Empowering UAE NRIs to Invest in India's Growth Story

The Indian community in the UAE, spread across major cities like Dubai, Abu Dhabi, Sharjah, and Al Ain, is a thriving and influential diaspora making significant contributions across industries. Their remarkable achievements are reflected in their growing economic strength, entrepreneurial ventures, and active community participation. As this vibrant group continues to aspire for financial prosperity, it is essential to explore structured ways to build and grow wealth, especially by leveraging opportunities in India's dynamic investment landscape.

Why FinEdge is the Top Choice for NRI Investors

Why FinEdge | Customized Investment Plan | Best Financial Advisor

Aspirations and Financial Goals of NRIs

NRIs have made immense sacrifices on their road to their achievements and they also nurture significant long term aspirations. These aspirations or goals as shown below need meticulous planning and execution.

- Building a financial legacy for their families

- Ensuring their children's global education aspirations

- Securing a comfortable retirement plan

- Investing in India's growth story for wealth creation

- Maintaining financial stability amidst international economic uncertainties

These goals underline the need for a disciplined and strategic investment approach that aligns with their unique circumstances as expatriates living in Dubai, Abu Dhabi, or other parts of the UAE.

Attain Financial Freedom

Challenges NRIs Face While Investing in India

India’s rapidly growing economy and burgeoning investment opportunities make it an attractive destination for NRIs. However, the journey of investing in India can be riddled with challenges. Below are the most common hurdles NRIs face and insights into overcoming them:

1. Mis-Selling of Financial Products : NRIs often become targets for mis-selling, with high-commission products like traditional insurance policies or complex investment plans being marketed as high-return investments. These products often come with poor returns, limited flexibility, and high lock-in periods, leading to wealth erosion rather than creation.

2. Limited Access to Expertise: Living abroad, NRIs often lack access to reliable investment advisors who understand their unique needs and provide personalized solutions. Lack of expert guidance can lead to poor investment choices, missed opportunities and inadequate portfolio management.

3. Regulatory and Documentation Complexities: NRIs must navigate through KYC processes, tax compliance, nominee updates, and repatriation rules, which can be daunting due to frequent regulatory changes. Delays in documentation and compliance-related challenges often disrupt investment plans. Opt for investment platforms with a dedicated support team to simplify processes such as KYC updates, account management, and compliance checks.

4. Market Volatility and Lack of Resilience: Unfamiliarity with Indian market dynamics and a tendency to focus on short-term market movements can lead to panic-driven decisions. This leads to frequent portfolio churn, premature withdrawals, and missed opportunities for long-term wealth creation.

5. Lack of Personalization: One-size-fits-all solutions provided by generic platforms often fail to meet the diverse financial goals and risk profiles of NRIs. A mismatch between investment products and goals reduces the likelihood of long-term success. Hyper-customization, ensures that investment strategies are specific to individual goals, risk tolerance, and financial situations.

6. Over-Reliance on DIY Platforms: While DIY apps offer convenience, they often lack the depth of guidance needed for complex financial decisions, leading to ill-informed investment choices. Poorly managed portfolios with inadequate goal alignment and reliance on past returns often result in suboptimal performance.

For NRIs, investing in India presents immense potential but requires overcoming significant challenges. The key lies in adopting a goal-based approach, supported by the right mix of human expertise and technology. The Dreams into Action (DiA) investment platform by FinEdge stands out by addressing these pain points and empowering NRIs to achieve their financial goals efficiently. Investing is easy, but wealth creation requires purpose, perseverance, and expert guidance. At FinEdge, we emphasize investing with purpose, ensuring our clients achieve financial goals without falling victim to misaligned products or practices. To navigate through market volatility and to avoid speculative traps, having a trusted expert is indispensable for informed decision-making.

Your Investing Experts

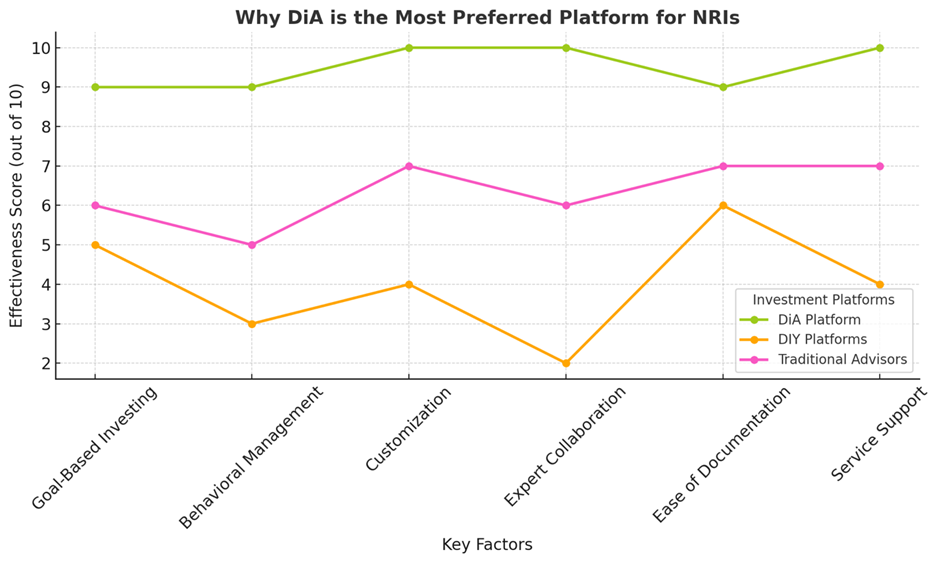

Why DiA is the Preferred Choice for NRIs based in UAE

- Goal-Based Investing: DiA ensures investments are aligned with the investor's personal goals, whether it’s retirement planning, children’s education, or building a financial legacy.

- Behavioural Management: The platform transitions NRIs from return-centric to goal-centric investing, ensuring resilience through volatile markets.

- Hyper-Customization: Personalized strategies are tailored to each investor’s unique cash flow, goals, and risk tolerance.

- Seamless Collaboration: DiA allows NRIs to co-own goals and make decisions collaboratively with expert advisors.

- Paperless Transactions: NRIs can complete onboarding, transactions, and compliance requirements effortlessly through DiA’s advanced tech features.

- Dedicated Service Support – A dedicated support team adept at handling complexities of NRI documentation for tasks like KYC registration, bank detail updates or nominee updates in investment folios can be a big differentiator and can add greatly to the investing experience for NRIs

The graph above highlights how the Dreams into Action (DiA) platform outperforms both DIY platforms and Traditional Advisors across key par ameters such as Goal-Based Investing, Behavioural Management, Customization, Expert Collaboration, Ease of Documentation and dedicated Service Support.

This visual clearly demonstrates why DiA is the preferred choice for NRIs seeking a seamless, personalized, and expert-led investment journey in India.

India’s booming economy, driven by strong GDP growth, infrastructure development, and demographic dividends, offers a compelling case for long-term investments, making it an ideal destination for NRIs to grow their wealth while contributing to India’s growth story. While India story remains bullish, the importance of the right investing platform becomes critical as the difference between wealth creation and wealth destruction could be the expert who guides in your investing journey.

What Our Clients Say About Us

Related Articles

Best Ways for NRIs to Invest in Indian Equities

Learn expert strategies on how to manage investment risk and achieve better returns. Diversify, allocate assets, and seek expert advice.

Mutual Funds vs Stocks: Which Investment Is Right for You?

To understand these investment options, the pros and cons of each, the difference between stocks and mutual funds, and which is better to invest in.

DiA helps you cut through the noise and invest with purpose. Start your journey with us today!