Investing Insights

Step-By-Step Guide to Starting a SIP: Everything You Need to Know

Most of us earn a regular monthly income and hence prefer to invest a regular monthly amount towards our financial goals. Also, it will be great if the monthly investment process is automated after a onetime setup. A Systematic Investment Plan or SIP allows you to do that. In this article, we will understand what is an SIP, how to invest in SIP, and where to invest in SIP.

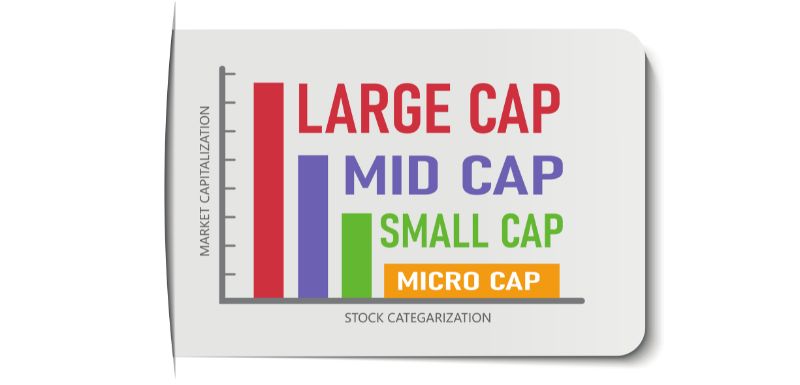

A Comparison of Small Cap, Mid Cap and Large Cap Funds

The equity mutual fund investing universe is quite vast. Many types of equity mutual funds exist based on the size or market capitalisation of the companies they invest in. These include large, mid, and small cap mutual fund schemes. In this article, we will understand what are large, mid, and small cap funds, their differences, and what you should consider before investing in them.

What Is STP in Mutual Funds and Its Types

Have you recently received a lump sum as an annual bonus from the employer, maturity proceeds of a financial product, or won prize money from some competition/lucky draw? You must be wondering how to invest this money in a staggered manner while not worrying about impulsive spending. A systematic transfer plan (STP) can help you do that. In this article, we will understand what is STP in mutual fund, its benefits, how to do it, and things to consider before doing an STP.

The Pros & Cons of Robo Advisors

Over the years, the definition of FinTech or “Financial Technology” has expanded from covering companies that supply back-end software systems to Financial Institutions to encompassing a multitude of ventures that leverage technology to disrupt existing ways of executing financial transactions or managing money.

Sectoral/Thematic Funds Have Seen Inflows of Rs. 55,000 Crores in the Last 6 Months: Should You Invest?

As of July 2024, sectoral and thematic mutual funds have seen more than Rs. 55,000 crore inflows in the last six months. The AMCs are on a NFO launching spree and mutual fund investors are lapping these funds. So, what are these sectoral/thematic funds, why are investors pouring so much money into these, and should you invest? Let us discuss.

9 Personal Finance Mistakes to Avoid

You must have heard the famous phrase: "Knowing is half the battle". It signifies the importance of being informed. The other half is the application of knowledge. Unknowingly, people do make mistakes and learn from them. However, learning from personal finance mistakes can come at a cost and derail or push you back in your financial planning journey. Hence, it is best to be aware of these money mistakes and avoid them so your financial planning journey can be smooth. In this article, we will discuss some common financial mistakes to avoid.

Active and Passive Funds, How They Can Complement Your Portfolio

In the last few years, passive funds have become quite popular among investors. Some reasons for this include the number of passive funds launched by AMCs, wider awareness about them, their performance and benefits, etc.

How Understanding Risk Is Critical While Investing and Ways to Mitigate Risk in Investing

When it comes to investing, the risk involved and the potential reward go hand in hand. The higher the risk involved, the higher the reward expectation. However, can the risk be reduced or mitigated while keeping the reward potential still high? The answer is yes. In this article, we will understand what risk is, why understanding it is critical, and ways of mitigating it.

What It Takes to Build a Resilient Portfolio

The Indian stock market has been on an upward trend for nearly three years. The sharp market correction of 30% plus seen during March 2020 seems to be an event in the distinct past. However, such sharp volatility is a part and parcel of equity investing. Hence, from an investor perspective what one needs is a resilient portfolio which can weather any market disruption.

Steps to Construct a Great Investment Portfolio – A Guide for Smart Investors

Living in today’s information age has its pros and cons. You have your broker, family members, friends, colleagues, and others giving you friendly investment tips. You also have TV channels, newspapers, magazines, social media and other internet channels bombarding you with investment recommendations/tips.

Emergency Fund: What Is It, Why and How Much of It Should You Have?

In 2023-24, many IT companies and start-ups laid off many employees. The IT companies had to lay off people as the demand or discretionary spending pickup in their major market, i.e. the US, was not as strong as expected. The start-ups had to lay off people as they were not able to raise subsequent round(s) of funding due to the funding winter. In both scenarios, people who lost jobs were left in the lurch. As the IT and start-up sectors were going through a soft patch, it was difficult for these people to either get new jobs or at the same/better pay package.

Succession Planning: What Is a Will, Terms Related to It, and How to Make It?

As per Indian succession laws, on the death of an individual, their assets are distributed among the legal heirs. The legal heirs are categorised into various classes and are listed in the sequence in which they can claim the assets. However, what if you want to distribute your assets to other people along with your legal heirs?

Latest Posts

Multi-Generational Investment Planning Tips: Boomers, GenX, Millenials, GenZ

Mar 21, 2025

Why a Home Purchase Plan is Important – A Home Loan Checklist

Mar 11, 2025

Rupee Falling in 2025? Here’s How to Protect and Grow Your Investments!

Feb 08, 2025

The Impact of Inflation on Your Financial Goals

Feb 08, 2025

Your Child’s Education Goal: A Step-by-Step Investment Guide

Feb 08, 2025

Investment Plans for NRIs: Yasser Khan’s Testimonial

Apr 02, 2025

Appreciation shown by our clients

Oct 05, 2023

How the Modern Woman is taking Investing decisions

Aug 21, 2024

Investing Stories