings or capital appreciation, consider diversifying your approach and staying committed for long-term growth

Equity-linked saving schemes, or ELSS, are open-ended (funds that have no restriction on number of shares issued) and diversified (a way of allocating capital in a variety of assets in a way that reduces exposure to risk thereby mitigating loss) schemes offered through mutual funds.

The unique feature of this scheme is that it offers tax benefits under the section 80C of the Income Tax Act, which means that you can reduce your tax liability.

"One can avail a maximum deduction of Rs. 1.5 lakhs invested into these funds from you income during a financial year . This in turn, would help in saving tax of upto Rs. 46,350/- (if you fall in the highest income slab) during a financial year. These funds are efficient tax saving investments with the least lock in period and a superior track record on performance," says Mayank Bhatnagar, Chief Operating Officer, FinEdge.

However, this instrument should not be looked from the perspective of saving taxes, but how one can channelise these investments towards long term goals.

The equity element in ELSS allows investors to create wealth in the long run.

Further, by choosing for the 'Dividend Payout' option in the ELSS investors can receive tax free payouts from their investment even before the maturity of the scheme, says Mayank.

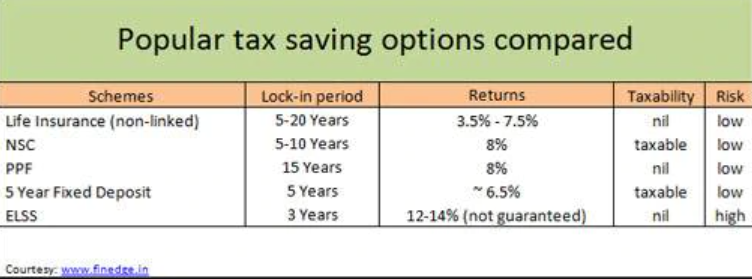

"ELSS also offer greater liquidity as the lock in period in these funds is only 3 years in comparison to PPF which has lock in period of 15 years," he adds.

Additionally, the option of investing them in SIPs (Systematic Investment Plans) makes investing in ELSS flexible and mitigates the risk of investing in equities too.

In ELSS funds you can invest as low as Rs 500 on a one time lumpsum basis.

Experts also advice investors to avoid one time investments in ELSS and to break it down into monthly and recurring mode of payments.

This allows an investor to practice disciplined investing and reign better control of tax saving investments and future wealth creation prospect.

Apart from mitigating risk, investing through SIPs in ELSS provides the benefit of compounding.

"Compounding can be best described as 'returns earned on returns'. By accruing profits within your ELSS over a 10-15 year time frame rather than redeeming the profits periodically, one can create a significant corpus for oneself over a long period of time," says Mayank.

What about other schemes that give equity linked returns?

Unit Linked Insurance Plan (ULIPs) are a mix of life insurance and investments but incur huge costs, especially during the initial phase of the policy. ULIPs also has a lock-in period of 5 years which is higher in comparison to ELSS's 3 year lock in period.

Mayank also elaborates that expenses towards ELSS are clearly stated making it more transparent. However, the varying cost structure for ULIPSs can confuse the investor on the principal that has been invested out of the premium paid by him.

On the other hand, National Pension Scheme (NPS) is an apt instrument for creating a retirement corpus, but its equity allocation being capped at 50 per cent limits its scope for capital gains. NPS has restrictions of withdrawals too.

According to Value Research, here are some of the highly rates ELSS mutual funds you can look into:

Tata India tax saving fund

Falling under the equity tax planning category, this fund has a asset worth of Rs 656 crore as on April 2017. The scheme gives a 1 year return of 24.12 per cent and 3 year/5 year return of over 21 per cent.

Since its launch the fund has given 20.06 per cent returns with a record of 46 per cent turnover.

Value Research ranks this scheme's returns as 'above average'.

Reliance tax saver (ELSS)

With a larger asset base of Rs 8,045 crore and a growth price of Rs 56.99 this fund belongs to the Reliance Mutual Fund family.

Launched in 2005, its return since has been 16.04 per cent with a turnover of 63 per cent. The minimum investment required is Rs 500.

The scheme has a 1 year return of 29.26 per cent, 3 year return of 18.32 per cent and 5 year return of 22.84 per cent.

Top holdings of this fund are automobiles, engineering and technology sectors led by TVS Motors with over 8 per cent assets.

Motilal Oswal MOSt Focused Long Term Fund

From the house of Motilal Oswal Mutual Fund, this scheme was launched in 2015 with a return of 20.72 per cent and turnover of 85 per cent.

This scheme offers a 1 year return of 37.27 per cent with a minimum investment of Rs 500.

The asset allocation is highly equity based with majority holdings in the financial sector led by HDFC Bank at 9.08 per cent.

Mirae asset tax saver fund

This scheme has given a 28.26 per cent return since launch and boasts a turnover of 118 per cent. It is an open-ended and diversified scheme with major holdings in the financial and automobile sector.

With an expense ratio of 2.62 per cent, it gives back a return of 37.19 per cent in 1 year.

L&T tax advantage fund

With large asset base of Rs 2,202 crore as on April 2017, this fund reaps 29.19 per cent in 1 year. In 3 years and 5 years, the scheme gives back 18.50 per cent and 19.93 per cent returns.

Rated 3 stars by Value Research, it has a market capitalisation of Rs 29,701.78 crore.

This, too, has a diversified sectoral holding ranging between Financial, FMCG, Technology, Textiles, etc.

This article was published on Business Today Online on 31st May 2017 with inputs from FinEdge.

Your Investing Experts

Relevant Articles

How To Select The Best Mutual Funds For Long Term Goals

Mutual funds offer a compelling way to invest for long-term goals, leveraging professional management and diversification to potentially achieve significant returns. But with a vast array of options available, selecting the best mutual funds for the long term can feel daunting. This guide will equip you with the knowledge to confidently navigate the mutual fund landscape and learn how to select the best mutual fund aligned with your long-term aspirations.

Understanding Debt and Equity Funds: Key Differences and Benefits

Investors can choose from different types of mutual funds depending on factors like investment time horizon, return expectation, lock-in period, taxation, risk involved, etc. You can look at equity funds for growth and debt funds for stability. In this article, we will understand what are equity funds and debt funds, the difference between equity and debt mutual funds, and things to consider before choosing these funds.

ETFs Versus Index Funds: What Are the Differences, and Which One Should You Choose?

In the last few years, there has been a rise in passive investing due to factors like diversification, low costs, wide availability and choice of passive funds, ease of investing, etc. When it comes to passive investing, there are two ways of doing it. Exchange traded funds (ETFs) and index funds. In this article, we will understand what are ETFs and index funds, the differences, and which one you should choose.

.png)