How Much to Invest in SIP's to Reach Your Goals? How Can Step-up SIP Boost the Process?

You must have heard the famous sayings like: "Good things take time", "Good things happen to those who wait", or "Good things come in small packages".

In the investing world, one thing that resembles all the above sayings is the systematic investment plan or SIP mode of investing. Like some other good things, SIP takes time to show results with the power of compounding. Also, like good things, SIP works for those who can wait for the long term to enjoy its fruits. And finally, like good things, SIP comes in small packages, meaning you can invest a small amount regularly and make it big in life.

So, what is SIP, how much should you invest in SIPs to reach your financial goals, and how can a step-up SIP help you reach your goals faster? Let us discuss all these points.

What Is SIP?

A SIP or systematic investment plan is a mode of investing in mutual funds. A SIP allows you to invest a specified amount with a specified frequency in a selected mutual fund scheme for a specified time period.

For example, Ajay started a monthly SIP of Rs. 1,000 in a Nifty 50 Index Fund for five years. In this case, Rs. 1,000 will be automatically debited from Ajay’s bank account on a specified date every month for five years. As and when Ajay’s bank account is debited, every month, his mutual fund folio will be credited with units of the Nifty 50 Index scheme equivalent to Rs. 1,000.

SIP Components

Now that you understand an SIP, the next step is to know its components. The three main components of an SIP are as follows.

Amount Invested

The general rule is: The higher the amount invested, the higher the corpus you will accumulate, other things being constant. When you start earning, your income will be low. As a result, your investment amount will also be low. However, as your annual income increases, you can increase the SIP amount through the step-up SIP.

A step-up SIP automatically allows you to increase the monthly SIP amount on an annual basis. The increase can be by an absolute amount or a percentage of the SIP amount.

Investment Time Horizon

The general rule is: The longer the investment time horizon, the higher the corpus you will accumulate, other things being constant. In the long run, you benefit from the power of compounding. In the first few years, it will be slow to show its impact. But, as the investment tenure goes on increasing, you will see your corpus rising at a faster pace.

You should ideally start investing from the time you start earning. It gives you enough time to plan for your financial goals, invest towards them, and achieve financial freedom.

Expected Rate of Return

The general rule is: The higher the rate of return, the higher the corpus you will accumulate, other things being constant. The expected rate of return depends on the financial product you choose for investment.

For example, fixed-income products like bank fixed deposits, Government bonds, small savings schemes, debt funds, etc., can give you pre-tax returns in the 6-9% CAGR range. A large-cap equity fund has the potential to give returns in the 9-11% CAGR range in the long run. A mid or small-cap equity fund has the potential to give returns in the 12-14% CAGR range in the long run.

How Much Return You Can Get In SIP?

Please note that usually, the higher the expected rate of return, the higher the risk involved. You should always invest in equities for the long term. Usually, in the long term, the equity investment risk and volatility reduce, and the possibility of earning higher returns increases.

So, now you understand the three components of an SIP. To get maximum benefits of SIP investment and its components, you should,

- Increase the annual investment amount with a step-up SIP,

- Invest for the long-term, and

- Choose equity mutual funds to earn a higher expected rate of return

How Much Should You Invest In SIP?

In the above sections, you understood an SIP and its components. Now, let us calculate the amount you need to invest in an SIP to reach your financial goals. The amount required to be invested will depend on the amount you want to accumulate, the time horizon in which you want to accumulate, and the expected rate of return.

