What Are the Different Types of SIPs? How to Use Step-Up SIP to Reach Your Financial Goals Faster?

In the past, over long investment periods, stock markets have given excellent returns and created wealth for investors. However, in the short term, markets can be very volatile and experience big bouts of corrections. Hence, it is always recommended that you invest in small amounts regularly over the long term.

One of the best ways to do that is through the systematic investment plan (SIP) mode. Within SIP, there are different types that AMCs offer. In this article, we will understand various types of SIPs and how you can reach your financial goals faster using the Step-Up SIP option.

Types of SIPs

AMCs have been taking feedback from investors regularly to understandWhat are the different types of SIPs? How can you use Step-Up SIP to reach your financial goals faster? their needs. Accordingly, they are innovating and offering various investment solutions. One of them is the different types of SIPs. Some of these include the following:.

1) Regular SIP

A regular SIP allows you to invest a specified amount in a specified mutual fund scheme at a specified frequency for a specified time period. For example, Divya invests Rs. 2,000 every month in a small-cap scheme for a tenure of five years.

In a regular SIP, the following components are fixed:

- The amount being invested

- The frequency of investment. You can choose from daily, weekly, monthly, quarterly, half-yearly, and yearly options. In the case of a weekly SIP, you can select the day your bank account will be debited every week for the SIP amount. For a monthly SIP, you can choose the date your bank account will be debited every month for the SIP amount.

- The tenure for which the investment will continue. You can specify the investment end date.

A regular SIP is the most popular form of SIP among investors. It is also the simplest and most basic form of SIP.

How Can a Regular SIP Help You With Wealth Creation?

Gita wants to accumulate a corpus of Rs. 1 crore for her retirement in 20 years. She is expecting a 12% CAGR rate of return on her corpus. In this case, Gita will have to start a monthly SIP of Rs. 10,009 to achieve her goal.

She will achieve her retirement corpus of Rs. 1 crore in 20 years with a 12% CAGR.

Chart: Regular SIP for Achieving Financial Goals

(Source: ICICI Bank)

The above chart shows that over the next 20 years, Gita will be investing Rs. 24.02 lakhs from her pocket. The return on investment will be Rs. 75.97 lakhs, a little three times than her investment. Thus, regular SIPs are an excellent way to plan for your financial goals and achieve financial freedom.

2) Step-Up SIP

A Step-Up SIP allows you to increase the SIP amount by a specified amount or specified percentage at a specified frequency.

For example, if an individual starts a monthly SIP of Rs. 10,000, they can increase the SIP amount in one of two ways:

1) Absolute Amount

For example, an individual can opt to increase the SIP amount by Rs. 500 every year. In this case, the monthly SIP amount will be Rs. 10,000 in the first year, Rs. 10,500 in the second year, Rs. 11,000 in the third year, and so on.

2) Percentage

For example, an individual can opt to increase the SIP amount by 10% every year. In this case, the monthly SIP amount will be Rs. 10,000 in the first year, Rs. 11,000 in the second year, Rs. 12,000 in the third year, and so on.

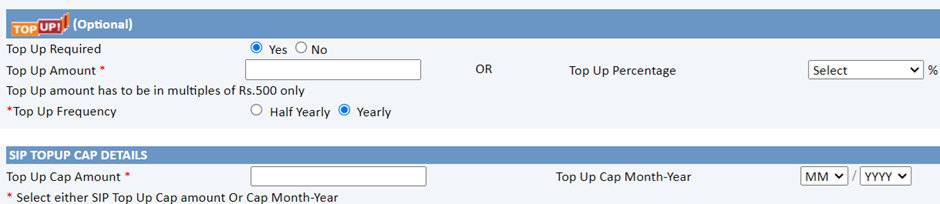

Some AMCs give you the option to specify the frequency of the step-up. For example, you can choose the step-up frequency between half-yearly and yearly.

Some AMCs give you the option to specify step-up cap details. You can specify the step-up cap amount. For example, an individual can start a Rs. 10,000 monthly SIP for 20 years with an annual step-up of Rs. 1,000 and a step-up cap amount of Rs. 15,000. In this case, the SIP will go up by Rs. 1,000 every year. Once it reaches Rs. 15,000, it will stay constant for the remaining tenure.

