Women and Goal Based Investing

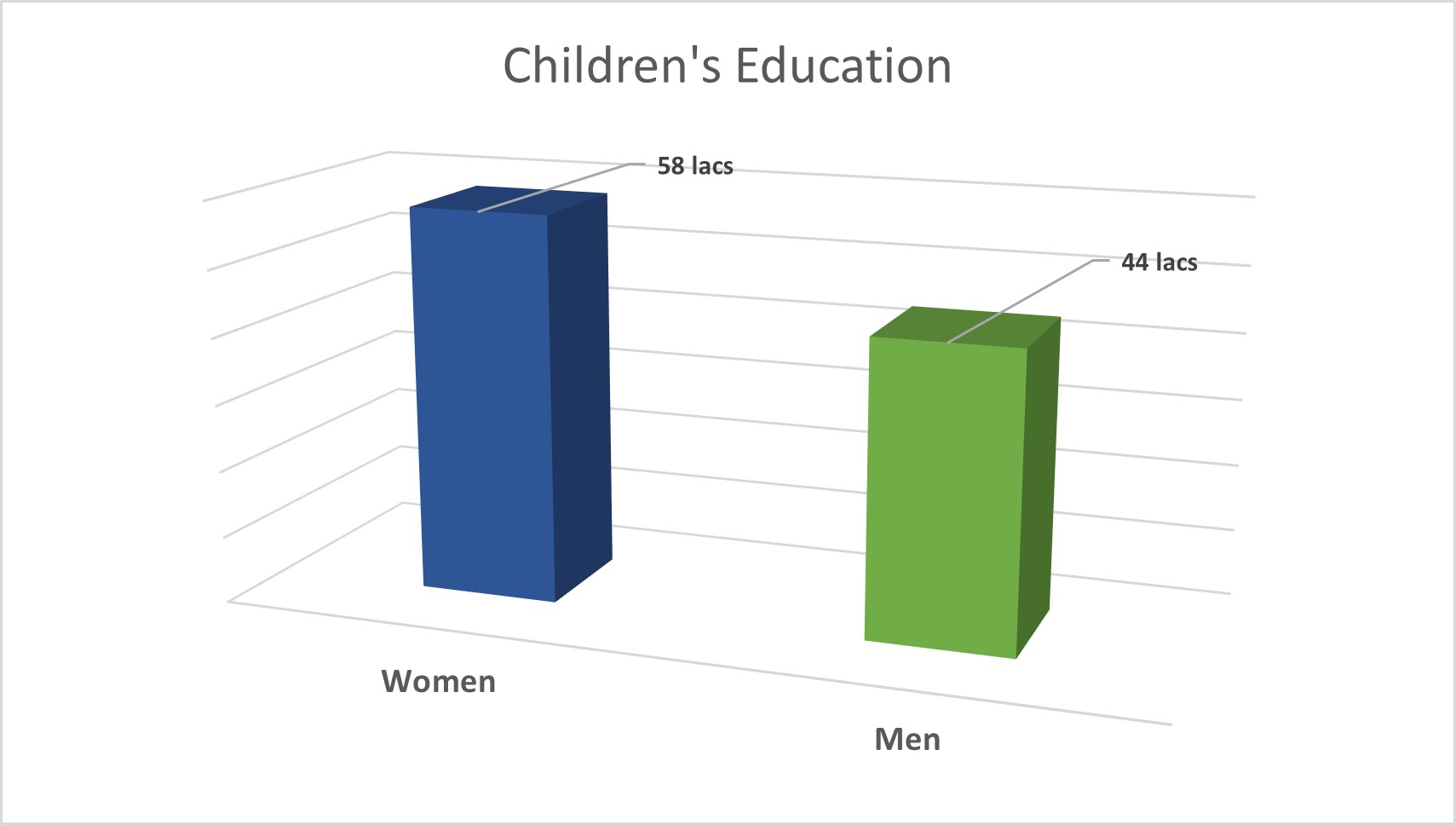

Women also set larger individual goals for their children’s education, with an average goal size of Rs. 58 lakhs compared to men’s Rs. 44 Lakhs, indicating a more focused approach.

Dreams into Action – An Investing Platform for Empowered Women Investors

Dreams into Action (DiA) is a ground breaking investing platform that has empowered thousands of women investors to take control of their financial future and make informed investment decisions to achieve their financial goals. DiA focuses on personalising investment roadmaps by incorporating a collaborative approach.

We believe that women have unique investing needs, temperament and risk tolerance. The platform achieves high level of customisation for investors and takes into account ones financial situation independently. The process of investing is immersive and greater emphasis is given to understanding of individual cash flows and household budget, personal finance ratios, investing beliefs and financial goals. The outcome of a sound investing process is investing into products or instruments that perfectly align with your goals and risk tolerance and form a critical aspect of investing success.

Through its user-friendly interface and ability to create a collaborative value added experience, Dreams into Action empowers women to transform their dreams into actionable investment plans. Through this platform, women can confidently navigate through their investment journey focusing on goal achievement with a disciplined and consistent investing approach.

Recognizing the unique investment needs of women, the DiA investment platform offers a range of comprehensive tools and resources designed to make a generation of successful investors.

#SheInvestsbest Initiative

We associate great importance to a diverse investing landscape with more women participating independently towards their financial freedom. This has led us to carry on with our initiative called ‘#sheinvestsbest’ to educate and empower more women investors and help them create a financial roadmap that is aligned with their goals and aspirations. The initiative aims to address some of the challenges women face such as:

- Lack of Financial Literacy: Continuously provide knowledge base for informed investment decisions.

- Confidence Gap in Investing: Boost women's confidence to invest successfully and independently.

- Time Constraints for Young Professionals: Highlight the importance of prioritizing investment despite busy schedules.

- Lack of Customization: Offer customised investment solutions for unique needs and goals.

- Delay in Investing: Stress the importance of early investment decisions to achieve financial goals.

.png)