How Falling Markets Can Benefit Your SIP Plan

Market downturns can trigger anxiety, but for SIP investors, they present a golden opportunity. By consistently investing through volatility, you benefit from rupee cost averaging, accumulating more units at lower prices and enhancing long-term returns. With the power of compounding and a disciplined approach, SIPs turn market dips into wealth-building moments

For many investors, a falling market triggers anxiety and fear. However, if you are investing systematically through a Systematic Investment Plan (SIP), market downturns can actually work in your favor. SIP plans, particularly the best mutual fund SIPs, allow you to leverage market volatility and accumulate more units when prices are low, ultimately enhancing long-term returns. As a seasoned financial advisor would tell you, downturns are not to be feared but rather embraced as an opportunity to build wealth systematically in the long term.

Investing is not a sprint but a marathon that needs preparation, patience, persistence, and resilience. The markets reward those who demonstrate these qualities when investing for their long-term goals. Just as Warren Buffet said, “Only buy something that you’d be perfectly happy to hold if the market shut down for ten years.”

Understanding the SIP Advantage

A Systematic Investment Plan (SIP) is a method of investing in mutual funds wherein you invest a fixed amount at regular intervals, irrespective of market conditions. This disciplined approach ensures that you do not need to time the market, a challenge even for experienced investors. Instead, you benefit from rupee cost averaging, which helps reduce the overall cost per unit and mitigates the impact of market fluctuations.

When markets fall, your fixed SIP amount purchases more units of the selected mutual fund. Conversely, when markets rise, fewer units are purchased. Over time, this strategy balances out market volatility and leads to potentially higher returns when markets recover.

How Falling Markets Benefit SIP Investors

1. Rupee Cost Averaging in Action: Market downturns offer SIP investors a golden opportunity to accumulate more mutual fund units at lower prices. This process, known as rupee cost averaging, helps reduce the average cost of acquisition over time. When the market eventually rebounds, the investor benefits from higher gains as the value of the accumulated units appreciates.

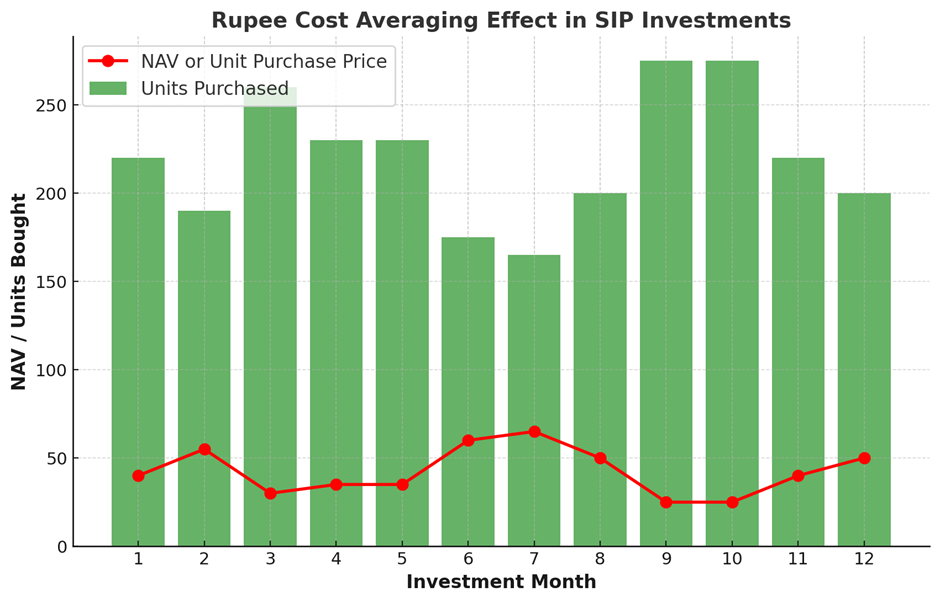

For instance, if you are investing Rs.10,000 monthly in a mutual fund SIP, and the Net Asset Value (NAV) of the fund drops, you acquire more units for the same amount. When the NAV increases, these accumulated units yield substantial returns. The graph below depicts this. See how units acquired are inversely proportionate to market movement that governs the NAV or per unit price.

2. Compounding Rewards Patience: The power of compounding plays a significant role in your long-term SIP plan. By consistently investing, even during market downturns, you allow your investments to grow exponentially over time. The longer you stay invested, the greater the impact of compounding, ensuring that short-term market fluctuations do not hinder your financial goals.

3. Eliminating the Need to Time the Market: Trying to predict market movements is a risky and often futile exercise. Financial advisors recommend SIPs because they remove the burden of market timing. Instead of making investment decisions based on emotions, SIP investors stay committed to a disciplined investment approach. This long-term mindset ensures that investors continue accumulating wealth even during challenging market conditions.

