Goal Reviews

Goal Reviews are critical for investing success!

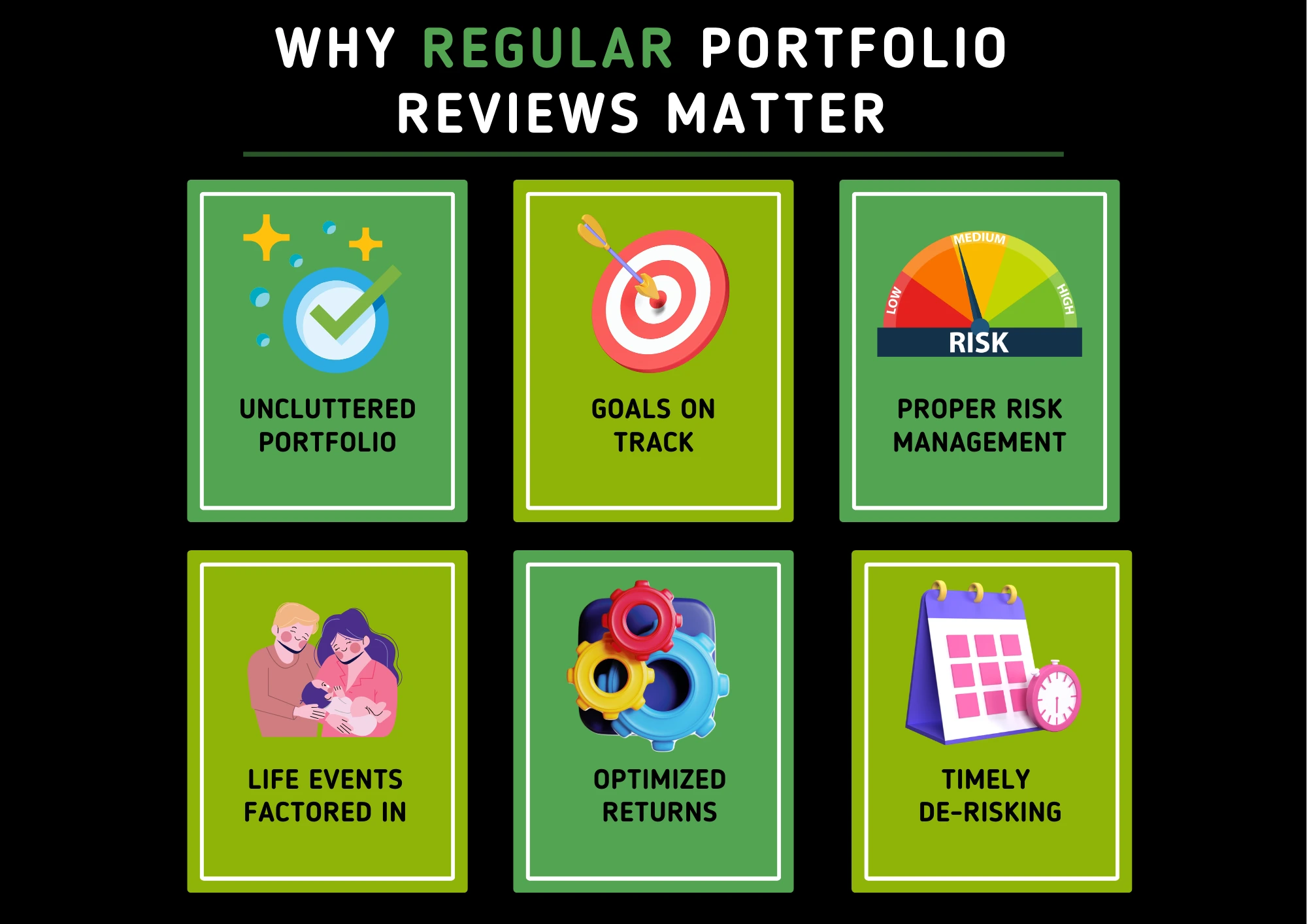

Regular reviews ensure that your mutual fund portfolio is clean and free of clutter, that your risks are managed, and that you are firmly in the drivers seat when it comes to meeting your critical financal goals.

It also ensures that your investments are always in sync with your life events, so that you are never caught off guard.