SIP Investment Plan to Reach a Financial Goal

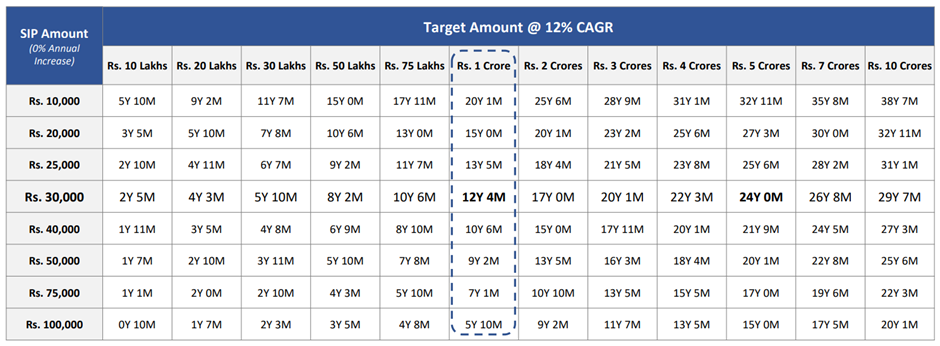

The above table shows you the monthly SIP amount you need to invest to achieve a specified corpus in a specified time with a specified expected rate of return. Let us assume you want to accumulate Rs. 1 crore. If your expected rate of return is 12% CAGR, you will have to do a monthly SIP of Rs. 10,000 for 20 years and 1 month to reach your target.

Similarly, if your expected rate of return is 12% CAGR, and you increase the monthly SIP amount to Rs. 30,000, you will reach your target of Rs. 1 crore in 12 years and 4 months.

How Can Step-Up SIP Accelerate Your Financial Planning Journey?

We have seen how you can reach your financial goals faster with a step-up SIP. Let us understand it with an example. Let us continue with our earlier example of accumulating Rs. 1 crore with a monthly SIP of Rs. 10,000 and an expected rate of return of 12% CAGR. How will a step-up SIP accelerate the financial planning journey?

|

Annual Increase |

Monthly SIP Amount |

Expected Rate Of Return |

Time Required To Reach Rs. 1 Crore Financial Goal |

|

SIP With No Annual increase |

Rs. 10,000 |

12% CAGR |

20 years 1 month |

|

SIP With A 5% Annual increase |

Rs. 10,000 |

12% CAGR |

17 years 10 months |

|

SIP With A 10% Annual increase |

Rs. 10,000 |

12% CAGR |

15 years 10 months |

The above table shows, to reach the financial goal of Rs. 1 crore:

- It will take 20 years and 1 month with a monthly SIP of Rs. 10,000 and an expected return of 12% CAGR

- The time required reduces to 17 years and 10 months with a monthly SIP of Rs. 10,000 and a 5% annual increase

- The time required further reduces to 15 years and 10 months with a monthly SIP of Rs. 10,000 and a 10% annual increase

Hence, it is always better to choose a step-up SIP as it will accelerate your financial planning journey. The higher the percentage increase in your annual investment amount, the faster you will reach your financial goal.

Make SIP The Stepping Stone To Your Financial Goals

Coming back to one of the famous sayings with which we started the article: "Good things come in small packages". The SIP mode of investing comes with a small package, wherein you can invest small amounts every month towards your financial goals. With time and the power of compounding, the small amounts will cumulatively grow into a substantial corpus. The step-up option provides the much-needed boost to reach financial goals faster and achieve financial freedom.

Your Investing Experts

Relevant Articles

How Falling Markets Can Benefit Your SIP Plan

Market downturns can trigger anxiety, but for SIP investors, they present a golden opportunity. By consistently investing through volatility, you benefit from rupee cost averaging, accumulating more units at lower prices and enhancing long-term returns. With the power of compounding and a disciplined approach, SIPs turn market dips into wealth-building moments

Why is a SIP Investment Calculator beneficial?

With the rapid rise in online financial planning, more and more smart investors are choosing SIP investments as their investment avenue of choice for meeting their long and short term goals. As a thumb rule, SIP’s work best when you dispassionately keep them running despite the ups and downs of the markets.

How to Use SIPs to Create Long-Term Wealth

The financial planning journey to create wealth, and fulfil financial goals is a marathon, not a sprint. In this marathon, investing regularly in a disciplined manner through the systematic investment plan (SIP) route is the key to creating long-term wealth. In this article, we will understand how a consistent and disciplined long-term SIP investment can provide you with the benefits of compounding and create wealth.