Enjoy free hotel stays during your vacation with credit card rewards

In November 2023, Bajaj Allianz Life Insurance Company (BALIC) published the "Life Goal Preparedness Survey 2023". The hunger to pack one life with many goals was one of the most significant revelations in the survey. One of the highlights was that 84% of Indians desire to live a balanced life compared to 51% in 2019. An essential component of a balanced life is regular vacations, with other components being health and fitness, relationships, pursuing hobbies, socialising, etc.

Start your SIP today!

In the 2019 survey edition, 28% of participants had a travel goal, with 1 in 3 women leading in the travel goal category compared to 1 in 4 men. In the 2023 edition of the survey, there was a 2X increase in Indians pursuing travel goals compared to 2019. With an annual vacation becoming a part of the goals bucket list for many Indians, let us understand how you can enjoy free hotel stays during your vacation with credit card rewards.

Some hotel loyalty programs allow you to convert credit card reward points into hotel loyalty points which can then be used for booking hotel stays. So, what are these hotel loyalty programs, what are their benefits?

What are hotel loyalty programs?

A hotel loyalty program is a member-only program offered by a hotel chain to retain loyal customers and acquire new customers. The members get various ben`efits like discounts on stays, exclusive perks, member-only offers, etc. Some of the well-known hotel loyalty programs in India include the following.

| Hotel loyalty program | What it offers |

|---|---|

| Marriott Bonvoy by Marriott International | Provides members access to 8,700 hotel properties across 130 countries under 30 brands |

| Accor Live Limitless by Accor Group | Provides members access to 5,487 hotel properties across 110 countries under 53 brands |

| Neupass by Indian Hotels Company Limited | Provides members access to 280 hotel properties across 10 countries with its popular Taj Hotels and other brands |

| Club ITC by ITC Hotels | Provides members access to 115 hotel properties across 80 destinations in India under 6 brands |

Similarly, many other hotel chains have their respective hotel loyalty programs.

Benefits of hotel loyalty programs

All hotel loyalty programs offer certain benefits to their members. Some of these include the following.

a) Booking hotel stays using loyalty points

b) Member discounted rate or bonus points on every hotel booking and other eligible purchases

c) Early check-in and/or late check-out subject to availability

d) Welcome gift/s

e) Complimentary breakfast, lounge access, access to other amenities, etc.

f) Member discounts on meals

g) Room upgrades

h) Complimentary Wi-Fi

i) Guaranteed room availability

j) Exclusive offers for members only

k) Early access to private sale offers

l) Facility to transfer hotel loyalty program points to frequent flyer programs (FFPs) and other hotel loyalty programs

m) Dedicated customer care, etc.

Please note that not all hotel loyalty programs offer all the above membership benefits. Each hotel loyalty program may offer some combination of some of the above benefits. Most hotel loyalty programs have membership tiers.

For example, in Marriott Bonvoy, a member starts with a base level of Silver. As the member stays more nights in a calendar year, they progress to Gold, Platinum, Titanium, and Ambassador tier. Some hotel loyalty programs like Accor Live Limitless have a combination of the number of nights stayed or the amount spent in a calendar year to decide the membership status level. The higher the membership tier/status, the higher the member benefits.

How to enjoy free hotel stays using credit card rewards

Now that we understand the basics of hotel loyalty programs and their benefits let us focus on how to enjoy free hotel stays using credit card rewards.

Transferring credit card reward points

Some banks have tie-ups with hotel loyalty programs wherein they allow the conversion of credit card reward points into hotel loyalty points in a specific ratio. The value of 1 credit card reward point may equal 1 hotel loyalty point, less than 1, or more than 1, depending on the specific conversion ratio.

Some banks that allow you to transfer credit card reward points to hotel loyalty points include the following.

| Bank name | Hotel loyalty program to which reward points can be transferred |

|---|---|

| Axis Bank | Accor Live Limitless, Club ITC, Marriott Bonvoy, IHG One Rewards, Wyndham Rewards |

| HDFC Bank | Accor Live Limitless, IHG One Rewards, Wyndham Rewards |

| American Express | Marriott Bonvoy |

The conversion ratio of different cards of the same bank to the same hotel loyalty program may vary.