By ensuring that you start de-risking your investments in a timely manner as you approach your goals, portfolio reviews also help safeguard your capital so that it is available for you when you need it the most.

Reviewing your Goals periodically with the support of a qualified investing expert can make a huge difference to your investing success!

Get Goals Reviewed by an Expert

Why Rebalance?

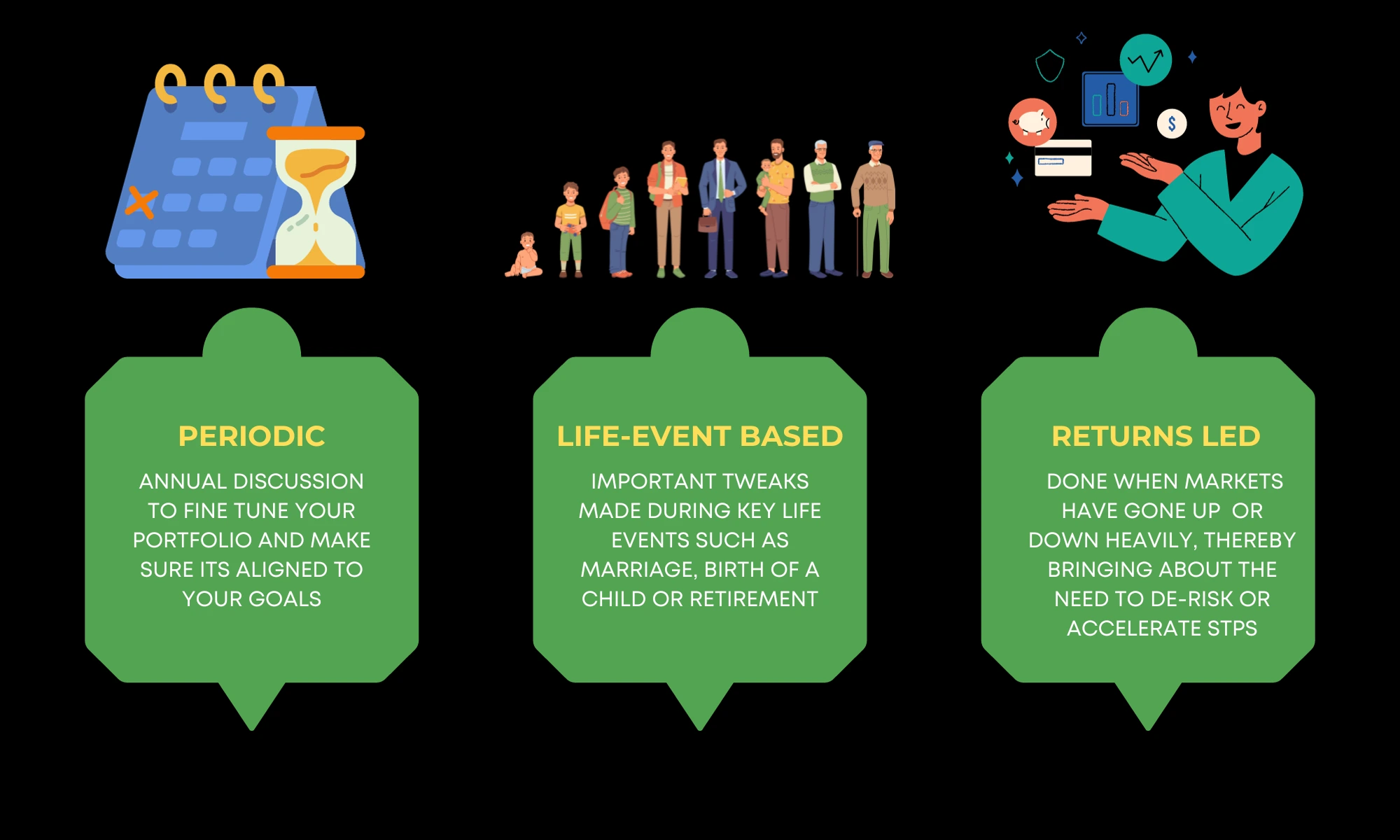

There are three main reasons for which you should consider reviewing your goal based portfolio

Disciplined Rebalancing

Once a year, sit down with your Investment Manager and take a re-look at your asset allocation. Is it in sync with your goals? Take this opportunity to revisit your financial goals and check your progress towards them – upping your regular savings if this is feasible and required. In the past twelve months, the markets will most likely have thrown your asset allocation out of sync with your target. For instance, if stocks performed well in the past 12 months, you may now be over-exposed to equities in percentage terms, as they would have grown at a faster clip than your fixed income assets. Switching back to your asset allocation will, in this case, automatically result in disciplined risk reduction.

