Mind the Gap: Bridging the Returns Gap with Dreams into Action

Retail investors often experience a frustrating phenomenon known as the "returns gap." This gap represents the difference between the returns offered by investments and the returns actually realized by investors. The culprit? Emotional decisions, lack of discipline, and short-term thinking often lead investors to buy high, sell low, or chase trends. However, platforms like FinEdge’s ‘Dreams into Action (DiA)’ can help bridge the returns gap and align investor outcomes with their financial goals.

Understanding the Returns Gap

Numerous studies highlight the returns gap in retail investing. For instance, the Dalbar Quantitative Analysis of Investor Behavior (QAIB) consistently shows that investor behavior significantly undercuts potential returns. The 2023 QAIB report revealed that over a 20-year period, the average equity mutual fund investor earned only a fraction of the market’s returns, largely due to emotional decision-making and ill-timed trades.

For additional insights, visit FinEdge Blogs for thought leadership on investment strategies.

This behavior stems from a range of psychological biases:

1. Loss aversion: Fear of losing money causes investors to sell during downturns.

2. Recency bias: Overemphasis on recent market performance leads to chasing past winners.

3. Overconfidence: Believing they can time the market, investors often make hasty decisions.

The result? A persistent returns gap that prevents wealth creation and derails financial goals.

Attain Financial Freedom

How Dreams into Action (DiA) helps Bridge the Returns Gap

FinEdge’s proprietary platform, Dreams into Action, tackles the root causes of the returns gap by focusing on behavioral alignment, goal-driven investing, and disciplined wealth creation. Here’s how DiA empowers retail investors:

1. Purpose-Driven Investing

DiA anchors every investment to a specific goal, such as a child’s education, retirement, or a dream vacation. By linking investments to personal aspirations, DiA keeps investors focused on long-term objectives rather than short-term market fluctuations.

2. Behavioral Coaching

One of the key reasons for the returns gap is emotional decision-making. DiA integrates technology with human expertise, offering proactive behavioral coaching to help investors stay resilient during volatile markets. This coaching ensures investors avoid knee-jerk reactions like panic selling.

3. Hyper-Customization

DiA provides highly personalized investment plans tailored to an investor’s unique financial situation, risk tolerance, and goals. This customization fosters confidence and trust in the investment process, reducing the likelihood of impulsive decisions.

4. Systematic Investing Process

DiA follows a structured investment framework that emphasizes discipline. By automating investments and focusing on long-term strategies, the platform reduces the risk of ad hoc decision-making, a primary contributor to the returns gap.

Real-Life Example: Bridge the Returns Gap

To illustrate the returns gap, consider the following scenario:

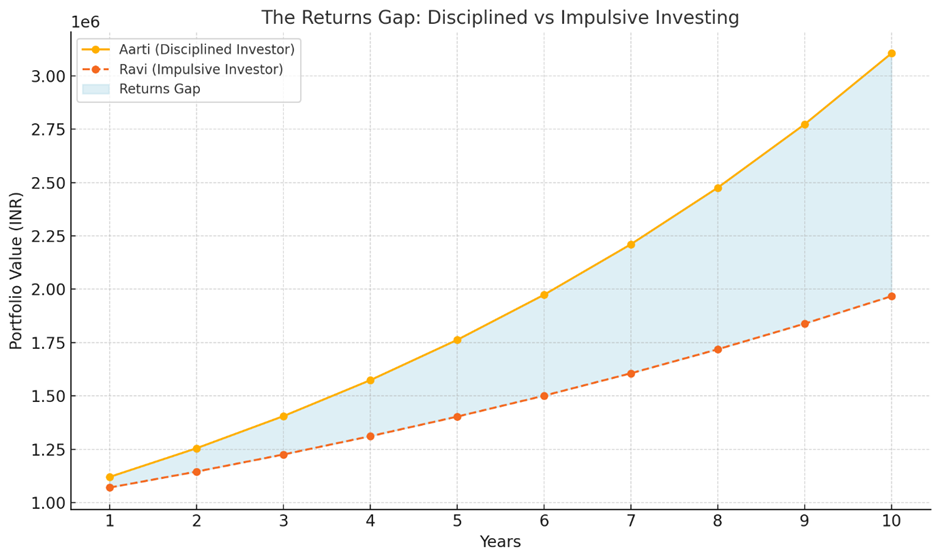

The Returns Gap in Action: Imagine two investors, Aarti and Ravi, both investing INR 10,00,000 in the same mutual fund. Over 10 years, the fund delivers an annualized return of 12%. However, due to impulsive actions like selling during market dips and buying during highs, Ravi’s realized return is only 7%, whereas Aarti, who stayed disciplined, achieved the full 12%.

• Aarti’s corpus after 10 years: INR 31,05,849

• Ravi’s corpus after 10 years: INR 19,67,151

This INR 11,38,698 difference is the returns gap caused by behavioral inefficiencies.

The graph above highlights the stark contrast in portfolio values between a disciplined and an impulsive investor over 10 years. The shaded area represents the returns gap—a visual reminder of how emotional decisions can erode wealth.

With FinEdge’s Dreams into Action, Ravi could have avoided these missteps and achieved his financial goals more effectively.

Let’s consider another investor, Ramesh, who’s saving for his daughter’s higher education 10 years from now. Without a structured platform like DiA, Ramesh might succumb to recency bias, investing heavily in trending sectors during bull markets and pulling out during market corrections. Over time, these decisions could erode his potential returns.

With DiA, however, Ramesh’s investments are anchored to his goal. The platform’s behavioral coaching ensures he stays invested during market volatility, while its systematic process ensures regular contributions. By staying disciplined and goal-focused, Ramesh is likely to achieve his target corpus with minimal stress.

Why Retail Investors Should Choose Dreams into Action

Investing isn’t just about selecting the right funds or stocks; it’s about staying the course and letting compounding work its magic. FinEdge’s Dreams into Action is designed to do just that. By addressing the behavioral and systemic issues that create the returns gap, DiA offers investors a reliable path to achieving their financial dreams.

DiA helps you cut through the noise and invest with purpose. Start your journey with us today!

The returns gap doesn’t have to derail your financial future. With Dreams into Action, retail investors can transform their aspirations into reality while avoiding common investing pitfalls. It’s time to invest smarter, stay disciplined, and take action—because your dreams deserve nothing less.

Related Articles

A Step-by-Step Guide to Personal Financial Planning

Understand how financial planning can help you map your goals, invest toward them, and review them.

Step-By-Step Guide to Starting a SIP: Everything You Need to Know

Learn all about SIPs-what is an SIP, how to invest in an SIP, and where to invest in an SIP.