You can also specify the step-up cap by month and year. For example, in May 2024, an individual starts a Rs. 10,000 monthly SIP for 20 years with an annual step-up of Rs. 1,000 and a step-up cap month and year of December 2030. In this case, the SIP will go up by Rs. 1,000 every year. Once it reaches December 2030, it will stay constant for the remaining tenure.

A Step-Up SIP helps you increase the SIP amount on an annual basis in line with the annual increase in your income.

3) Step-Up SIP Option

(Source: ICICI Prudential Mutual Fund)

The above image shows the step-up options with amount / percentage, step-up frequency (half-yearly or yearly), and step-up cap amount or month year.

For example, Jaya starts a regular SIP of Rs. 10,000 in a mid-cap scheme for a tenure of 20 years. Her expected rate of return is 14% CAGR. In this case, she will accumulate Rs. 1.31 crores (Rs. 1,31,63,463) in 20 years.

However, if Jaya increases her monthly SIP by 10% on an annual basis, she will accumulate Rs. 2.48 crores (Rs. 2,48,09,316) in 20 years. Thus, the difference between a Step-Up SIP and a regular SIP is a whopping Rs. 1.16 crores.

The other way of looking at it is that Jaya will require 20 years to accumulate Rs. 1.31 crores with a regular SIP in a mid-cap fund with a 14% expected CAGR. However, if she invests in a 10% top-up SIP, she will be able to accumulate the same Rs. 1.31 corpus in a little over 16 years. With Step-Up SIP, she will be able to accumulate the corpus in four years less than a regular SIP. Thus, a Step-Up SIP can help you reach your goals faster than a regular SIP.

3) Perpetual SIP

A perpetual SIP is one that goes on forever without any specified end date. When you choose a perpetual SIP, you just need to specify the start date. Usually, the system-defined end date for perpetual SIPs is 2099.

You can pause or stop the SIP at any point. A perpetual SIP helps you continue investing for the long term, enjoy the power of compounding, and create wealth for yourself.

4) Flexible SIP

As the name suggests, a flexible SIP provides you flexibility with certain SIP components. You get flexibility with the SIP amount (increase or decrease), date, frequency, number of SIP installments, etc. Any changes have to be communicated to the AMC at least a week prior to the next SIP due date.

Flexible SIPs are more suited for freelancers, self-employed people, business people, etc. These people don’t have a fixed income every month. Hence, they can change their SIP investments every month based on their monthly income.

Which Is the Best Type of SIP?

There is no one type of SIP that suits the requirements of every investor. Hence, AMCs provide investors with various SIP options. The best type of SIP is one that suits your requirements. If you prefer simplicity, go for a regular SIP. If you want to increase your SIP investment amount regularly and reach your financial goals faster, go for a Step-Up SIP. If your monthly income fluctuates, go for a flexible SIP. Irrespective of the type of SIP you choose, you should invest regularly for the long term until you achieve your financial goals. SIPs are the best vehicle to help you reach financial goals and enjoy financial freedom.

Your Investing Experts

Relevant Articles

SIP Vs Lumpsum Investments: Which Is Better?

Investing towards financial goals can be done in two ways. The first option is to invest a part of the income every month for the long term. The other option is to invest a lumpsum amount once and stay invested for the long term. Both options have pros and cons, and investors often wonder which option they should choose. In this article, we will discuss SIP vs Lump sum, and which approach an investor should take.

A Decade of Investing: Analysing Average SIP Returns in 10 Years

In the last few years, many retail investors have started investing regularly in mutual funds through the systematic investment plan (SIP) route. Also, the stock markets have done well in the last few years. During the Covid pandemic, the Nifty 50 Index fell to levels of around 7,500.

Should I Invest Now or Wait for a Market Correction ?

On 12th June 2024, the Nifty 50 Index hit a new all-time high of 23,441. The small correction on 4th June 2024, resulting from lower-than-expected seats won by the BJP, lasted for just one week or so. With markets touching new all-time highs once again, investors waiting on the sidelines are wondering whether they should invest at these levels or wait for a correction.

.png)