Life-Event Based

Sometimes, the need to tweak our asset allocation arises from a drastic change in our life stage. For instance, the transition from being single to being married would increase the need for a larger emergency corpus. Similarly, when you enter the five years leading up to your retirement, you’ll need to systematically stagger moneys out of high risk assets into lower risk assets. When you do actually retire, you may need to convert the bulk of your assets from high growth investments to steadier, income generating ones. It’s a good idea to speak with your adviser whenever there’s a material change in your life-stage, in order to take an informed decision on whether or not it raises the requirement for a change in your broad asset allocation strategy.

Returns Based

Beside the regular annual rebalancing, you could set up a simple checklist of ‘trip wire’ triggers which will signal the need to rebalance your investments. As a very basic example, you could consider increasing or decreasing your equity allocation based on the PE Ratio (Price to Earnings Ratio) of the bellwether NIFTY index. For instance, the PE of the NIFTY dropping below 15X could signal the need to add more high risk funds for your long term goals or accelerate your STP's, whereas the PE dropping surging above 25X could signal the need to temporarily switch to a liquid fund and start a 12-15 month STP back into your target fund. Since the quantum of the adjustments is a function of your individual risk appetite and liquidity constraints, the support of a qualified expert is critical.

Your Investing Experts

Three Problems that arise when you don't review your Goal Portfolio

Mutual Funds have been designed to make investing simple. The efforts involved in conducting rigorous research, predicting future economic trends and selecting stocks are effectively delegated by Mutual Fund investors to the Fund Management team of the asset management company. While mutual fund investing is relatively simple in principle, you must have a disciplined review process in place which enables a conversation around your portfolio and goals, between you and your investment manager. Here are a few problems that can arise when you do not have a proper portfolio review process in place.

Excessive Churning

By and large, your mutual fund portfolio is meant to be relatively passive. You do not necessarily need to churn your portfolio every couple of months and replace your existing funds with different funds, or especially NFO’s (New Fund Offers) which may have higher expense ratios and no previous track records of performance. If your advisor is recommending frequent churns, this probably isn’t in your interest.

Remember that your Fund Manager is, in fact, managing your portfolio dynamically and using his research workforce and intellect to have you in the best possible stocks at any given point of time. Attempting to ‘manage the manager’ will create very little value addition, if any. It could also create tax inefficiencies and lead to losses in your portfolio, if you’re unlucky.

When you don't have a disciplined process for reviewing your portfolio, you will be tempted to invest in an ad-hoc manner without clear goals, and this would eventually result in wealth erosion.

Being too Passive

Remember that market movements will distort your ideal asset allocation, and it’s a wise idea to go back to your portfolio once a year and check whether you’re not skewed in either direction with respect to your financial goals. You could do this on your portfolio anniversary, once a year on a specific date, or depending upon market triggers (such as when the Nifty PE Ratio dips below or crosses a certain level).

Being too passive may lead to an accumulation of ‘has been’ funds in your portfolio. Many funds perform well for a time, and then they either become unwieldy or a systemic change in the asset manager leads to extended bouts of underperformance. It’s important to go back to your portfolio with the support of a qualified Advisor, and weed out these underperformers.

Having a Scattered Portfolio

There are no medals for owning tens of mutual funds; only to eventually lose track of them as monitoring them just became too tedious.

A single Equity Mutual Fund scheme is likely to be investing into 50-75 different stocks, so there’s really no point in owning several funds.

In fact, studies have shown that diversification benefits taper off beyond a point and start affecting your portfolio negatively after a point. It’s better to draw the line at 5 to 7 funds in each category (equity and debt) at all points of time. If you have a very large portfolio, you may want to extend this number to a ceiling limit of ten funds in each category, but going beyond that will just work to your detriment.

Over time, a scattered portfolio will result in underperformance and may hold you back from achieving your goals.