Depending on the credit card you hold and the hotel loyalty program you want to transfer to, you can go ahead with the points conversion. You can then use the hotel loyalty points to book your free stay at the hotel and enjoy your vacation. With the hotel loyalty program, apart from booking a free hotel stay, you can enjoy other benefits of the program based on your membership tier/status.

Purchase of hotel gift cards

If the bank doesn’t have a tie-up with the hotel loyalty program of your choice, you will not be able to transfer the reward points. In that case, you can purchase the hotel gift card with the credit card reward points. For example, American Express has a tie-up with Marriott Bonvoy loyalty program for transfer of credit card reward points. But what if you want to stay at an ITC or Taj Hotel?

In that case, you can redeem your American Express credit card reward points for gift cards of various hotel brands. You can then use the hotel gift card to book your free stay at the hotel for your vacation.

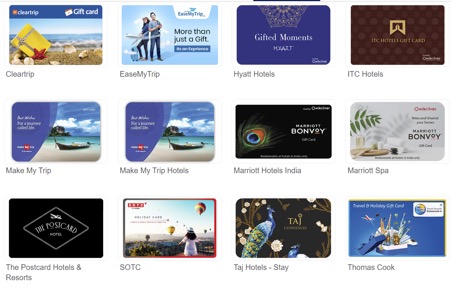

American Express: Hotel gift card options for reward points redemption

(Source: American Express website)

As seen in the above image, you can redeem your American Express credit card reward points for gift cards of hotel brands like Hyatt Hotels, ITC Hotels, Marriott Hotels, The Postcard Hotels & Resorts, Taj Hotels, etc.

Similarly, you can use credit card reward points of various banks to redeem them against hotel gift cards of various brands. The redemption value of 1 reward point usually ranges from 25 to 50 paise.

Purchase of OTA gift cards

In the above section, we saw how you can redeem credit card reward points for gift cards of various hotel brands. Similarly, you can redeem credit card reward points for gift cards of various online travel aggregators (OTAs) such as MakeMyTrip, Yatra, ClearTrip, EaseMyTrip, etc. You can then use the gift cards further for making hotel bookings and enjoy your free stay during the vacation.

Hotel co-branded credit card

In August 2023, India's first hotel co-branded credit card – Marriott Bonvoy HDFC Bank Credit Card was launched. On this credit card, as a welcome benefit and annual renewal benefit, you receive a one-night free stay at Marriott hotels. Using the card, you earn Mariott Bonvoy points on all eligible purchases. You also earn free night stays at Marriott hotels on crossing specified spend milestones in a card anniversary year as follows.

| Spend milestone | Benefit |

|---|---|

| Rs. 6 lakhs | 1-night free stay (valued up to 15,000 Marriott Bonvoy points) |

| Rs. 9 lakhs | 1-night free stay (valued up to 15,000 Marriott Bonvoy points) |

| Rs. 15 lakhs | 1-night free stay (valued up to 15,000 Marriott Bonvoy points) |

An annual spending of Rs. 15 lakhs on the card can give you 4 nights stay at Marriott hotels: 1-night stay as a joining/renewal benefit and 3 nights stay on achieving spend milestones. You will also get additional Marriott Bonvoy points for eligible spends. You can use the milestone benefits and Marriott Bonvoy points to book free stays at Marriott hotels during your vacation.

Fulfilling the Annual Vacation Goal

An annual family vacation is a must-have for many individuals. You can take two approaches to fulfilling the vacation goal. A year before the vacation date, you can calculate the amount required and start a goal-based monthly SIP in a debt mutual fund to accumulate the amount needed. In parallel, you can start accumulating rewards on your credit card spends. At the time of booking the hotel stay, if you have sufficient credit card rewards, you can use them to enjoy your free hotel booking for the vacation. If the rewards are insufficient, you can redeem the accumulated amount in the debt fund and go ahead with your vacation.

Credit card rewards are one of the best ways to enjoy a free stay at a luxurious hotel during a vacation. However, make sure you use credit cards for need-based spends only, and always pay the entire outstanding every month, before or on the due date.

References

https://www.bajajallianzlife.com/life-goals-preparedness-index-survey.html

https://www.bajajallianzlife.com/life-goals-preparedness-index.html

https://www.marriott.com/loyalty/member-benefits.mi

https://all.accor.com/loyalty-program/cards-status-benefits-details/index.en.shtml

https://www.marriott.com/credit-cards/india-credit-cards.mi

Achieve your goals with SIP's