4. Market Recoveries Lead to Stronger Gains

History has shown that markets eventually recover from downturns and reach new highs. Investors who continue their SIP plans during bearish phases stand to gain the most when markets rebound. By accumulating more units at lower prices, they enjoy enhanced returns when the NAV of their funds rises in the future.

For example, during market crashes such as the 2008 financial crisis or the COVID-19 crash of 2020, investors who continued their SIPs benefited significantly as markets bounced back in subsequent years.

5. Avoiding Emotional Investment Decisions

One of the biggest mistakes investors make is letting emotions drive their decisions. Panic selling during a downturn locks in losses and prevents investors from benefiting when the market recovers. SIPs help mitigate emotional biases by enforcing a disciplined investment approach, ensuring that you keep investing regardless of short-term market trends.

The Role of a Financial Advisor in SIP Investing

While SIPs offer numerous benefits, selecting the best mutual fund SIPs for your investment goals is crucial. A financial advisor helps you navigate market conditions, identify suitable funds based on your risk profile, and ensure that your investment strategy aligns with your long-term financial objectives.

Financial advisors provide insights on:

• Diversification: Choosing funds across different asset classes to manage risk.

• Risk Assessment: Evaluating your risk tolerance and recommending appropriate mutual funds.

• Investment Horizon: Aligning your SIP investments with long-term financial goals such as retirement, children's education, or wealth creation.

Key Takeaways for SIP Investors in Falling Markets

1. Stay Invested: Market downturns are opportunities, not threats. Continue your SIP plan to maximize gains when markets recover.

2. Leverage Rupee Cost Averaging: Lower NAVs allow you to buy more units, reducing your overall investment cost.

3. Embrace Market Volatility: Volatility works in your favor when investing through SIPs.

4. Seek Expert Guidance: A financial advisor can help you identify the best mutual fund SIP plan suited to your needs.

5. Think Long-Term: SIP investments are most effective when held for extended periods, allowing compounding to enhance returns.

Conclusion

Falling markets may seem daunting, but they present a unique advantage for SIP investors. By staying committed to your SIP investments, you harness the power of rupee cost averaging and compounding, which ultimately lead to superior long-term returns. Consulting a financial advisor ensures that you choose the best mutual fund SIPs aligned with your goals, enabling you to navigate market cycles with confidence. Instead of fearing a market downturn, embrace it as an opportunity to build wealth systematically.

FAQs

Should I stop my SIP when the market is falling?

No, stopping your SIP during a market downturn can reduce long-term returns. Continuing your SIP investments ensures you buy more units at lower prices, benefiting from a market recovery in the future. When you invest through a SIP, you must invest with your goal tenor in mind and should avoid a ‘start and stop’ approach.

How does a financial advisor help in choosing the best mutual fund SIPs?

A financial advisor helps select the best mutual fund SIPs based on risk tolerance, investment goals, and market conditions. They also provide guidance on asset allocation, diversification and long-term goal achievement.

What should I do if my SIP returns are negative during a market downturn?

Do not panic! Negative returns are temporary in falling markets. SIPs work best when continued through all market cycles, as markets historically recover over time, leading to long-term growth.

What happens to my SIP if the market keeps falling for a long time?

If markets continue to fall, your SIP will continue accumulating more units at lower prices. This means you are effectively building a larger portfolio, which can generate higher returns when the market rebounds.

What is Rupee Cost Averaging in SIP?

Imagine buying potatoes on the same date every month. Some months they're cheap, so you get more; other times they're pricey, so you get less. Over a year, you’ve stocked up a good amount at different prices—this is exactly how SIPs work and how Rupee Cost Averaging takes effect. In investing, it is a strategy where you invest a fixed amount regularly, regardless of market conditions. When prices are low, you buy more units; when prices rise, you buy fewer. This lowers the average cost per unit over time, helping SIP investors mitigate market volatility.

Your Investing Experts

Relevant Articles

Why is a SIP Investment Calculator beneficial?

With the rapid rise in online financial planning, more and more smart investors are choosing SIP investments as their investment avenue of choice for meeting their long and short term goals. As a thumb rule, SIP’s work best when you dispassionately keep them running despite the ups and downs of the markets.

How to Use SIPs to Create Long-Term Wealth

The financial planning journey to create wealth, and fulfil financial goals is a marathon, not a sprint. In this marathon, investing regularly in a disciplined manner through the systematic investment plan (SIP) route is the key to creating long-term wealth. In this article, we will understand how a consistent and disciplined long-term SIP investment can provide you with the benefits of compounding and create wealth.

Step-By-Step Guide to Starting a SIP: Everything You Need to Know

Most of us earn a regular monthly income and hence prefer to invest a regular monthly amount towards our financial goals. Also, it will be great if the monthly investment process is automated after a onetime setup. A Systematic Investment Plan or SIP allows you to do that. In this article, we will understand what is an SIP, how to invest in SIP, and where to invest in SIP.

.png)